Are Large Shareholders Effective Monitors? An Investigation

... large shareholdings and leverage may be systematically related. The agency costs of debt (Jensen and Meckling 1976) may be affected by large shareholders. Alternatively, as with dividends, large shareholders may reduce the need for other financial signals of future performance (Ross 1977). Our tests ...

... large shareholdings and leverage may be systematically related. The agency costs of debt (Jensen and Meckling 1976) may be affected by large shareholders. Alternatively, as with dividends, large shareholders may reduce the need for other financial signals of future performance (Ross 1977). Our tests ...

Equity Risk Premiums (ERP)

... process, it affects the expected return on every risky investment and the value that we estimate for that investment. Consequently, it makes a difference in both how we allocate wealth across different asset classes and which specific assets or securities we invest in within each asset class. ...

... process, it affects the expected return on every risky investment and the value that we estimate for that investment. Consequently, it makes a difference in both how we allocate wealth across different asset classes and which specific assets or securities we invest in within each asset class. ...

TRADING VOLUME TREND AS THE INVESTOR`S SENTIMENT

... between the two groups of investors (Zweig (1973), Lee, Shleifer and Thaler (1991), Baker and Stein (2004), and Brown and Cliff (2005)). Miller (1977) argues that stock prices reflect only the most optimistic opinions among investors when short-sales constraints are present. When investors become mo ...

... between the two groups of investors (Zweig (1973), Lee, Shleifer and Thaler (1991), Baker and Stein (2004), and Brown and Cliff (2005)). Miller (1977) argues that stock prices reflect only the most optimistic opinions among investors when short-sales constraints are present. When investors become mo ...

Why Has Home Ownership Fallen Among the Young?

... the evidence, Moffitt and Gottschalk (2009) conclude that there has been a substantial rise in earnings uncertainty after 1980 compared to the 1970s, and that much of this increase occurred in the early part of the 1980s. There are differences depending on educational attainment and whether income ...

... the evidence, Moffitt and Gottschalk (2009) conclude that there has been a substantial rise in earnings uncertainty after 1980 compared to the 1970s, and that much of this increase occurred in the early part of the 1980s. There are differences depending on educational attainment and whether income ...

Is the Growth-value Anomaly Related to the Asset Growth Anomaly?

... analysis, we control for total asset growth in portfolio sorts as well as total asset growth over the previous two years in cross sectional regressions. We hypothesize that the growth-value anomaly is linked to the asset growth anomaly via the mispricing channel. Lakonishok, Shleifer, and Vishny (19 ...

... analysis, we control for total asset growth in portfolio sorts as well as total asset growth over the previous two years in cross sectional regressions. We hypothesize that the growth-value anomaly is linked to the asset growth anomaly via the mispricing channel. Lakonishok, Shleifer, and Vishny (19 ...

Neonode, Inc (Form: 10-Q, Received: 08/09/2016 08:48:47)

... that management will be successful in meeting its revenue targets and reducing its operating loss. In the future, we will require sources of capital in addition to cash on hand to continue operations and to implement our strategy. We are seeking sources of capital such as credit line facilities from ...

... that management will be successful in meeting its revenue targets and reducing its operating loss. In the future, we will require sources of capital in addition to cash on hand to continue operations and to implement our strategy. We are seeking sources of capital such as credit line facilities from ...

RADIUS GOLD INC. (Form: 20-F, Received: 05/15

... Exchange Act of 1934, as amended (the “Exchange Act”), which represent expectations or beliefs of the Company about future events. These statements can be identified generally by forward-looking words such as “expect”, “believe”, “anticipate”, “plan”, “intend”, “estimate”, “may”, “will” or similar w ...

... Exchange Act of 1934, as amended (the “Exchange Act”), which represent expectations or beliefs of the Company about future events. These statements can be identified generally by forward-looking words such as “expect”, “believe”, “anticipate”, “plan”, “intend”, “estimate”, “may”, “will” or similar w ...

Information Asymmetry and Discretionary Accounting in

... Accounting choices that are used to manage earnings and hence alter the information content to capital providers is an area that has generated great interest of researchers. From the view of standard-setters, the purpose of accounting information is to assist investors or other capital providers in ...

... Accounting choices that are used to manage earnings and hence alter the information content to capital providers is an area that has generated great interest of researchers. From the view of standard-setters, the purpose of accounting information is to assist investors or other capital providers in ...

Evaluating the Riskiness of Initial Public Offerings: 1980-2000

... riskier issue. A similar adverse selection friction may also be at work between the underwriter and issuer. A risky firm planning to go public may be more compelled to seek the advice of a larger full-service advisor that has the marketing resources and capacity to support the issue in the aftermark ...

