Institute of Actuaries of India Subject CT8 – Financial Economics INDICATIVE SOLUTIONS

... All assets are perfectly divisible and perfectly liquid (that is, marketable at the going price) All investors are price takers (that is, all investors assume that their own buying and selling activity will not affect stock prices) The quantities of all assets are given and fixed There are n ...

... All assets are perfectly divisible and perfectly liquid (that is, marketable at the going price) All investors are price takers (that is, all investors assume that their own buying and selling activity will not affect stock prices) The quantities of all assets are given and fixed There are n ...

doc chapter 1 solutions

... compensation to the success of the firm. However, the manager might view this as the safest compensation structure and therefore value it more highly. b. A salary that is paid in the form of stock in the firm means that the manager earns the most when the shareholders’ wealth is maximized. This stru ...

... compensation to the success of the firm. However, the manager might view this as the safest compensation structure and therefore value it more highly. b. A salary that is paid in the form of stock in the firm means that the manager earns the most when the shareholders’ wealth is maximized. This stru ...

Review for Midterm

... • When you buy a stock on margin you own the stock (with all the rights) and owe the broker the amount of the loan. • If the stock declares a dividend, then, since you own the stock you will receive the dividend in the entire amount. ...

... • When you buy a stock on margin you own the stock (with all the rights) and owe the broker the amount of the loan. • If the stock declares a dividend, then, since you own the stock you will receive the dividend in the entire amount. ...

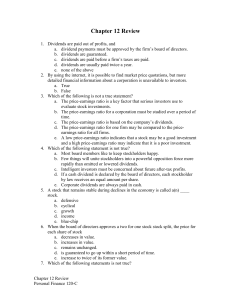

Chapter12Review

... c. dividends are paid before a firm’s taxes are paid. d. dividends are usually paid twice a year. e. none of the above 2. By using the internet, it is possible to find market price quotations, but more detailed financial information about a corporation is unavailable to investors. a. True b. False 3 ...

... c. dividends are paid before a firm’s taxes are paid. d. dividends are usually paid twice a year. e. none of the above 2. By using the internet, it is possible to find market price quotations, but more detailed financial information about a corporation is unavailable to investors. a. True b. False 3 ...

Snímek 1

... Sometime is over and sometime is under intrinsic value. The exchange rate volatile about intrinsic value. In the stock market is running continual valuation process. Analytics and Investors are trying to identify over- and underestimate stocks. As a result they change demand about particulate stock ...

... Sometime is over and sometime is under intrinsic value. The exchange rate volatile about intrinsic value. In the stock market is running continual valuation process. Analytics and Investors are trying to identify over- and underestimate stocks. As a result they change demand about particulate stock ...

Answers

... The weighted average cost of capital (WACC) is the average return required by current providers of finance. The WACC therefore reflects the current risk of a company’s business operations (business risk) and way in which the company is currently financed (financial risk). When the WACC is used as di ...

... The weighted average cost of capital (WACC) is the average return required by current providers of finance. The WACC therefore reflects the current risk of a company’s business operations (business risk) and way in which the company is currently financed (financial risk). When the WACC is used as di ...

How_Much_International

... We invest internationally primarily to reduce portfolio risk. Cross border investing brings asset classes with low correlations to our domestic holdings, resulting in lower volatility for the investment plan. There is a wealth of academic theory and real world experience to support this thesis, but ...

... We invest internationally primarily to reduce portfolio risk. Cross border investing brings asset classes with low correlations to our domestic holdings, resulting in lower volatility for the investment plan. There is a wealth of academic theory and real world experience to support this thesis, but ...

Using the CAPM

... The residuals (e) show the level of firm-specific risk. This might be quite high for an individual stock, but since E(e) = 0, when we have a reasonably large portfolio of stocks they should all cancel each other out (for each firm that has unexpected bad firm-specific news on a given day, another fi ...

... The residuals (e) show the level of firm-specific risk. This might be quite high for an individual stock, but since E(e) = 0, when we have a reasonably large portfolio of stocks they should all cancel each other out (for each firm that has unexpected bad firm-specific news on a given day, another fi ...

CP World History (Unit 7, #2)

... taking a risk of losing money as well. B. ____________________________ 1. The greater the risk you are willing to take the higher the potential rewards you can earn C. ____________________________ 1. The lower the risk you are willing to take the lower the potential rewards you will earn V. Risk and ...

