Significant pullback in market presents opportunities

... market and the lower currency which at current levels adds around 8% to the profit of the market. This is presenting opportunities in a range of stocks. The S&P/ASX 200 Accumulation Index was down 4.5% in May and 2.4% in the three months to 31 May 2013, with Australia underperforming global markets ...

... market and the lower currency which at current levels adds around 8% to the profit of the market. This is presenting opportunities in a range of stocks. The S&P/ASX 200 Accumulation Index was down 4.5% in May and 2.4% in the three months to 31 May 2013, with Australia underperforming global markets ...

Diversification

... The nature of business Businesses sell stock to raise capital Investing in the stock market is simply investing in companies ...

... The nature of business Businesses sell stock to raise capital Investing in the stock market is simply investing in companies ...

Stocks

... The nature of business Businesses sell stock to raise capital Investing in the stock market is simply investing in companies ...

... The nature of business Businesses sell stock to raise capital Investing in the stock market is simply investing in companies ...

MODEL MCQs – CAIIB, PAPER-2, MOD

... e. decision is inversely proportional to the number of estimates f. difficult to pinpoint the correct single estimate g. because it does not provide the extent of error h. a & c ...

... e. decision is inversely proportional to the number of estimates f. difficult to pinpoint the correct single estimate g. because it does not provide the extent of error h. a & c ...

Year 9 Financial Management Revision Booklet Name: Date: Topics

... 16. In general describe the relationship between risk and rate of return. The higher the risk, the higher the return. 17. What is the difference between a Bull Market and a Bear Market? A bull market is a market on an upward trend. A bear market is a market on the downward trend. 18. Match the follo ...

... 16. In general describe the relationship between risk and rate of return. The higher the risk, the higher the return. 17. What is the difference between a Bull Market and a Bear Market? A bull market is a market on an upward trend. A bear market is a market on the downward trend. 18. Match the follo ...

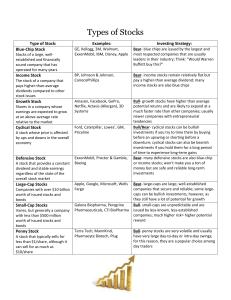

Types of Stocks

... investments if you try to time them by buying before an upswing or shorting before a downturn; cyclical stocks can also be bearish investments if you hold them for a long period of time to experience long-term gains Bear- many defensive stocks are also blue-chip or income stocks; won’t make you a to ...

... investments if you try to time them by buying before an upswing or shorting before a downturn; cyclical stocks can also be bearish investments if you hold them for a long period of time to experience long-term gains Bear- many defensive stocks are also blue-chip or income stocks; won’t make you a to ...

Disclaimer - Betala.in

... others. The information contained herein is from the public domain or sources believed to be fair and correct and opinions based thereupon are reasonable. Due to the very nature of research it cannot be warranted or represented that it is accurate or complete and it should not be relied upon as such ...

... others. The information contained herein is from the public domain or sources believed to be fair and correct and opinions based thereupon are reasonable. Due to the very nature of research it cannot be warranted or represented that it is accurate or complete and it should not be relied upon as such ...

FridayMarch7thMeeting - Sites at Lafayette

... investors nervous • Return on Capital Employed (ROCE) for 2013 : 17%. Usually great for other companies but not for Exxon • Despite high prices – Exxon can’t have ROCE of 20% which what it usually has • On Wednesday, CEO announces spending cuts – 10% decrease in capital expenditures budget. • Stock ...

... investors nervous • Return on Capital Employed (ROCE) for 2013 : 17%. Usually great for other companies but not for Exxon • Despite high prices – Exxon can’t have ROCE of 20% which what it usually has • On Wednesday, CEO announces spending cuts – 10% decrease in capital expenditures budget. • Stock ...

Alternative Investment Exposures at Endowments

... Annualized monthly volatility is lower than daily volatility ...

... Annualized monthly volatility is lower than daily volatility ...

Chapter 9 - McGraw Hill Higher Education

... 6. Show how a line of credit affects financial statements. 7. Explain how to account for bonds issued at face value and their related interest costs. 8. Use the straight-line method to amortize bond discounts and premiums. 9. Distinguish between current and noncurrent assets and liabilities. ...

... 6. Show how a line of credit affects financial statements. 7. Explain how to account for bonds issued at face value and their related interest costs. 8. Use the straight-line method to amortize bond discounts and premiums. 9. Distinguish between current and noncurrent assets and liabilities. ...

