Credit Unit

... Supply is the relationship of prices to the quantities of a good or service sellers are willing to offer for sale at any given point in time Demand is the relationship of prices to the quantities and the corresponding quantities of a good or service buyers are willing to purchase at any given point ...

... Supply is the relationship of prices to the quantities of a good or service sellers are willing to offer for sale at any given point in time Demand is the relationship of prices to the quantities and the corresponding quantities of a good or service buyers are willing to purchase at any given point ...

IB SL WORD PROBLEMS Population of animals, people and

... How long will it take for the number of leopards to reach 100? Give your answers to an appropriate degree of accuracy. ...

... How long will it take for the number of leopards to reach 100? Give your answers to an appropriate degree of accuracy. ...

Chapter 27: Money, Banking, and the Financial Sector

... stock prices to the extent that growth in stock prices and GDP growth both reflect economic well-being in a country. Also, many of the companies are multinational companies, and where the company is based may not reflect where its value added is generated. Chapter 27: Appendix B 2. a. ...

... stock prices to the extent that growth in stock prices and GDP growth both reflect economic well-being in a country. Also, many of the companies are multinational companies, and where the company is based may not reflect where its value added is generated. Chapter 27: Appendix B 2. a. ...

Cost of Capital

... • If we are using CAPM to arrive at a cost of capital to evaluate a long term project, we need for the risk free rate a short term real rate plus expected long term inflation • rf = r30 - risk premium • risk premium is probably 1-2% ...

... • If we are using CAPM to arrive at a cost of capital to evaluate a long term project, we need for the risk free rate a short term real rate plus expected long term inflation • rf = r30 - risk premium • risk premium is probably 1-2% ...

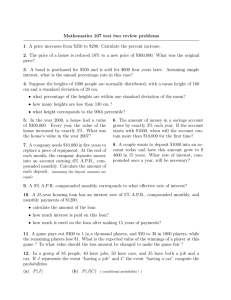

test two review problems

... 2. The price of a house is reduced 10% to a new price of $360,000. What was the original ...

... 2. The price of a house is reduced 10% to a new price of $360,000. What was the original ...

Tracking Your Investments Pre-Test (HS)

... 14. You want earnings to keep going up each year for any stock you own. a. True b. False 15. The stock market is influenced by the economy. a. True b. False 16. The price of a stock reflects the company’s value as well as a. the value of other companies in the same industry. b. the expected earnings ...

... 14. You want earnings to keep going up each year for any stock you own. a. True b. False 15. The stock market is influenced by the economy. a. True b. False 16. The price of a stock reflects the company’s value as well as a. the value of other companies in the same industry. b. the expected earnings ...

The market environment for 2015

... In prior years, companies with increased profitability have been nervous about adding workers or increasing long-term expansion by increasing capital expenditures except when absolutely necessary. Businesses seemed to feel very uncertain about the recovery, and with that they tended to redirect the ...

... In prior years, companies with increased profitability have been nervous about adding workers or increasing long-term expansion by increasing capital expenditures except when absolutely necessary. Businesses seemed to feel very uncertain about the recovery, and with that they tended to redirect the ...

June 2008 Performance Review – Listed Hybrid Sector

... they were able to refinance the structure from the proposed 55% debt levels to something higher. Otherwise the price paid seems to be stupid. The price Albertis/Citi paid only made sense using last year’s debt costs and availability and last years equity risk premium. Using this year’s debt cost and ...

... they were able to refinance the structure from the proposed 55% debt levels to something higher. Otherwise the price paid seems to be stupid. The price Albertis/Citi paid only made sense using last year’s debt costs and availability and last years equity risk premium. Using this year’s debt cost and ...

Select this.

... Valuation of Preferred Stock • Owner of preferred stock receives a promise to pay a stated dividend, usually quarterly, for perpetuity • Since payments are only made after the firm meets its bond interest payments, there is more uncertainty of returns • Tax treatment of dividends paid to ...

... Valuation of Preferred Stock • Owner of preferred stock receives a promise to pay a stated dividend, usually quarterly, for perpetuity • Since payments are only made after the firm meets its bond interest payments, there is more uncertainty of returns • Tax treatment of dividends paid to ...

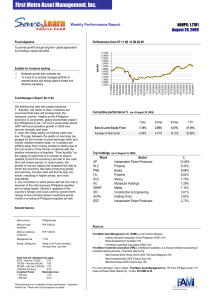

08.20.09-salef - First Metro Asset Management Inc

... Fund Manager’s Report 08.11.09 We believe this rally will sustain because: 1. “liquidity” will return to Asia. Investors are convinced that Asia will emerge from the recession sooner. Inasfar as the Philippine economy is concerned, global economists expect the Philippines to be 1 of only 4 economies ...

... Fund Manager’s Report 08.11.09 We believe this rally will sustain because: 1. “liquidity” will return to Asia. Investors are convinced that Asia will emerge from the recession sooner. Inasfar as the Philippine economy is concerned, global economists expect the Philippines to be 1 of only 4 economies ...

FASB Statement 149 and Redeemable Preferred

... Statement 149, crafted in the wake of Enron, WorldCom and similar scandals, will establish rules for determining when financial instruments must be classified as liabilities rather than equity on a company’s balance sheet. Specifically, the proposal creates three new categories of instruments that a ...

