* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Final Examination for Financial Management

Investment management wikipedia , lookup

Modified Dietz method wikipedia , lookup

Private equity wikipedia , lookup

Private equity secondary market wikipedia , lookup

Present value wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Pensions crisis wikipedia , lookup

Systemic risk wikipedia , lookup

Stock trader wikipedia , lookup

Global saving glut wikipedia , lookup

Private equity in the 1980s wikipedia , lookup

Business valuation wikipedia , lookup

Financialization wikipedia , lookup

Mergers and acquisitions wikipedia , lookup

Financial economics wikipedia , lookup

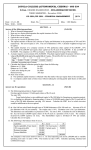

Department: Final Examination for Financial Management Name: Student Number: Answer Sheet 1. Conceptual multiple choices, 4 points for each question: 1 2 3 4 5 6 7 8 9 10 11 12 2. Computational multiple choices, 5 points for each question: 1 2 3 4 5 6 7 8 9 10 11 12 1. Conceptual multiple choices. sheet above. Please select a most correct answer, and fill in the answer 1. The Modigliani-Miller Proposition I without taxes states a. b. c. d. A firm cannot change the total value of its outstanding securities by changing its capital structure proportions. When new projects are added to the firm the firm value is the sum of the old value plus the new. Managers can make correct corporate decisions that will satisfy all shareholders if they select projects that maximize value. the determination of value must consider the timing and risk of the cash flows. 1 2. Which of the following are correct in relation to M&M Proposition II with no taxes? I. II. III. IV. The return on assets is equal to the weighted average cost of capital. Financial risk is determined by the debt-equity ratio. Financial risk determines the return on assets. The cost of equity declines when the amount of leverage used by a firm rises. a. b. c. d. I and III only II and IV only I and II only III and IV only 3. Combining MM theory and CAPM, which of the following is correct? a. Since the systematic risk of debt (Beta) is zero, the cost of debt is zero. b. c. d. When leverage ratio increases, the WACC of a firm will increase with a non-zero tax. When leverage ratio increases, the financial risk premium of equity will increase. The business (operating) risk premium and debt ratio of a company are positively correlated. 4. One of the indirect costs of bankruptcy is the incentive for managers to take large risks. When following this strategy, the firm will a. b. c. d. 5. rank all projects and take the project which results in the highest expected value of the firm. bondholders expropriate value from stockholders by selecting high risk projects. stockholders expropriate value from bondholders by selecting high risk projects. always take the low risk project. Which of following statements about dividend policy is NOT correct? a. b. c. d. MM states that the value of a firm depends on the ability of making profit, not the process of distribution. Bird-in-the-hand theory states that investors prefer cash dividend to capital gain, thus higher cash dividend paid, the better the stock price. The signaling theory states that managers use the actual dividend payout ratio to disclose the firm’s perspective. According to the clientele effect theory, we can find that the higher investors’ income tax rate, the higher payout ratio of the stocks that investors hold. 2 6. Which of the following lists events in chronological order from earliest to latest? a. b. c. d. 7. Date of Record, Declaration Date, Ex-Dividend Date. Date of Record, Ex-Dividend Date, Declaration Date. Declaration Date, Date of Record, Ex-Dividend Date. Declaration Date, Ex-Dividend Date, Date of Record. One corporate repurchases its stock by cash that borrowed from a bank. Which of the following is incorrect? a. Stock repurchasing signals the market that stock price is undervalued, and the stock price will increase. b. The debt-to-equity ratio increases, thus a higher financial risk. When the probability of bankruptcy does not exist, then the firm’s WACC increases. c. Stock repurchasing can be used to substitute for cash dividend. It can increase share holders’ after-tax income under the condition of no capital-gain tax. d. When a corporate increases its leverage ratio, market considers that the firm has confidence in future earnings. So it is a positive signal. 