New Logo Newsletter 114.pub - Lodestar Investment Counsel

... once the weather improves, with any strength flowing through to corporate earnings? Will the Federal Reserve finish tapering its bond purchases by ...

... once the weather improves, with any strength flowing through to corporate earnings? Will the Federal Reserve finish tapering its bond purchases by ...

4 - Cengage

... 2009 as available-for-sale securities instead of trading securities. On December 31, 2009, the cost and fair values of the securities are as follows: ...

... 2009 as available-for-sale securities instead of trading securities. On December 31, 2009, the cost and fair values of the securities are as follows: ...

Revenue Recognition Certificates

... Assume: 3% nominal growth, 30 year maturity Given today’s Treasury rates of 2%, Govt needs to pay 0.3% of GDP of which principal is some $20 billion ...

... Assume: 3% nominal growth, 30 year maturity Given today’s Treasury rates of 2%, Govt needs to pay 0.3% of GDP of which principal is some $20 billion ...

security analysis - Goenka College of Commerce and Business

... change, availability of raw materials, change in consumer preference, labour problems etc. This portion of the risk can be eliminated by an investor ...

... change, availability of raw materials, change in consumer preference, labour problems etc. This portion of the risk can be eliminated by an investor ...

Supplemental Instruction Finance 301: Porter 1o/22/08 A bond that

... PV=-1000 FV= 1090 (what it is worth with the 9% call premium) CPT I/Y= 15.03% 7. What is current yield? a. The annual interest payment on a bond divided by the bonds current price. b. Annual interest/PRICE 8. A bond has a par value of $1000, 10 years to maturity, a 7% coupon and it sells for $985. W ...

... PV=-1000 FV= 1090 (what it is worth with the 9% call premium) CPT I/Y= 15.03% 7. What is current yield? a. The annual interest payment on a bond divided by the bonds current price. b. Annual interest/PRICE 8. A bond has a par value of $1000, 10 years to maturity, a 7% coupon and it sells for $985. W ...

The Supernormal Growth Example

... Corporate Valuation Model A firm is able to pay dividend because it has free cash flows, cash not needed for operation and can be paid to finance providers This second method to stock valuation is based on Free Cash Flow (FCF). The value of the firm equals the PV of future FCF. FCF for a given year ...

... Corporate Valuation Model A firm is able to pay dividend because it has free cash flows, cash not needed for operation and can be paid to finance providers This second method to stock valuation is based on Free Cash Flow (FCF). The value of the firm equals the PV of future FCF. FCF for a given year ...

Personal Finance and Portfolio Management Strategies Module Exam

... Finding a buyer for a piece of real estate can be difficult if loan money is scarce b. There are many factors to consider before investing in real estate c. Poor location can cause a piece of real estate property to go down in value d. There is no reason to evaluate a real estate investment because ...

... Finding a buyer for a piece of real estate can be difficult if loan money is scarce b. There are many factors to consider before investing in real estate c. Poor location can cause a piece of real estate property to go down in value d. There is no reason to evaluate a real estate investment because ...

Personal Finance and Portfolio Management Strategies Module Exam

... Finding a buyer for a piece of real estate can be difficult if loan money is scarce b. There are many factors to consider before investing in real estate c. Poor location can cause a piece of real estate property to go down in value d. There is no reason to evaluate a real estate investment because ...

... Finding a buyer for a piece of real estate can be difficult if loan money is scarce b. There are many factors to consider before investing in real estate c. Poor location can cause a piece of real estate property to go down in value d. There is no reason to evaluate a real estate investment because ...

May 2014 Examinations Subject CT8 – Financial Economics INDICATIVE SOLUTIONS

... Capital asset pricing model is based on a number of assumptions that are far from the reality. For example it is very difficult to find a risk free security. A short term highly liquid government security is considered as a risk free security. It is unlikely that the government will default, but inf ...

... Capital asset pricing model is based on a number of assumptions that are far from the reality. For example it is very difficult to find a risk free security. A short term highly liquid government security is considered as a risk free security. It is unlikely that the government will default, but inf ...

Quarterly Newsletter - December 2001 : Pinney and Scofield : http

... allocation send us a current statement and a list of the choices and we will help you avoid such risks. Over the last year investors have seen returns fall not only for equities but also for short-term fixed income instruments. Money market yields are now half or less of what they were a year ago. I ...

