Employee Equity Plans

... links and future intent. The key finding was that, despite the current economic circumstances, most companies that operate stock plans have no current intention of substantially changing plan provisions or eligibility. Other findings indicate that eligibility has declined for option plans (with more ...

... links and future intent. The key finding was that, despite the current economic circumstances, most companies that operate stock plans have no current intention of substantially changing plan provisions or eligibility. Other findings indicate that eligibility has declined for option plans (with more ...

Hedging and Speculating with Interest Rate Swaps

... interest rate derivatives usage over time and to compare it to the variation in the cross section. Using our hand-collected data covering interest rate swap activity for 1,854 firms for up to 10 years, we find that the time-series variation in swap usage is of similar magnitude as the cross-sectiona ...

... interest rate derivatives usage over time and to compare it to the variation in the cross section. Using our hand-collected data covering interest rate swap activity for 1,854 firms for up to 10 years, we find that the time-series variation in swap usage is of similar magnitude as the cross-sectiona ...

MAKING CUSTOMERS PAY: MEASURING AND MANAGING

... Other authors have recognised the importance of customer attractiveness (profitability, growth, etc.) but have discussed this largely in qualitative terms (for example, Fiocca, ...

... Other authors have recognised the importance of customer attractiveness (profitability, growth, etc.) but have discussed this largely in qualitative terms (for example, Fiocca, ...

0001053532-17-000022 - Lasalle Hotel Properties

... the SEC. These unaudited consolidated financial statements, in the opinion of management, include all adjustments (consisting of normal recurring adjustments) considered necessary for a fair presentation of the consolidated balance sheets, consolidated statements of operations and comprehensive inco ...

... the SEC. These unaudited consolidated financial statements, in the opinion of management, include all adjustments (consisting of normal recurring adjustments) considered necessary for a fair presentation of the consolidated balance sheets, consolidated statements of operations and comprehensive inco ...

Market Implied Costs of Bankruptcy

... The paper proceeds as follows. Sec on 2 contains the structural model. Sec on 3 documents the esma on procedure and describes the data. Our main results are reported in Sec on 4 with respect to bankruptcy costs es mates and explanatory variables. Sec on 5 contains the leverage regressions and test o ...

... The paper proceeds as follows. Sec on 2 contains the structural model. Sec on 3 documents the esma on procedure and describes the data. Our main results are reported in Sec on 4 with respect to bankruptcy costs es mates and explanatory variables. Sec on 5 contains the leverage regressions and test o ...

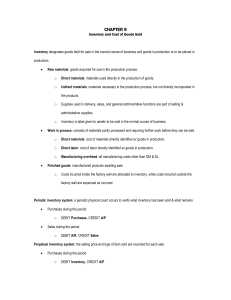

ACCO_120_09

... Double extension method: record of base-year prices and end-of-year prices for each individual inventory item. Price index: an overall measure of how much prices have increased during the year. (Ex. CPI) Inventory @ End-of-Year Prices / Year-End Price Index = Inventory @ Base-Year Prices Layers in B ...

... Double extension method: record of base-year prices and end-of-year prices for each individual inventory item. Price index: an overall measure of how much prices have increased during the year. (Ex. CPI) Inventory @ End-of-Year Prices / Year-End Price Index = Inventory @ Base-Year Prices Layers in B ...

Sustainable Withdrawal Rates From Your Retirement Portfolio

... Other studies have taken a more academic approach. Ho, Milevsky, and Robinson (1994) developed an analytical model to determine the optimal allocation between a risky and risk-free asset in order to minimize the probability that withdrawals will prematurely exhaust a retirement fund. Using historica ...

... Other studies have taken a more academic approach. Ho, Milevsky, and Robinson (1994) developed an analytical model to determine the optimal allocation between a risky and risk-free asset in order to minimize the probability that withdrawals will prematurely exhaust a retirement fund. Using historica ...

A Centralised Investment Process: joined up

... portfolio’; in the language of investment performance measurement, it is the Maximum Sharpe ratio portfolio (MSRP), ie, it offers the highest expected excess return (over the risk free rate) relative to its risk, as measured by standard deviation. It is the adviser’s task, following skilful risk ass ...

