Geren. Con.SU.J:t1nlil

... As a small business owner, I feel it's necessary to contact you regarding stock options. As you can imagine, when the economy is shaky it is an uphill struggle for many companies to attract talented people to come to work for them. Frankly, it would be all but impossible to attract those people with ...

... As a small business owner, I feel it's necessary to contact you regarding stock options. As you can imagine, when the economy is shaky it is an uphill struggle for many companies to attract talented people to come to work for them. Frankly, it would be all but impossible to attract those people with ...

Chapter 5- Valuation Concepts

... Interest Rate Price Risk: the risk of changes in bond prices to which investors are exposed due to changing interest rates. Interest Rate Reinvestment Rate Risk: the risk that income from a bond portfolio will vary because cash flows have to be reinvested at current (presumably lower) market rat ...

... Interest Rate Price Risk: the risk of changes in bond prices to which investors are exposed due to changing interest rates. Interest Rate Reinvestment Rate Risk: the risk that income from a bond portfolio will vary because cash flows have to be reinvested at current (presumably lower) market rat ...

Should `Minority Discounts` Diminish Share Value Under Judicial

... itself was an actual, not a hypothetical, “ready market” for the shares. In Murphy, minority shareholders of U.S. Dredging Corp. (USD), a closely held corporation, petitioned for dissolution of the corporation pursuant to N.Y. BCL §1104-a on the ground that the controlling shareholders were oppressi ...

... itself was an actual, not a hypothetical, “ready market” for the shares. In Murphy, minority shareholders of U.S. Dredging Corp. (USD), a closely held corporation, petitioned for dissolution of the corporation pursuant to N.Y. BCL §1104-a on the ground that the controlling shareholders were oppressi ...

1. value: 3.00 points Investors expect the market rate of return this

... Suppose investors believe the stock will sell for $53 at year-end. Is the stock a good or bad buy? What will investors do? ...

... Suppose investors believe the stock will sell for $53 at year-end. Is the stock a good or bad buy? What will investors do? ...

3rd Quarter - Legacy Asset Management

... have been preaching that equities would fall and slowly recover (like the Nike Swoosh) as signs of economic improvement materialize. So far, we have been more or less right on as the markets have waffled within the current range. Although equity prices rebounded last quarter on broad based belief th ...

... have been preaching that equities would fall and slowly recover (like the Nike Swoosh) as signs of economic improvement materialize. So far, we have been more or less right on as the markets have waffled within the current range. Although equity prices rebounded last quarter on broad based belief th ...

FREE Sample Here

... 1-12. Money markets refer to those markets dealing with short-term securities that have a life of one year or less. Capital markets refer to securities with a life of more than one year. 1-13. A primary market refers to the use of the financial markets to raise new funds. After the securities are so ...

... 1-12. Money markets refer to those markets dealing with short-term securities that have a life of one year or less. Capital markets refer to securities with a life of more than one year. 1-13. A primary market refers to the use of the financial markets to raise new funds. After the securities are so ...

Real Estate Investment

... Market of Investors buying and selling properties The Asset Market deals with Financial Capital Much more a function of Money flows over time ...

... Market of Investors buying and selling properties The Asset Market deals with Financial Capital Much more a function of Money flows over time ...

Lectures 5 - 7

... For the shareholder, this valuation approach has limited benefits in maximizing potential shareholder value (unless, of course, the company is already in distress). The approach involves a discounting of book values- and is therefore even more conservative than the net book value ...

... For the shareholder, this valuation approach has limited benefits in maximizing potential shareholder value (unless, of course, the company is already in distress). The approach involves a discounting of book values- and is therefore even more conservative than the net book value ...

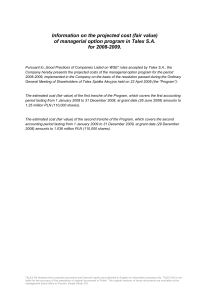

Information on the projected cost (fair value) of

... General Meeting of Shareholders of Talex Spółka Akcyjna held on 22 April 2008 (the “Program”): ...

... General Meeting of Shareholders of Talex Spółka Akcyjna held on 22 April 2008 (the “Program”): ...

TopicsInAnalysis

... Does certainty equivalent depend on mean and variance? What does Barry Schwartz think of all this? 8. Uncertain future payments (uncertainty and time) Expected values of cash flows Higher discount rates as a proxy for uncertainty (Bringing in the lawyers: “We agree that the truth is between 3.2% and ...

... Does certainty equivalent depend on mean and variance? What does Barry Schwartz think of all this? 8. Uncertain future payments (uncertainty and time) Expected values of cash flows Higher discount rates as a proxy for uncertainty (Bringing in the lawyers: “We agree that the truth is between 3.2% and ...