8. Which of the following is incorrect? a. The empirical evidence indicates that the shareholders of target firms take most of gains from M&A. In the short run, target firm gets above 20% excess return in a successful merger and tender offer. The firm who has won the bidding war in merger, its stock price has a greater possibility to go down than go up. For those firms which finance their mergers with new issues of stocks are more likely b. c. d. to have better post-merger performance than those which finance by cash. 9. Which of the following are considered financial synergy in a successful merger? I Tax benefits II A lower cost of capital III The reduction in operating cost IV The increase in the expected growth rate in revenue 3 a. I., and II b. I, II, and IV c. I , II, III, and IV d. I, II, and III. 10. Which of following takeover defenses tactics need shareholders’ approval? I. II. Dual Class recapitalization. Change in corporate charter. III. Anti-trust lawsuits. IV Change in registration venue. a. I., and II b. I, II, and IV c. I , II, III, and IV d. I, II, and III. 11. Which of following account items is often NOT expressed as a proportion of sales when we conduct financial forecasting? a. b. c. d. Current asset. Cost of goods sold. Notes payables. Accounts Payable and Accruals. 12. Which of following statements about calculating the operating cycle is incorrect? a. The account receivable collection period is equal to average account receivable divided by purchase per day. b. The operating cycle is equal to the inventory conversion period plus account receivable collection period. c. We can use 360 days to divide by the inventory turnover to get the inventory conversion period. d. The cash period is the period that a firm needs to finance short-term capital. 4 2. Computational multiple choices. Please select a right answer, and fill in the answer sheet above. 1. Sky company can produce the same products via two processes. Process A demands an $600,000 investment on fixed cost, and variable cost is $3 per unit. Process B demands a $800,000 investment on fixed cost and variable cost is $2 per unit. Assumed the selling price per unit is $5. Please compute the sales revenue on which makes Processes A and B to produce the same EBIT. a. b. $1,000,000。 $1,600,000。 c. d. e. $2,000,000。 $1,800,000。 $2,400,000。 2. The following is XYZ Company’s partial financial statement. What is the degree of combined leverage? Sales $2,000,000 Fixed costs 720,000 Variable costs 640,000 Interest expense 100,000 Preferred dividend Tax 75,000 25% a. 5.15. b. 4.37. c. 4.09. d. 3.41. e. 3.09. 3. King Company expects its perpetual EBIT to be $600,000; and its par value (equals market value) of debt is $2,000,000. Its interest rate is 6% annually. If the cost of un-levered equity is 12%, and its tax ratio is 25%. Please compute the WACC for the firm. 5 a. 10.59%。 b. c. d. e. 11.32%。 11.70%。 12.12%。 12.86%。 4. Taichung Company expects its perpetual EBIT to be $1,200,000. Its cost of un-levered equity is 12%, and its tax rate is 25%. Assumed it has $2,000,000 debt (before tax cost of debt 6%). Please compute the cost of levered equity for the firm. a. 12.60%。 b. 13.64%。 c. 14.25%。 d. 14.68%。 e. 15.20%。 5. ABC Company is an originally un-levered firm. Its expected perpetual EBIT is $800,000, and its cost of capital is 12% when it is un-levered. Its tax rate is 25%. Assumed now risk-free interest rate is 6%, and Yon Company can borrow $3,000,000 and repurchase the outstanding shares. Please compute the market a. b. c. d. e. 6. value of equity after leverage for ABC Company after leverage. $2,000,000. $2,500,000. $2,750,000. $3,500,000. $3,750,000. Kim company’s current leverage ratio is 70%. Now it wants to decrease its leverage ratio to reduce its financial risk. Assumed Kim Company can reduce leverage ratio to 40% with its current borrowing (risk-free) rate 5%. If its current L is 1.32. (when its leverage ratio is 70%) Please compute its cost of equity when its leverage ratio becomes 40%. Assumed its tax ratio is 25%, and the expected market return is 14%. a. b. c. d. 12.96%。 