Soft Landings (February 2000), with Martin Schneider

... Gilchrist (1998)) have considered a setup in which the price of capital is allowed to fluctuate due to adjustment costs. ...

... Gilchrist (1998)) have considered a setup in which the price of capital is allowed to fluctuate due to adjustment costs. ...

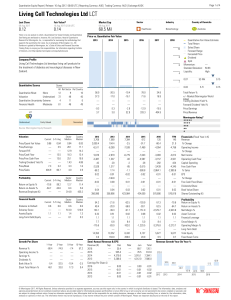

Living Cell Technologies Ltd LCT

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

24/01/2013 - EXEL Industries

... We will continue our international expansion and consolidate our presence in the gardening segment with the acquisition of HOZELOCK in October 2012. We have begun 2013 with the same level of determination and pragmatism that marked our approach in 2012, focusing on our three operating priorities. > ...

... We will continue our international expansion and consolidate our presence in the gardening segment with the acquisition of HOZELOCK in October 2012. We have begun 2013 with the same level of determination and pragmatism that marked our approach in 2012, focusing on our three operating priorities. > ...

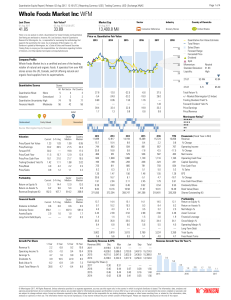

Whole Foods Market Inc WFM

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

word - Nasdaq`s INTEL Solutions

... application software, and services to provide its customers new products and solutions with superior ease-of-use, seamless integration, and innovative industrial design. The Company believes continual investment in research and development is critical to the development and enhancement of innovative ...

... application software, and services to provide its customers new products and solutions with superior ease-of-use, seamless integration, and innovative industrial design. The Company believes continual investment in research and development is critical to the development and enhancement of innovative ...

Returning Cash to the Owners: Dividend Policy

... paid large dividends. You are now planning to enter the telecommunications and media markets. Which of the following paths are you most likely to follow? Courageously announce to your stockholders that you plan to cut dividends and invest in the new markets. Continue to pay the dividends that you us ...

... paid large dividends. You are now planning to enter the telecommunications and media markets. Which of the following paths are you most likely to follow? Courageously announce to your stockholders that you plan to cut dividends and invest in the new markets. Continue to pay the dividends that you us ...

Dividends and Interest Rate Sensitivity

... central banks have been reluctant to tighten monetary policy over this period. The current economic environment has increased the potential divergence of policy across the world’s economic regions. The European Union has been mired in the prevention of a Greece default, amid soft growth in the South ...

... central banks have been reluctant to tighten monetary policy over this period. The current economic environment has increased the potential divergence of policy across the world’s economic regions. The European Union has been mired in the prevention of a Greece default, amid soft growth in the South ...

Joint Dynamics of Bond and Stock Returns - Wisconsin-School

... comovement, or a “common factor” in returns on assets with independent cash flows in general equilibrium. Martin (2012) generalized this setup to multiple “trees”. My paper differs from these by endogenizing the size of “trees” and modeling technologies with different amounts of cash-flow risk. The ...

... comovement, or a “common factor” in returns on assets with independent cash flows in general equilibrium. Martin (2012) generalized this setup to multiple “trees”. My paper differs from these by endogenizing the size of “trees” and modeling technologies with different amounts of cash-flow risk. The ...

Inequality, stock market participation, and the equity premium

... is finite, when the wealthy hold relatively more stocks, the middle and lower classes must hold relatively less, therefore the participation rate falls. Holding all else equal, a distribution with more inequality requires less participation. At the other extreme, when only participation costs decrea ...

... is finite, when the wealthy hold relatively more stocks, the middle and lower classes must hold relatively less, therefore the participation rate falls. Holding all else equal, a distribution with more inequality requires less participation. At the other extreme, when only participation costs decrea ...

Asymmetric Timely Loss Recognition, Earnings Smoothness and

... the demand for, and the provision of, a conservative reporting strategy. Additionally, Lawrence et al. 2013 provides evidence that there is variation in the level of mandatory conservatism across firms. When conservatism is more pronounced for a firm, economic losses are more likely to be recognized ...

... the demand for, and the provision of, a conservative reporting strategy. Additionally, Lawrence et al. 2013 provides evidence that there is variation in the level of mandatory conservatism across firms. When conservatism is more pronounced for a firm, economic losses are more likely to be recognized ...

Private Placement Financing - Informa Financial Intelligence

... Investors stuck to their post-election guns when it came to sectors in early December, steering more money into the EPFR Globaltracked Sector Funds they believe will benefit from the reflationary policies promised by US President-elect Donald Trump and pulling money out of those they expect will suf ...

... Investors stuck to their post-election guns when it came to sectors in early December, steering more money into the EPFR Globaltracked Sector Funds they believe will benefit from the reflationary policies promised by US President-elect Donald Trump and pulling money out of those they expect will suf ...

European Option Pricing and Hedging with both Fixed

... The break-trough in option valuation theory starts with the publication of two seminal papers by Black and Scholes (1973) and Merton (1973). In both papers authors introduced a continuous time model of a complete frictionfree market where a price of a stock follows a geometric Brownian motion. They ...

... The break-trough in option valuation theory starts with the publication of two seminal papers by Black and Scholes (1973) and Merton (1973). In both papers authors introduced a continuous time model of a complete frictionfree market where a price of a stock follows a geometric Brownian motion. They ...

Financial Market Infrastructure Ordinance

... require authorisation if they are necessary for the continuation of important business processes, in particular in the areas of liquidity management, treasury, risk management, master data administration and accounting, personnel, information technology, trading and settlement, and legal and complia ...

... require authorisation if they are necessary for the continuation of important business processes, in particular in the areas of liquidity management, treasury, risk management, master data administration and accounting, personnel, information technology, trading and settlement, and legal and complia ...

MAR 16/2007

... selling price, cost of production of the OEM, etc…) provided by BLFR and BLBE, but also based on the assumption that all production will be through the OEM in China and the USA. Even though several other products have already been developed by BLBE and a third product is scheduled for launch on Oct ...

... selling price, cost of production of the OEM, etc…) provided by BLFR and BLBE, but also based on the assumption that all production will be through the OEM in China and the USA. Even though several other products have already been developed by BLBE and a third product is scheduled for launch on Oct ...

How suitable is the Fama-French ve-factor model for

... approaches trying to find economic explanations for systematic risk. Second – and this is by far the largest group – there are approaches that model systematic risk by variables that empirically seem to correlate with asset returns. Among these empirical approaches, the three-factor model introduced ...

... approaches trying to find economic explanations for systematic risk. Second – and this is by far the largest group – there are approaches that model systematic risk by variables that empirically seem to correlate with asset returns. Among these empirical approaches, the three-factor model introduced ...

Value Creation by Oilfield Service Companies

... As in our previous studies, we start with the premise that shareholder value tracks the expected intrinsic value of the firm. Intrinsic value in turn is shaped by expectations of growth, returns on capital and risk. These are the result of strategic portfolio choices, execution capabilities and the ...

... As in our previous studies, we start with the premise that shareholder value tracks the expected intrinsic value of the firm. Intrinsic value in turn is shaped by expectations of growth, returns on capital and risk. These are the result of strategic portfolio choices, execution capabilities and the ...