... allocation send us a current statement and a list of the choices and we will help you avoid such risks. Over the last year investors have seen returns fall not only for equities but also for short-term fixed income instruments. Money market yields are now half or less of what they were a year ago. I ...

Exam 1 2008

... Jill has just invented a non-slip wig for men which she expects will cause sales to double, increasing after-tax net income to $1,000. She feels that she can handle the increase without adding any fixed assets. (1) Will Jill need any outside capital if she pays no dividends? (2) If so, how much? a. ...

... Jill has just invented a non-slip wig for men which she expects will cause sales to double, increasing after-tax net income to $1,000. She feels that she can handle the increase without adding any fixed assets. (1) Will Jill need any outside capital if she pays no dividends? (2) If so, how much? a. ...

Document

... assets involve great risk but those that also have a possibility of great gain • Speculative stocks possess a high probability of low or negative rates of return and a low probability of normal or high rates of return ...

... assets involve great risk but those that also have a possibility of great gain • Speculative stocks possess a high probability of low or negative rates of return and a low probability of normal or high rates of return ...

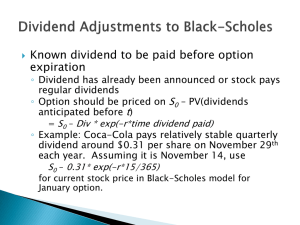

Option Price and Portfolio Simulation

... stock having the same volatility as the stock on which the option is written and growing at the risk-free rate of interest. The cash flows are discounted continuously at the risk-free rate The option price does not depend on the growth rate of the stock! ...

... stock having the same volatility as the stock on which the option is written and growing at the risk-free rate of interest. The cash flows are discounted continuously at the risk-free rate The option price does not depend on the growth rate of the stock! ...

Market Structures - McEachern High School

... options— And fast food is all very similar. In selling a SIMILAR product, such businesses must highlight SMALL DIFFERENCES— In a process called PRODUCT DIFFERENTIATION— In order to attract customers. They do this through… Advertising. ...

... options— And fast food is all very similar. In selling a SIMILAR product, such businesses must highlight SMALL DIFFERENCES— In a process called PRODUCT DIFFERENTIATION— In order to attract customers. They do this through… Advertising. ...

1. You were hired as a consultant to Keys Company, and you were

... 3. Tapley Inc. recently hired you as a consultant to estimate the company’s WACC. You have obtained the following information. (1) Tapley's bonds mature in 25 years, have a 7.5% annual coupon, a par value of $1,000, and a market price of $936.49. (2) The company’s tax rate is 40%. (3) The risk-free ...

... 3. Tapley Inc. recently hired you as a consultant to estimate the company’s WACC. You have obtained the following information. (1) Tapley's bonds mature in 25 years, have a 7.5% annual coupon, a par value of $1,000, and a market price of $936.49. (2) The company’s tax rate is 40%. (3) The risk-free ...

Allianz US Short Duration High Income Bond

... an investment in the asset class. The US economy is expected to expand at a moderate pace in 2017; and the equity market performance and steepness of the Treasury yield curve helps confirm this notion. Moreover, the president’s agenda should result in even stronger economic growth. Positive tax refo ...

... an investment in the asset class. The US economy is expected to expand at a moderate pace in 2017; and the equity market performance and steepness of the Treasury yield curve helps confirm this notion. Moreover, the president’s agenda should result in even stronger economic growth. Positive tax refo ...

TUGAS FINANCIAL MANAGEMENT Fery Purwa Ginanjar Eksekutif

... Corporation must decide whether to go ahead and develop the deposit. The most costeffective method of mining gold is sulfuric acid extraction, a process that could result in environmental damage. Before proceeding with the extraction, CTC must spend $900,000 for new mining equipment and pay $165,000 ...

... Corporation must decide whether to go ahead and develop the deposit. The most costeffective method of mining gold is sulfuric acid extraction, a process that could result in environmental damage. Before proceeding with the extraction, CTC must spend $900,000 for new mining equipment and pay $165,000 ...

Presentation

... trade-off may be appropriate since your learning and grades will likely improve. financial opportunity costs involve monetary values of decisions made. For example, the purchase of an item with money from your savings means you will no longer obtain interest on those funds. time value of money can b ...

... trade-off may be appropriate since your learning and grades will likely improve. financial opportunity costs involve monetary values of decisions made. For example, the purchase of an item with money from your savings means you will no longer obtain interest on those funds. time value of money can b ...