Options

... • Net present value NPV(x)=x0+x1/(1+r)+…+xn/(1+r)n • Discount all payments/investments back to time t=0 and add the discounted values up • If cash flow is uncertain then NPV is often replaced by expected NPV (risk-neutral valuation) • Benefits and limitations of NPV valuations and risk-neutral prici ...

... • Net present value NPV(x)=x0+x1/(1+r)+…+xn/(1+r)n • Discount all payments/investments back to time t=0 and add the discounted values up • If cash flow is uncertain then NPV is often replaced by expected NPV (risk-neutral valuation) • Benefits and limitations of NPV valuations and risk-neutral prici ...

Expected Cash Flow: a Novel Model of Evaluating Financial Assets

... The present paper aims to lay the foundation of a novel asset pricing model that would avoid the shortcomings of the universally recognised Discounted Cash Flow model (J. Williams, 1938), superseding the latter. The Discounted Cash Flow model (DCF) works good for explaining price formation for bank ...

... The present paper aims to lay the foundation of a novel asset pricing model that would avoid the shortcomings of the universally recognised Discounted Cash Flow model (J. Williams, 1938), superseding the latter. The Discounted Cash Flow model (DCF) works good for explaining price formation for bank ...

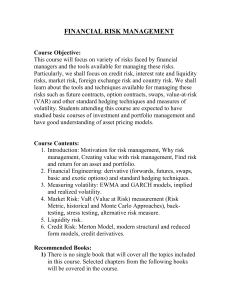

FINANCIAL RISK MANAGEMENT

... FINANCIAL RISK MANAGEMENT Course Objective: This course will focus on variety of risks faced by financial managers and the tools available for managing these risks. Particularly, we shall focus on credit risk, interest rate and liquidity risks, market risk, foreign exchange risk and country risk. We ...

... FINANCIAL RISK MANAGEMENT Course Objective: This course will focus on variety of risks faced by financial managers and the tools available for managing these risks. Particularly, we shall focus on credit risk, interest rate and liquidity risks, market risk, foreign exchange risk and country risk. We ...

Econ 306

... liquidity crises worldwide FED cut interest rate by 0.75% and the Central Bank of Turkey followed the trend and cut the interest rate by 1%. What would happen in the short run in terms of capital flows? Would the YTL depreciate or appreciate? Why? 2. (16 points) The spot exchange rate between YTL an ...

... liquidity crises worldwide FED cut interest rate by 0.75% and the Central Bank of Turkey followed the trend and cut the interest rate by 1%. What would happen in the short run in terms of capital flows? Would the YTL depreciate or appreciate? Why? 2. (16 points) The spot exchange rate between YTL an ...

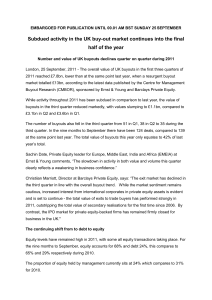

CMBOR UK Q3 2011_Final_23.09.11 - Workspace

... recording only 9 and £992m respectively. This compares to 16 deals completed with a value of £2.8bn in 2010. Date comments, “The retail sector enters its most important trading period in the lead up to Christmas but with disposable income stretched it is likely to be tough on the high street for som ...

... recording only 9 and £992m respectively. This compares to 16 deals completed with a value of £2.8bn in 2010. Date comments, “The retail sector enters its most important trading period in the lead up to Christmas but with disposable income stretched it is likely to be tough on the high street for som ...

2. MLS Agents Are Excited About Your Home

... buyers are willing to pay for a home at a specific point in time. Who Then Controls Price? Generally speaking, it is the overall economic condition of the economy itself and the local user market. Who Is The Local User Market? It consists of buyers & sellers who reach agreement on home sale prices. ...

... buyers are willing to pay for a home at a specific point in time. Who Then Controls Price? Generally speaking, it is the overall economic condition of the economy itself and the local user market. Who Is The Local User Market? It consists of buyers & sellers who reach agreement on home sale prices. ...

Stocks and Bonds - NUS Investment Society

... Information contained herein has been obtained from sources believed to be reliable, but is not guaranteed. This article is distributed for educational purposes and should not be considered investment advice or an offer of any security for sale. Statements concerning financial market trends are base ...

... Information contained herein has been obtained from sources believed to be reliable, but is not guaranteed. This article is distributed for educational purposes and should not be considered investment advice or an offer of any security for sale. Statements concerning financial market trends are base ...

Chapter 15 Valuation Analysis: Income Discounting, Cap Rates and

... Older properties typically have more risk as a result of greater repair volatility. More risk means higher cap rates and lower values ...

... Older properties typically have more risk as a result of greater repair volatility. More risk means higher cap rates and lower values ...

Answers to Chapter 22 Questions

... liquidation value of a distressed bank. Among the arguments against market value accounting are that market values are sometimes difficult to estimate, particularly for small banks with nontraded assets. In addition, some argue that market value accounting would produce higher volatility in the earn ...

... liquidation value of a distressed bank. Among the arguments against market value accounting are that market values are sometimes difficult to estimate, particularly for small banks with nontraded assets. In addition, some argue that market value accounting would produce higher volatility in the earn ...