Liquidity ratios

... Formulate a statement of strategic, operating, and financial objectives. Prepare a list of underlying assumptions describing the expected business and economic environment. Assess the current and new projects. Prepare pro forma financial statements. Analyze the pro forma statements for feasibility a ...

... Formulate a statement of strategic, operating, and financial objectives. Prepare a list of underlying assumptions describing the expected business and economic environment. Assess the current and new projects. Prepare pro forma financial statements. Analyze the pro forma statements for feasibility a ...

CHAPTER 4 The Financial Environment: Markets, Institutions, and

... finance their investment opportunities. These groups are willing to pay a rate of return(interest) on the capital they borrow. ...

... finance their investment opportunities. These groups are willing to pay a rate of return(interest) on the capital they borrow. ...

Beyond EBITDA: 5 Other Factors That Affect

... investor can handicap the future opportunity when a team is in place and able to provide a large amount of upfront information to chart the company’s course. That said, not every seller has developed a complete team or can recruit the talent it needs. In fact, most entrepreneurs tend to run lean org ...

... investor can handicap the future opportunity when a team is in place and able to provide a large amount of upfront information to chart the company’s course. That said, not every seller has developed a complete team or can recruit the talent it needs. In fact, most entrepreneurs tend to run lean org ...

7IM Specialist Investment Funds-7IM Emerging Markets Equity

... to their intrinsic value using company fundamentals. Securities trading at a discount to intrinsic value are generally defined as companies with a high cash-flow to price, high book-to-price or similar valuation ratio. Profitability is defined as high return-on-equity (ROE), return-on-asset (ROA), r ...

... to their intrinsic value using company fundamentals. Securities trading at a discount to intrinsic value are generally defined as companies with a high cash-flow to price, high book-to-price or similar valuation ratio. Profitability is defined as high return-on-equity (ROE), return-on-asset (ROA), r ...

a governança tem que ser exercida de fato

... “A group of standards and regulations to be followed by publicly traded organizations, to ensure equitable treatment of all investors, with due regard for minority shareholders, the implementation of Full Disclosure practices, and to add value to the company and the asset product.” A good Corporate ...

... “A group of standards and regulations to be followed by publicly traded organizations, to ensure equitable treatment of all investors, with due regard for minority shareholders, the implementation of Full Disclosure practices, and to add value to the company and the asset product.” A good Corporate ...

Slides

... • In addition to the $150 million purchase price for Ideko’s equity, $4.5 million will be used to repay Ideko’s existing debt. ▫ With $5 million in transaction fees, the acquisition will require $159.5 million in total funds. ▫ KKP’s sources of funds include the new loan of $100 million as well as I ...

... • In addition to the $150 million purchase price for Ideko’s equity, $4.5 million will be used to repay Ideko’s existing debt. ▫ With $5 million in transaction fees, the acquisition will require $159.5 million in total funds. ▫ KKP’s sources of funds include the new loan of $100 million as well as I ...

Ch.13

... Efficient Markets Theory • Trade as little as possible • Diversified portfolio with different stocks • Assemble a diversified set of stocks – Hold on to them – Buy and sell only when new cash comes in or cash needs to be taken out ...

... Efficient Markets Theory • Trade as little as possible • Diversified portfolio with different stocks • Assemble a diversified set of stocks – Hold on to them – Buy and sell only when new cash comes in or cash needs to be taken out ...

Summary on Financial Markets The three main functions of the

... EV = market value of common and preferred stock + market value of debt – cash and short-term investments EBITDA is frequently used as the denominator in EV multiples because EV represents total company value, and EBITDA represents earnings available to all investors. Asset-based models value equity ...

... EV = market value of common and preferred stock + market value of debt – cash and short-term investments EBITDA is frequently used as the denominator in EV multiples because EV represents total company value, and EBITDA represents earnings available to all investors. Asset-based models value equity ...

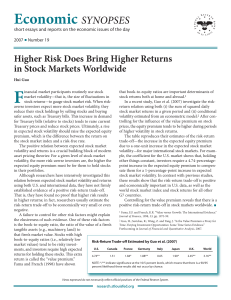

The Return Shortfall in Equity Markets

... • If an economy experiences a long period of economic growth, stock prices will soar – The ratio of stocks to bonds will be much higher than historically – But investors want to hold assets in similar proportions as before – What happens • Investors sell stocks and buy bonds • Firms will issue relat ...

... • If an economy experiences a long period of economic growth, stock prices will soar – The ratio of stocks to bonds will be much higher than historically – But investors want to hold assets in similar proportions as before – What happens • Investors sell stocks and buy bonds • Firms will issue relat ...