Standards and Analysis: Part II - National Farm Viability Conference

... Financial Analysis Financial Analysis compares trends in • revenues and expense • projected to actual cash flow • Changes in ratios related to solvency, liquidity, profitability and efficiency. ...

... Financial Analysis Financial Analysis compares trends in • revenues and expense • projected to actual cash flow • Changes in ratios related to solvency, liquidity, profitability and efficiency. ...

Common Sense Economics -

... 13. Which of the following has enhanced the ability of investors, without any special business skills, to benefit from the ownership of corporate America? a. the increased availability of mutual funds, that make it possible for even small investors to purchase a diverse stock portfolio at a low cos ...

... 13. Which of the following has enhanced the ability of investors, without any special business skills, to benefit from the ownership of corporate America? a. the increased availability of mutual funds, that make it possible for even small investors to purchase a diverse stock portfolio at a low cos ...

NOTEBOOK12.1 - Plymouth State College

... analysis, regards quantitative and statistical patterns and trends in (primarily) the firm's stock price to forecast future stock prices. 1) RATIO ANALYSIS: Ratio analysis is the classic approach to conducting corporate financial analysis. The technique has been used for over 100 years and many diff ...

... analysis, regards quantitative and statistical patterns and trends in (primarily) the firm's stock price to forecast future stock prices. 1) RATIO ANALYSIS: Ratio analysis is the classic approach to conducting corporate financial analysis. The technique has been used for over 100 years and many diff ...

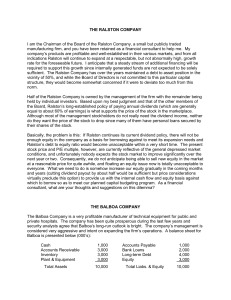

The Ralston Company/The Balboa Company

... enough equity in the company as a basis for borrowing against to meet its expansion needs and Ralston’s debt to equity ratio would become unacceptable within a very short time. The present stock price and P/E multiple, however, are currently reflective of the general depressed market conditions, and ...

... enough equity in the company as a basis for borrowing against to meet its expansion needs and Ralston’s debt to equity ratio would become unacceptable within a very short time. The present stock price and P/E multiple, however, are currently reflective of the general depressed market conditions, and ...

Finance Notes 2008 Size: 351.5kb Last modified

... characteristics (i.e. relatively predictable cash flows). Firms with high risk characteristics from either financial difficulty (telecom) or growth firms (Internet) have unpredictable cash flows that are difficult to evaluate using DCF methodology. These situations are better valued using option pri ...

... characteristics (i.e. relatively predictable cash flows). Firms with high risk characteristics from either financial difficulty (telecom) or growth firms (Internet) have unpredictable cash flows that are difficult to evaluate using DCF methodology. These situations are better valued using option pri ...

Prepare your portfolio for rising interest rates

... and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses which may be obtained by visiting www.iShares.com or www.blackrock.com. Read the prospectus carefully before investing. Investing involves risk, including possible loss of principal. Institutiona ...

... and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses which may be obtained by visiting www.iShares.com or www.blackrock.com. Read the prospectus carefully before investing. Investing involves risk, including possible loss of principal. Institutiona ...

Law for Business

... What is a Insurance? Protection against financial loss Insurance companies share risk and charge a premium which represents their estimate of average losses plus a competitive profit The contract outlining payments between you and the insurance company is known as a policy ...

... What is a Insurance? Protection against financial loss Insurance companies share risk and charge a premium which represents their estimate of average losses plus a competitive profit The contract outlining payments between you and the insurance company is known as a policy ...

Common Financial Ratios

... Bonded Debt / Stockholders’ Equity Total Liabilities / (Common Equity – Intangible Assets) Sales / Average Cash (which usually includes marketable ...

... Bonded Debt / Stockholders’ Equity Total Liabilities / (Common Equity – Intangible Assets) Sales / Average Cash (which usually includes marketable ...

investing in swaziland government treasury bills

... on behalf of the Government of Swaziland. When Tbills are bought, one cannot cash them before maturity but one can sell them in the secondary market either to a primary dealer or the Central Bank of Swaziland. Because they are government-backed securities, they can be and are recognized as collatera ...

... on behalf of the Government of Swaziland. When Tbills are bought, one cannot cash them before maturity but one can sell them in the secondary market either to a primary dealer or the Central Bank of Swaziland. Because they are government-backed securities, they can be and are recognized as collatera ...