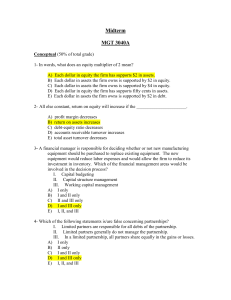

Answers to Midterm 3040A

... 14- In a common size statement, the balance sheet may be expressed as a percentage of ____________ while the income statement may be expressed as a percentage of ...

... 14- In a common size statement, the balance sheet may be expressed as a percentage of ____________ while the income statement may be expressed as a percentage of ...

Researching to Find Good Investments

... Do they carry only assets that maximize value. Do they return cash to shareholders when there are no credible value-creating opportunities to invest in the business. Do they reward CEOs and other senior executives for delivering superior long-term returns. Do they reward operating-unit executives fo ...

... Do they carry only assets that maximize value. Do they return cash to shareholders when there are no credible value-creating opportunities to invest in the business. Do they reward CEOs and other senior executives for delivering superior long-term returns. Do they reward operating-unit executives fo ...

Presentation Slideshow

... - pledge to borrow only what is needed for educational expenses. - must graduate in 4-years of continuous enrollment. - are required to take financial literacy programs in freshman and senior years. - must fulfill community service requirements. ...

... - pledge to borrow only what is needed for educational expenses. - must graduate in 4-years of continuous enrollment. - are required to take financial literacy programs in freshman and senior years. - must fulfill community service requirements. ...

security analysis and portfolio management

... c) Ownership securities as returns are based on net profit—rates are variable. 2. Returns— A major factor influencing pattern of investment is its return—i.e. yield plus capital appreciation .(Yield is interest or dividend). Yield has to be calculated on the purchase price. ...

... c) Ownership securities as returns are based on net profit—rates are variable. 2. Returns— A major factor influencing pattern of investment is its return—i.e. yield plus capital appreciation .(Yield is interest or dividend). Yield has to be calculated on the purchase price. ...

Trade Log - Portfolio Strategies Investment Managers

... slowdown in Q1 reflected the temporary drag from the coldest winter on record in the Northeast and from the dockworkers’ strike in Los Angeles. Soft global demand and the appreciating $U.S. are taking their toll on the manufacturing sector. But in a relatively closed service-based economy like the U ...

... slowdown in Q1 reflected the temporary drag from the coldest winter on record in the Northeast and from the dockworkers’ strike in Los Angeles. Soft global demand and the appreciating $U.S. are taking their toll on the manufacturing sector. But in a relatively closed service-based economy like the U ...

Multinational Financial Management 896N1

... numerical values should be used in its application, especially the equity risk premium – The equity risk premium is the expected average annual return on the market above riskless debt – Typically, the market’s return is calculated on a historical basis yet others feel that the number should be forw ...

... numerical values should be used in its application, especially the equity risk premium – The equity risk premium is the expected average annual return on the market above riskless debt – Typically, the market’s return is calculated on a historical basis yet others feel that the number should be forw ...

Alternative Investment Market: The first ten years

... sells them, only pays 35% CGT. If held shares for four years or more, the tax rate falls to 10%. ...

... sells them, only pays 35% CGT. If held shares for four years or more, the tax rate falls to 10%. ...

CHAPTER 1

... equity of 12.5%. The company’s stock is selling for $50. Now the firm decides to repurchase half of its shares and substitute an equal value of debt. The debt is risk-free, with a 5% interest rate. The company is exempt from corporate income taxes. Assuming MM are correct, calculate the following it ...

... equity of 12.5%. The company’s stock is selling for $50. Now the firm decides to repurchase half of its shares and substitute an equal value of debt. The debt is risk-free, with a 5% interest rate. The company is exempt from corporate income taxes. Assuming MM are correct, calculate the following it ...

Cost Approach Methods for Mineral Property Valuation

... knowledge documents to accommodate the needs of the minerals and rural appraiser professions • For market valuations, most Cost Approach methods should be used in combination with another approach if possible • The Rural Cost Appraisal method is a particularly powerful valuation method, available fo ...

... knowledge documents to accommodate the needs of the minerals and rural appraiser professions • For market valuations, most Cost Approach methods should be used in combination with another approach if possible • The Rural Cost Appraisal method is a particularly powerful valuation method, available fo ...

"409A and Option Pricing"

... Founding Stage. During the very early stage of a typical technology or life sciences company, in particular from the time of founding to the time when the company begins to have assets (whether tangible or intangible) and operations and begins to make option grants to multiple employees, we generall ...

... Founding Stage. During the very early stage of a typical technology or life sciences company, in particular from the time of founding to the time when the company begins to have assets (whether tangible or intangible) and operations and begins to make option grants to multiple employees, we generall ...

