Value Versus Growth - CORDA Investment Management

... the price action of the stock market. He said; “Basically, price fluctuations have only one significant meaning for the true investor. They provide him with an opportunity to buy wisely when prices fall sharply and to sell wisely when they advance a great deal. At other times he will do better if he ...

... the price action of the stock market. He said; “Basically, price fluctuations have only one significant meaning for the true investor. They provide him with an opportunity to buy wisely when prices fall sharply and to sell wisely when they advance a great deal. At other times he will do better if he ...

Manager`s Comment Performance Total Return

... unlocking the trapped value, we do not believe the Chairman Richard Baker, who together with his family owns 18% of the company, would countenance such a move in the foreseeable future. HBC is a polarising stock and we have up until recently been in the bull camp, but our concerns are now sufficient ...

... unlocking the trapped value, we do not believe the Chairman Richard Baker, who together with his family owns 18% of the company, would countenance such a move in the foreseeable future. HBC is a polarising stock and we have up until recently been in the bull camp, but our concerns are now sufficient ...

Exam Preparation Assignment 4 Version 1: ANSWER KEY

... This contractionary monetary policy will cause the interest rate to rise and output to fall. The higher interest rate will reduce the present value of future dividends. The reduction in output will cause a reduction in expected dividends because profits are now expected to be lower. Both of these ef ...

... This contractionary monetary policy will cause the interest rate to rise and output to fall. The higher interest rate will reduce the present value of future dividends. The reduction in output will cause a reduction in expected dividends because profits are now expected to be lower. Both of these ef ...

BM 418 Personal Finance

... million to replicate the same company. You have been asked by your boss to value your company, which is likely to go public soon. Since he owns 72% of the company, he would like to get the highest valuation possible. List three different ways you would value the company, and your approximate values ...

... million to replicate the same company. You have been asked by your boss to value your company, which is likely to go public soon. Since he owns 72% of the company, he would like to get the highest valuation possible. List three different ways you would value the company, and your approximate values ...

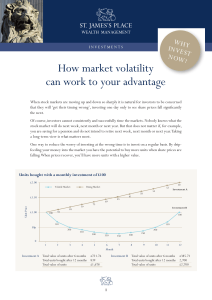

How market volatility can work to your advantage

... when stock markets are moving up and down so sharply it is natural for investors to be concerned that they will ‘get their timing wrong’, investing one day only to see share prices fall significantly the next. of course, investors cannot consistently and successfully time the markets. nobody knows w ...

... when stock markets are moving up and down so sharply it is natural for investors to be concerned that they will ‘get their timing wrong’, investing one day only to see share prices fall significantly the next. of course, investors cannot consistently and successfully time the markets. nobody knows w ...

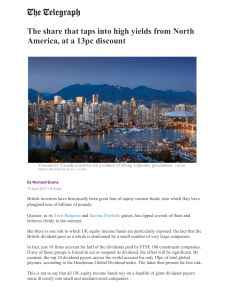

The share that taps into high yields from North America, at a 13pc

... shareholders since it listed just over 10 years ago, even though the value of its assets has risen. This means of course that the trust is now trading at a discount, currently around 13pc. This “discount” – the gap between the share price and the higher value of the underlying assets – has been wide ...

... shareholders since it listed just over 10 years ago, even though the value of its assets has risen. This means of course that the trust is now trading at a discount, currently around 13pc. This “discount” – the gap between the share price and the higher value of the underlying assets – has been wide ...

Mackenzie Cundill Value Fund – Series C

... Mackenzie Financial Corporation will not necessarily update the information to reflect changes after that date. Forward-looking statements are not guarantees of future performance and risks and uncertainties often cause actual results to differ materially from forward-looking information or expectat ...

... Mackenzie Financial Corporation will not necessarily update the information to reflect changes after that date. Forward-looking statements are not guarantees of future performance and risks and uncertainties often cause actual results to differ materially from forward-looking information or expectat ...

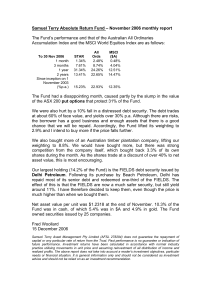

November 2006 - Samuel Terry

... Fund was in cash, of which 5.4% was in $A and 4.9% in gold. The Fund owned securities issued by 25 companies. Fred Woollard 15 December 2006 Samuel Terry Asset Management Pty Limited (AFSL 278294) does not guarantee the repayment of capital or any particular rate of return from the Trust. Past perfo ...

