* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Consultation paper - Ministry of Justice

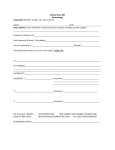

Survey

Document related concepts

Rate of return wikipedia , lookup

Investment management wikipedia , lookup

Merchant account wikipedia , lookup

Financial economics wikipedia , lookup

Credit rationing wikipedia , lookup

Present value wikipedia , lookup

Interbank lending market wikipedia , lookup

Continuous-repayment mortgage wikipedia , lookup

Credit card interest wikipedia , lookup

Interest rate ceiling wikipedia , lookup

Internal rate of return wikipedia , lookup

Business valuation wikipedia , lookup

Pensions crisis wikipedia , lookup

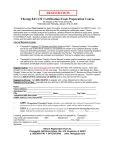

Transcript