Portfolio Compass

... All bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and are subject to availably and change in price. High yield/ junk bonds are not investment grade securities, involve substantial risks and generally should be part of th ...

... All bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and are subject to availably and change in price. High yield/ junk bonds are not investment grade securities, involve substantial risks and generally should be part of th ...

Training - NYU Stern

... management try to get their nominees elected to the board of directors. Forced CEO turnover: The board of directors, in exceptional cases, can force out the CEO of a company and change top management. Hostile acquisitions: If internal processes for management change fail, stockholders have to hope t ...

... management try to get their nominees elected to the board of directors. Forced CEO turnover: The board of directors, in exceptional cases, can force out the CEO of a company and change top management. Hostile acquisitions: If internal processes for management change fail, stockholders have to hope t ...

Startup Financial Engineering Tutorial

... ◦ Overall, this is much higher than for most industries ◦ However, 15% growth versus 50% growth is consistent with observed 90% public equity decline ◦ Next-generation areas will grow much faster (50%) ...

... ◦ Overall, this is much higher than for most industries ◦ However, 15% growth versus 50% growth is consistent with observed 90% public equity decline ◦ Next-generation areas will grow much faster (50%) ...

Money, Banking, and Financial Markets (Econ 353) Midterm

... A) They can both be long-term financial instruments. B) They can both be short-term financial instruments. C) They both involve a claim on the issuer's income. D) They both enable a corporation to raise funds. 3) The Foreign Exchange Market A) Allows one currency to be converted into another. B) Hel ...

... A) They can both be long-term financial instruments. B) They can both be short-term financial instruments. C) They both involve a claim on the issuer's income. D) They both enable a corporation to raise funds. 3) The Foreign Exchange Market A) Allows one currency to be converted into another. B) Hel ...

Chapter 1: Introduction

... Arbitrage: A market situation whereby an investor can make a profit with: no equity and no risk. Efficiency: A market is said to be efficient if prices are such that there exist no arbitrage opportunities. Alternatively, a market is said to be inefficient if prices present arbitrage opportunities fo ...

... Arbitrage: A market situation whereby an investor can make a profit with: no equity and no risk. Efficiency: A market is said to be efficient if prices are such that there exist no arbitrage opportunities. Alternatively, a market is said to be inefficient if prices present arbitrage opportunities fo ...

(as for FX options).

... Value the “Intrinsic Value” Element • Method #1: Adjust to its fair value (obtainable from market quotes). – FAS 133 requires this method. • Method #2: Determine by the change in the spot rate. – Allowed prior to FAS 133. ...

... Value the “Intrinsic Value” Element • Method #1: Adjust to its fair value (obtainable from market quotes). – FAS 133 requires this method. • Method #2: Determine by the change in the spot rate. – Allowed prior to FAS 133. ...

chapter 9 - U of L Class Index

... A major problem with comparing a firm to its industry is that you may not feel comfortable with the measure of central tendency for the industry. Specifically, you may feel that the average value is not a very useful measure because of the wide dispersion of values for the individual firms within th ...

... A major problem with comparing a firm to its industry is that you may not feel comfortable with the measure of central tendency for the industry. Specifically, you may feel that the average value is not a very useful measure because of the wide dispersion of values for the individual firms within th ...

Note 3 Finansiell risikostyring_EN

... value creation and ensure the maintenance of a continued solid financial platform. Risk management frameworks and objectives comply with overall guidelines approved by the Board of Directors as well as associated risk mandates. Risk management is generally a key responsibility of each business unit’ ...

... value creation and ensure the maintenance of a continued solid financial platform. Risk management frameworks and objectives comply with overall guidelines approved by the Board of Directors as well as associated risk mandates. Risk management is generally a key responsibility of each business unit’ ...

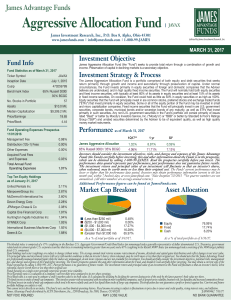

Aggressive Allocation Fund | JAVAX

... The blended index is comprised of a 35% weighting in the Barclays U.S. Aggregate Government/Credit Bond Index (an unmanaged index generally representative of dollar denominated U.S. Treasuries, government related and investment grade U.S. corporate securities that have a remaining maturity greater t ...

... The blended index is comprised of a 35% weighting in the Barclays U.S. Aggregate Government/Credit Bond Index (an unmanaged index generally representative of dollar denominated U.S. Treasuries, government related and investment grade U.S. corporate securities that have a remaining maturity greater t ...

Ayotte - NYU School of Law

... What purchases should be treated as assets (capitalized) and what should be expensed? o General rule: expense when benefits are immediate, or future benefits are too uncertain or immaterial (R&D expenditures) Income statements do not tell us anything about sources and uses of funds Where is the ...

... What purchases should be treated as assets (capitalized) and what should be expensed? o General rule: expense when benefits are immediate, or future benefits are too uncertain or immaterial (R&D expenditures) Income statements do not tell us anything about sources and uses of funds Where is the ...