... Statement 149, crafted in the wake of Enron, WorldCom and similar scandals, will establish rules for determining when financial instruments must be classified as liabilities rather than equity on a company’s balance sheet. Specifically, the proposal creates three new categories of instruments that a ...

Consumption & Investment

... savings suggest that consumption should respond more to business cycle changes in income than PIH argues. Interest Rates have ambiguous theoretical impact on consumption and savings. Empirically, the effect of interest rates on savings is positive, but small. Degree of impact of current income o ...

... savings suggest that consumption should respond more to business cycle changes in income than PIH argues. Interest Rates have ambiguous theoretical impact on consumption and savings. Empirically, the effect of interest rates on savings is positive, but small. Degree of impact of current income o ...

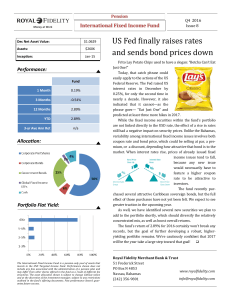

US Fed finally raises rates and sends bond prices down

... easily apply to the actions of the US Federal Reserve. The Fed raised US interest rates in December by 0.25%, for only the second time in nearly a decade. However, it also indicated that it cannot—as the phrase goes— “Eat Just One” and predicted at least three more hikes in 2017. While the fixed inc ...

... easily apply to the actions of the US Federal Reserve. The Fed raised US interest rates in December by 0.25%, for only the second time in nearly a decade. However, it also indicated that it cannot—as the phrase goes— “Eat Just One” and predicted at least three more hikes in 2017. While the fixed inc ...

Financial Markets - North Clackamas School District

... and collect payments and then disburse them to retirees. Excess revenues are invested in stocks, bonds and other investments ...

... and collect payments and then disburse them to retirees. Excess revenues are invested in stocks, bonds and other investments ...

Key

... Problems/Essays Note on grading essays: The numbers in brackets represent the number of “checks” possible for each concept. Use the scale at the bottom to convert to points out of 50 possible. 1. Assume that Market Gyrations Inc. will earn $500 before interest and taxes per year forever. Also assume ...

... Problems/Essays Note on grading essays: The numbers in brackets represent the number of “checks” possible for each concept. Use the scale at the bottom to convert to points out of 50 possible. 1. Assume that Market Gyrations Inc. will earn $500 before interest and taxes per year forever. Also assume ...

chapter_11

... best companies in a promising industry – This involves examining a firm’s past performance, but more important, its future prospects – It needs to compare the estimated intrinsic value to the prevailing market price of the firm’s stock and decide whether its stock is a good investment – The final go ...

... best companies in a promising industry – This involves examining a firm’s past performance, but more important, its future prospects – It needs to compare the estimated intrinsic value to the prevailing market price of the firm’s stock and decide whether its stock is a good investment – The final go ...

UNITED PARCEL SERVICE

... outlets, or have greater financial resources may have a competitive advantage. They are after all a much smaller company than some of the other competitors like BP, Chevron and Exxon Mobil. ...

... outlets, or have greater financial resources may have a competitive advantage. They are after all a much smaller company than some of the other competitors like BP, Chevron and Exxon Mobil. ...

Valuations in Mining and Exploration Seminar ‐ AIG (QLD)

... • International Financial Reporting Standards ‐ IFRS 13 states that when measuring fair value, the objective is to estimate the price at which an orderly transaction to sell an asset or to transfer a liability would take place between market participants at the measurement date under current mark ...

... • International Financial Reporting Standards ‐ IFRS 13 states that when measuring fair value, the objective is to estimate the price at which an orderly transaction to sell an asset or to transfer a liability would take place between market participants at the measurement date under current mark ...

Cost of Capital Corporations often use different costs of capital for

... average cost of capital (WACC) were used as the hurdle rate for all divisions, would more conservative or riskier divisions get a greater share of capital? Explain your reasoning. What are two techniques that you could use to develop a rough estimate for each division’s cost of capital? Your initial ...

... average cost of capital (WACC) were used as the hurdle rate for all divisions, would more conservative or riskier divisions get a greater share of capital? Explain your reasoning. What are two techniques that you could use to develop a rough estimate for each division’s cost of capital? Your initial ...

Explanation and Benefits of Fair Value Accounting

... Fair value is an estimate of the price an entity would realize if it were to sell an asset, or the price it would pay to relieve a liability. Many financial instruments – such as shares traded on an exchange, debt securities (U.S. Treasury bonds), and derivatives – are measured and reported at fair ...

... Fair value is an estimate of the price an entity would realize if it were to sell an asset, or the price it would pay to relieve a liability. Many financial instruments – such as shares traded on an exchange, debt securities (U.S. Treasury bonds), and derivatives – are measured and reported at fair ...

smarterinsightTM - Donald Wealth Management

... o'clock news, we would all do well to consider the wider context. The global economy actually grew by around 4% in 2011, according to the IMF. The US and German economies have grown in the first quarter of this year, too. Emerging economies continue to grow strongly, even if at a lower pace than the ...

... o'clock news, we would all do well to consider the wider context. The global economy actually grew by around 4% in 2011, according to the IMF. The US and German economies have grown in the first quarter of this year, too. Emerging economies continue to grow strongly, even if at a lower pace than the ...