... Fund was in cash, of which 5.4% was in $A and 4.9% in gold. The Fund owned securities issued by 25 companies. Fred Woollard 15 December 2006 Samuel Terry Asset Management Pty Limited (AFSL 278294) does not guarantee the repayment of capital or any particular rate of return from the Trust. Past perfo ...

FIN 508: Financial Management

... 3. Apply the concept of capital budgeting in the evaluation of projects. 4. Use the concept of risk and return in portfolio management. 5. Apply the capital asset pricing model in risk management. 6. Use the Black-Scholes model in options valuation. 7. Calculate the cost of capital for a firm. 8. Se ...

... 3. Apply the concept of capital budgeting in the evaluation of projects. 4. Use the concept of risk and return in portfolio management. 5. Apply the capital asset pricing model in risk management. 6. Use the Black-Scholes model in options valuation. 7. Calculate the cost of capital for a firm. 8. Se ...

Week5.1 Money Markets - B-K

... Cash Investments • Text calls all these “money market” investments ...

... Cash Investments • Text calls all these “money market” investments ...

Jeremy Moody

... length transactions since the vote. Therefore we have had to exercise a greater degree of judgment than would be applied under more liquid market conditions. The probability of our opinion of value coinciding exactly with the price achieved, were there to be a sale, has reduced. We would, therefore, ...

... length transactions since the vote. Therefore we have had to exercise a greater degree of judgment than would be applied under more liquid market conditions. The probability of our opinion of value coinciding exactly with the price achieved, were there to be a sale, has reduced. We would, therefore, ...

Equity Valuation-a

... Motivate using a standard income statement, cash flow data can be employed from any point on it, sales/EBITDA/Net Income/EPS/Dividends depending on which series is more reliable for the company at hand. Dividend Yield Dividend Payout Retention Ratio (b) ...

... Motivate using a standard income statement, cash flow data can be employed from any point on it, sales/EBITDA/Net Income/EPS/Dividends depending on which series is more reliable for the company at hand. Dividend Yield Dividend Payout Retention Ratio (b) ...

Reporting Considerations

... After the close of the equity markets on September 30, 2014, a Federal court issued an opinion on a case brought by a number of investors against the government about the Federal Housing Finance Agency's decision to permit the "sweep" of Fannie Mae's and Freddie Mac's earnings to the Treasury. This ...

... After the close of the equity markets on September 30, 2014, a Federal court issued an opinion on a case brought by a number of investors against the government about the Federal Housing Finance Agency's decision to permit the "sweep" of Fannie Mae's and Freddie Mac's earnings to the Treasury. This ...

Ch.1 - 13ed Overview of Fin Mgmt

... Fortune lists the most admired firms. In addition to high stock returns, these firms have: ...

... Fortune lists the most admired firms. In addition to high stock returns, these firms have: ...

Nov. 30, 2015 - Centre Funds

... Away from monetary policy and on a positive note, the normal “CEO Hubris”5 seen at this advanced stage of the business cycle, namely high capital spending, aggressive hiring, and inventory growth, is not widespread. Most company use of cash flows directed towards growth has not been focused on orga ...

... Away from monetary policy and on a positive note, the normal “CEO Hubris”5 seen at this advanced stage of the business cycle, namely high capital spending, aggressive hiring, and inventory growth, is not widespread. Most company use of cash flows directed towards growth has not been focused on orga ...

Key Issues and Ideas - BYU Marriott School

... Homework 3: Understand Chapter 2 Problems: 4, 6, 10, 13 Chapter 3 Problems: 1, 5, 16 Chapter 2 1. In what ways is preferred stock like long-term debt? In what ways is it like equity? 6. Find the after-tax return to a corporation that buys a share of preferred stock at $40, sells it at year-end at $4 ...

... Homework 3: Understand Chapter 2 Problems: 4, 6, 10, 13 Chapter 3 Problems: 1, 5, 16 Chapter 2 1. In what ways is preferred stock like long-term debt? In what ways is it like equity? 6. Find the after-tax return to a corporation that buys a share of preferred stock at $40, sells it at year-end at $4 ...