13.48%。 12.24%。 11.48%。 e. 10.72%。 6 7. ABC Company has common stocks 10,000,000 share outstanding, current price at $50 per share, and it decides to pay 25% stock dividend this year. Assume the stock dividend couldn’t produce any signal effect. What is the stock price after paying stock dividend? a. $27.5。 b. $37.5。 c. $40。 d. $45。 e. $50。 8. The capital structure for Asia Company is 60% debt and 40% equity. It expects it after-tax net income for next year is $2,000,000, and the need in capital budgeting is $4,000,000. Asia Company decides that it will follow the residual dividend policy. Please compute the dividend payout ratio? (note: dividend payout ratio equals dividend payment divided by the after-tax net income) a. 0%。 b. 10%。 c. 20%。 d. 25%。 e. 40%。 9. A company declares $6 cash dividend. Its stock price before ex-dividend is $60, and that after ex-dividend is $56. According to Dividend Clientele Theory by Elton and Gruber (1970), please compute the tax rate for investors if there is zero capital-gain tax. a. 10%。 b. 20%。 c. 25%。 d. 30%。 e. 33%。 7 10-11 10. The following is the partial financial statement of King Company: COGS $ 5,400,000 Average Inventory $ 600,000 Average AR $ 800,000 Sales $ 8,000,000 Account Payable $ 450,000 Assumed inventory turnover is defined as COGS divide by the average inventory, and account receivable turnover is defined as sales divide by the average account receivable. Please compute its operating cycle. (Assumed 360days/ year) a. 50 days b. 60 days c. 70 days d. 76 days e. 80 days 11. Assumed account payable turnover is defined as COGS divide by account payable. Please compute its cash cycle. a. 36 days b. 46 days c. 54 days d. 63 days e. 72 days 12. Here is a simplified balance sheet for XYZ Company: Current asset $400 Account Payable and Accrual $180 Fixed asset $800 Long-term debt $240 Equity $800 Total asset $1,200 Debt and Equity $1,200 (Million) 8 XYZ Company is currently 100% capacity. Sales revenue is $1,000M this year. Assuming that total assets, account payable and accruals grow proportionally with sales. XYZ Company expects its sales revenue to be $1,400M next year, after-tax profit margin is 8%, and dividend payout ration is 30%; please compute the additional fund needed for next year. a. No additional fund needed。 b. 200M。 c. 280M。 d. 330M。 e. 450M。 Formula SML E ( Ri ) R f E ( Rm ) R f i expected return: k s D1 g P0 WACC kd (1 t ) wd k pf w pf k s ws , DOL EPS Sales VC Sales VC EBIT FC Sales VC FC EBIT EBIT D F L EBIT D pf E B I T I 1 t ( EBIT I ) (1 t ) Dpf n M/M Proposition 1:Capital structure and Firm value (With tax and without tax) Vu EBIT (1 t ) , VL Vu tD k su M/M Proposition2:Cost of capital and Capital structure (With tax and without tax) k sl k su (k su k D ) A. Cost of equity after leverage without tax B. WACC after leverage without tax WACC C. Cost of equity after leverage with tax D. WACC after leverage with tax D S k su k sl k su (k su k D )(1 t ) WACC k su (1 D S tD ) V 9 Capital structure theory and CAPM l u [1 (1 t ) D ] S k sl R f u [ E ( Rm ) R f ] [ E ( Rm ) R f ] u [(1 t ) D ] S Elton and Gruber (1970) Dividend Clientele theory PB PA 1 tO D 1 tg AFN (Additional Funds Needed) = (A*/S0) ΔS - (L*/S0) ΔS - M(S1)(1 - d) (Inventory turnover) = Sales / Average Inventory, or COGS / Average Inventory [(Inventory Conversion) = 360 /Inventory turnover] (Accounts Receivable turnover) = Sales / AR [(Days A/R outstanding) = 360 /Account Receivable turnover] (Payable turnover) = Purchase (or COGS) / AP [Days A/P outstanding = 360 /Payable turnover] (Operating Cycle) =Inventory Conversion+ Days A/R outstanding Cash Cycle =Operating Cycle – Days A/P outstanding 10 1. Conceptual multiple choices, 4 points for each question: 1 2 3 4 5 A C C C D 6 7 8 9 10 D B D A B 11 12 C A 2. Computational multiple choices, 5 points for each question: 1 2 3 4 5 A E A B C 6 7 8 9 10 D C C E D 11 12 B D 11