... portfolio’; in the language of investment performance measurement, it is the Maximum Sharpe ratio portfolio (MSRP), ie, it offers the highest expected excess return (over the risk free rate) relative to its risk, as measured by standard deviation. It is the adviser’s task, following skilful risk ass ...

The Essays of Warren Buffett: Lessons for

... While they prefer negotiated acquisitions of 100% of such a business at a fair price, they take a "double-barreled approach" of buying on the open market less than 100% of such businesses when they can do so at a pro-rata price well below what it would take to buy 100%. The double-barreled approach ...

... While they prefer negotiated acquisitions of 100% of such a business at a fair price, they take a "double-barreled approach" of buying on the open market less than 100% of such businesses when they can do so at a pro-rata price well below what it would take to buy 100%. The double-barreled approach ...

Does Corporate Governance Predict Firms` Market

... that voluntary choose 50% outside boards and for large firms, which are required by law to have 50% outside directors, so it cannot be explained by endogenous firm choice. highly policy-relevant. ...

... that voluntary choose 50% outside boards and for large firms, which are required by law to have 50% outside directors, so it cannot be explained by endogenous firm choice. highly policy-relevant. ...

Equilibrium interest rate and liquidity premium under

... actively traded stocks averages around .5%. Moreover, transactions costs vary across assets ...

... actively traded stocks averages around .5%. Moreover, transactions costs vary across assets ...

NBER WORKING PAPER SERIES PRICE Nicolae Gârleanu

... sharply, and central banks stretched their balance sheets to facilitate funding. These funding problems had significant asset-pricing effects, the most extreme example being the failure of the Law of One Price: securities with (nearly) identical cash flows traded at different prices, giving rise to ...

... sharply, and central banks stretched their balance sheets to facilitate funding. These funding problems had significant asset-pricing effects, the most extreme example being the failure of the Law of One Price: securities with (nearly) identical cash flows traded at different prices, giving rise to ...

Leverage and Corporate Performance: Evidence from Unsuccessful

... It is often said that "talk is cheap" and that "actions speak louder than words." However, in many cases, target managers combine their cheap talk with meaningful actions. In particular, many of the targets of failed takeovers substantially increased their leverage ratios, which can be viewed as eit ...

... It is often said that "talk is cheap" and that "actions speak louder than words." However, in many cases, target managers combine their cheap talk with meaningful actions. In particular, many of the targets of failed takeovers substantially increased their leverage ratios, which can be viewed as eit ...

Dividend Policy as a Signaling Mechanism Under Different Market

... was experiencing boom. Their results show that abnormal returns of dividend increase announcements are larger during the recession than during the boom, suggesting that investors seem to respond less to dividend increase during the period of boom. Consistent with the results documented by Salminen a ...

... was experiencing boom. Their results show that abnormal returns of dividend increase announcements are larger during the recession than during the boom, suggesting that investors seem to respond less to dividend increase during the period of boom. Consistent with the results documented by Salminen a ...

Cost of Capital in Imperfect Competition Settings

... relative to the expected value of firms' cash flows. To highlight the impact of asymmetric information and imperfect competition, we compare cost of capital in settings where we hold investors' average precision constant. We ask three questions: 1) how does information asymmetry affect the cost of c ...

... relative to the expected value of firms' cash flows. To highlight the impact of asymmetric information and imperfect competition, we compare cost of capital in settings where we hold investors' average precision constant. We ask three questions: 1) how does information asymmetry affect the cost of c ...

del06 zhang 2763869 en

... We address three related questions on financial liberalization in a two-country model, given an interest rate differential in the two countries. How does financial liberalization affect production efficiency in the country with capital inflow as well as in the country with capital outflow? Who benefits from ...

... We address three related questions on financial liberalization in a two-country model, given an interest rate differential in the two countries. How does financial liberalization affect production efficiency in the country with capital inflow as well as in the country with capital outflow? Who benefits from ...