Economics 330 Money and Banking Lecture 18

... Hedges by locking in future interest rate if funds coming in future Short position = agree to sell securities at future date Hedges by reducing price risk from change in interest rates if holding bonds Pros 1. Flexible Cons 1. Lack of liquidity: hard to find counterparty 2. Subject to default risk: ...

... Hedges by locking in future interest rate if funds coming in future Short position = agree to sell securities at future date Hedges by reducing price risk from change in interest rates if holding bonds Pros 1. Flexible Cons 1. Lack of liquidity: hard to find counterparty 2. Subject to default risk: ...

market news - Sites at Lafayette

... • Bond buying by FED also referred to as quantitative easing (QE) has allowed the long term interest rates to remain low, encouraging investors to invest a lot more. EXAMPLE: The 10 year Treasury note’s yield which fell to 2.936% • Fed official Richard Fisher (Dallas Federal Reserve Bank president): ...

... • Bond buying by FED also referred to as quantitative easing (QE) has allowed the long term interest rates to remain low, encouraging investors to invest a lot more. EXAMPLE: The 10 year Treasury note’s yield which fell to 2.936% • Fed official Richard Fisher (Dallas Federal Reserve Bank president): ...

efficiency factor - Economic Regulation Authority

... their transportation tariff non-competitive and have settled for an asset valuation somewhere in between DORC and depreciated value. This would seem to be consistent with the realities of a competitive market place where the pricing point is never a precise formula driven number but rather, a market ...

... their transportation tariff non-competitive and have settled for an asset valuation somewhere in between DORC and depreciated value. This would seem to be consistent with the realities of a competitive market place where the pricing point is never a precise formula driven number but rather, a market ...

Review Questions

... the first midterm covering the first five chapters of Quadrini and Wright. 1) A coupon bond has a face value of $100, a coupon rate of 5%, time to maturity of 3 years and the yield is 6%. What is the price of the bond? What is the current yield? 2) Joe and Jane each buy a two year bond with a 10% yi ...

... the first midterm covering the first five chapters of Quadrini and Wright. 1) A coupon bond has a face value of $100, a coupon rate of 5%, time to maturity of 3 years and the yield is 6%. What is the price of the bond? What is the current yield? 2) Joe and Jane each buy a two year bond with a 10% yi ...

Random Variables and Probability Distributions

... checks the answers completely at random. For each correct answer the student gets one point and for each wrong answer he gets –a points (that is, a points are subtracted). Derive an expression for the expected value of the total score for the test. If you want this value to be exactly equal to n, so ...

... checks the answers completely at random. For each correct answer the student gets one point and for each wrong answer he gets –a points (that is, a points are subtracted). Derive an expression for the expected value of the total score for the test. If you want this value to be exactly equal to n, so ...

Finance 301 Chapter 6: Problems 10/16/08 30 day T

... Usually, if the bonds is called early, the issuer has to pay a call premium that awards the bond holder with more money than par. (example a 10% premium on a 100 dollar bond would give the holder 110 dollars if it were called early.) There is also something called “call protection” that prohibits th ...

... Usually, if the bonds is called early, the issuer has to pay a call premium that awards the bond holder with more money than par. (example a 10% premium on a 100 dollar bond would give the holder 110 dollars if it were called early.) There is also something called “call protection” that prohibits th ...

statement of risk - ACT Department of Treasury

... The market valuation of these securities for accounting and trading purposes will also change over time due to changes in interest rates. An increase in interest rates will generally lead to a decrease in the valuation of debt securities and vice versa. The degree of change in the valuation will dep ...

... The market valuation of these securities for accounting and trading purposes will also change over time due to changes in interest rates. An increase in interest rates will generally lead to a decrease in the valuation of debt securities and vice versa. The degree of change in the valuation will dep ...

bam_513financial_mangement_final_exam

... shares of stock Y which has a price of $3 per share. What is the proportion of N ico's portfol io invested in stock X? a. ...

... shares of stock Y which has a price of $3 per share. What is the proportion of N ico's portfol io invested in stock X? a. ...

Chapter_2_Presentation

... Reserve Recognition Accounting (RRA) is a current value standard for oil and gas companies. In 1982, the FASB issued SFAS 69 which required supplemental disclosure of certain information about the operations of publicly traded oil and gas companies SFAS 69 requires disclosure of the estimated P ...

... Reserve Recognition Accounting (RRA) is a current value standard for oil and gas companies. In 1982, the FASB issued SFAS 69 which required supplemental disclosure of certain information about the operations of publicly traded oil and gas companies SFAS 69 requires disclosure of the estimated P ...