... riskier issue. A similar adverse selection friction may also be at work between the underwriter and issuer. A risky firm planning to go public may be more compelled to seek the advice of a larger full-service advisor that has the marketing resources and capacity to support the issue in the aftermark ...

FREE Sample Here - Find the cheapest test bank for your

... C. the greater the level of inflation. D. none of the statements associated with this question are correct. 2. If the interest rate is 10% and cash flows are $1,000 at the end of year one and $2,000 at the end of year two, then the present value of these cash flows is A. $2,562. B. $3,200. C. $439. ...

... C. the greater the level of inflation. D. none of the statements associated with this question are correct. 2. If the interest rate is 10% and cash flows are $1,000 at the end of year one and $2,000 at the end of year two, then the present value of these cash flows is A. $2,562. B. $3,200. C. $439. ...

Document

... of $130,000. Therefore, merchandise with a total cost of $142,000 was available for sale during the year. At year end merchandise with a cost of $8,000 remains on ...

... of $130,000. Therefore, merchandise with a total cost of $142,000 was available for sale during the year. At year end merchandise with a cost of $8,000 remains on ...

12 Accounting for Partnerships

... Partnership accounting according to U. S. GAAP is similar, but not identical, to that under IFRS. 1. Both U. S. GAAP and IFRS include broad and similar guidance for partnership accounting. Partnership organization is similar worldwide, however, different legal systems dictate different implications ...

... Partnership accounting according to U. S. GAAP is similar, but not identical, to that under IFRS. 1. Both U. S. GAAP and IFRS include broad and similar guidance for partnership accounting. Partnership organization is similar worldwide, however, different legal systems dictate different implications ...

Ratio of the Month: Working Capital

... Rate of return on equity is the interest rate your investment in the business earned in the past year. It is calculated as follows: Net farm income – Value of operator’s labor and management Average total farm equity (beginning farm net worth + ending farm net worth /2) This ratio measures the rate ...

... Rate of return on equity is the interest rate your investment in the business earned in the past year. It is calculated as follows: Net farm income – Value of operator’s labor and management Average total farm equity (beginning farm net worth + ending farm net worth /2) This ratio measures the rate ...

Simulation_of_Correlated_Default_Processes

... models such as the KMV-Merton model. However, there have been relatively few attempts to model default risk at the portfolio level. The dependence structure of defaults by several firms is of particular interest to banks, credit rating institutions and regulators of derivative markets. The effect of ...

... models such as the KMV-Merton model. However, there have been relatively few attempts to model default risk at the portfolio level. The dependence structure of defaults by several firms is of particular interest to banks, credit rating institutions and regulators of derivative markets. The effect of ...

- Interroll

... these measures and investments have already resulted in an increase in output of around 80 % in the current fiscal year, using the same production area. Construction of the new building in Baal / Hückelhoven, Germany, was completed in the fourth quarter of 2015. The Academy and the Research Center h ...

... these measures and investments have already resulted in an increase in output of around 80 % in the current fiscal year, using the same production area. Construction of the new building in Baal / Hückelhoven, Germany, was completed in the fourth quarter of 2015. The Academy and the Research Center h ...

Does Investor Identity Matter in Equity Issues

... abnormal returns when matched to non-issuing firms. We additionally compare the postissue performance of firms that place equity privately with the post-issue performance of matched firms that issue public equity to examine whether the apparent inconsistency between announcement period and long-term ...

... abnormal returns when matched to non-issuing firms. We additionally compare the postissue performance of firms that place equity privately with the post-issue performance of matched firms that issue public equity to examine whether the apparent inconsistency between announcement period and long-term ...

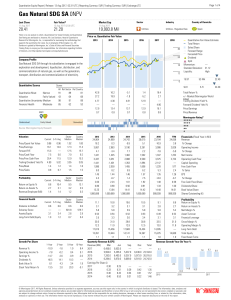

Gas Natural SDG SA 0NPV

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

ANNUAL REPORT 2011

... for the Group in 2009 by IMIS assuming increased total toll revenues on EastLink of 2-3%, however under our Concession Deed 50% of any associated net revenue uplift is liable to be shared with the State. Looking to the longer term, the change of State Government at the November 2010 election has led ...

... for the Group in 2009 by IMIS assuming increased total toll revenues on EastLink of 2-3%, however under our Concession Deed 50% of any associated net revenue uplift is liable to be shared with the State. Looking to the longer term, the change of State Government at the November 2010 election has led ...