... taking a risk of losing money as well. B. ____________________________ 1. The greater the risk you are willing to take the higher the potential rewards you can earn C. ____________________________ 1. The lower the risk you are willing to take the lower the potential rewards you will earn V. Risk and ...

File

... financing government issues treasury bills, notes, and bonds to borrow from public. • Financial Intermediaries: – Banks: Deals with other people’s money with interest margin. The balance sheet is characterized by very small amount of tangible assets. – Mutual funds : pool and manage the scattered sa ...

... financing government issues treasury bills, notes, and bonds to borrow from public. • Financial Intermediaries: – Banks: Deals with other people’s money with interest margin. The balance sheet is characterized by very small amount of tangible assets. – Mutual funds : pool and manage the scattered sa ...

Syllabus - Baylor University

... all corporations totals $300 million. Each investor group has the same amount of money to invest and their total net worth equals the value of all securities. In other words, all the interest income from muni’s as well as all corporate NOI mentioned above must flow through securities purchased by th ...

... all corporations totals $300 million. Each investor group has the same amount of money to invest and their total net worth equals the value of all securities. In other words, all the interest income from muni’s as well as all corporate NOI mentioned above must flow through securities purchased by th ...

PPT

... marginal tax rates. LO4 Determine a firm's cash flow from its financial Copyright (c) 2017 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. ...

... marginal tax rates. LO4 Determine a firm's cash flow from its financial Copyright (c) 2017 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. ...

Lower Returns Likely in the Years Ahead

... While we don’t make bold predictions, we do try to manage investor expectations. When we have a strong opinion about the potential returns available in the markets, we tell you. For instance, at the time of the stock market lows in early 2009, we stated in our commentary that, “We believe there are ...

... While we don’t make bold predictions, we do try to manage investor expectations. When we have a strong opinion about the potential returns available in the markets, we tell you. For instance, at the time of the stock market lows in early 2009, we stated in our commentary that, “We believe there are ...

II,1-3 Powerpoint

... What is an inventory and why is one necessary? An inventory is the listing and valuation of all business assets. Inventories are important in getting a financial picture of the business. Assets in the inventory are a major part of the ...

... What is an inventory and why is one necessary? An inventory is the listing and valuation of all business assets. Inventories are important in getting a financial picture of the business. Assets in the inventory are a major part of the ...

Final Examination for Financial Management

... to reduce its financial risk. Assumed Kim Company can reduce leverage ratio to 40% with its current borrowing (risk-free) rate 5%. If its current L is 1.32. (when its leverage ratio is 70%) Please compute its cost of equity when its leverage ratio becomes 40%. Assumed its tax ratio is 25%, and the ...

... to reduce its financial risk. Assumed Kim Company can reduce leverage ratio to 40% with its current borrowing (risk-free) rate 5%. If its current L is 1.32. (when its leverage ratio is 70%) Please compute its cost of equity when its leverage ratio becomes 40%. Assumed its tax ratio is 25%, and the ...

FinancialCalculations_001

... Taxable yield x (1 – your tax rate) For example: Cae D’Ann Drofsab is comparing a $1,000 corporate bond paying a 7.5% return with a municipal bond paying 6.2% return. If Miss Drofsab is in the 28% tax bracket, which investment is the best after tax choice? It would appear at first glance that the co ...

... Taxable yield x (1 – your tax rate) For example: Cae D’Ann Drofsab is comparing a $1,000 corporate bond paying a 7.5% return with a municipal bond paying 6.2% return. If Miss Drofsab is in the 28% tax bracket, which investment is the best after tax choice? It would appear at first glance that the co ...

FIN 303 Chap 9 Fall 2009

... Note: The value you put on the stock could be different from its current price in the market. Example: Suppose IBM is trading for $84/share. But you estimate it is worth $100/share. Based on that belief, you might buy IBM stock. You’d be betting others would figure out you are right and buy IBM stoc ...

... Note: The value you put on the stock could be different from its current price in the market. Example: Suppose IBM is trading for $84/share. But you estimate it is worth $100/share. Based on that belief, you might buy IBM stock. You’d be betting others would figure out you are right and buy IBM stoc ...