What Risk Premium Is "Normal"? - Wharton Statistics Department

... investments in stocks and bonds, In January that year, government bonds were yielding 3.7 percent. The United States was on a gold standard, government was small relative to the economy as a whole, and the price level of consumer goods, although volatile, had been trendless throughout most of U.S. h ...

... investments in stocks and bonds, In January that year, government bonds were yielding 3.7 percent. The United States was on a gold standard, government was small relative to the economy as a whole, and the price level of consumer goods, although volatile, had been trendless throughout most of U.S. h ...

COVENTRY GROUP LTD ANNUAL REPORT

... declines in the A$ exchange rate have not yet filtered through to the economy stimulating an increase in growth. large mining organisations have significantly scaled back their capital investment pipelines over the past 12 months and deferred major maintenance expenditure. This has increased competi ...

... declines in the A$ exchange rate have not yet filtered through to the economy stimulating an increase in growth. large mining organisations have significantly scaled back their capital investment pipelines over the past 12 months and deferred major maintenance expenditure. This has increased competi ...

northstar realty europe corp. - corporate

... This Quarterly Report on Form 10-Q contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, or Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, o ...

... This Quarterly Report on Form 10-Q contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, or Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, o ...

The information content of share repurchases

... problem caused by free cash flow. In general, if shareholders can restrict the assets under management control, it is harder for management to over-invest in negative net present value projects, to consume perquisites, or to be slothful (Grossman and Hart 1980, Easterbrook 1984, Jensen 1986, Stulz 1 ...

... problem caused by free cash flow. In general, if shareholders can restrict the assets under management control, it is harder for management to over-invest in negative net present value projects, to consume perquisites, or to be slothful (Grossman and Hart 1980, Easterbrook 1984, Jensen 1986, Stulz 1 ...

Fully Insured Plans: A Viable Retirement Plan Solution

... structure. The funding amount under the flexible premium contract is determined for each individual, based on the terminal cash accumulation, some blended interest rate assumption (which would vary by individual based on the assumed series of interest rates) and a method of allocating assets (in thi ...

... structure. The funding amount under the flexible premium contract is determined for each individual, based on the terminal cash accumulation, some blended interest rate assumption (which would vary by individual based on the assumed series of interest rates) and a method of allocating assets (in thi ...

Share price performance

... among 3-in-1 coffee brands in Singapore, with several brands offering major discounts, (3) regional competition is heating up, with Mayora Indah from Indonesia and Power Root from Malaysia competing aggressively in Singapore. We view Super as a leading brand, but expect strong competition to press ...

... among 3-in-1 coffee brands in Singapore, with several brands offering major discounts, (3) regional competition is heating up, with Mayora Indah from Indonesia and Power Root from Malaysia competing aggressively in Singapore. We view Super as a leading brand, but expect strong competition to press ...

Securities Processing: The Effects of a T+3 System on Security Prices

... prices, or it could be due to the wrong interest rate proxy. Then again, sellers may be demanding this premium because of potential processing errors that are costly to fix and that delay payment by more than six business days. In addition, his study explores whether payment delays explain the day ...

... prices, or it could be due to the wrong interest rate proxy. Then again, sellers may be demanding this premium because of potential processing errors that are costly to fix and that delay payment by more than six business days. In addition, his study explores whether payment delays explain the day ...

Document

... positive CFs, then cost to close project. For example, nuclear power plant or strip mine. ...

... positive CFs, then cost to close project. For example, nuclear power plant or strip mine. ...

estimating systematic risk: the choice of return

... confidence interval of 0.73 to 1.27 for a firm with an estimated beta of 1.0. If the estimation period increases to three years of daily returns, then the Sβ is still much smaller with a 95 percent confidence interval of 0.78 to 1.22 for a firm with an estimated beta of 1.0. If the estimation period ...

... confidence interval of 0.73 to 1.27 for a firm with an estimated beta of 1.0. If the estimation period increases to three years of daily returns, then the Sβ is still much smaller with a 95 percent confidence interval of 0.78 to 1.22 for a firm with an estimated beta of 1.0. If the estimation period ...

2000 Annual Report PDF Version

... two objectives; the first will require some luck. It’s appropriate here to thank two groups that made my job both easy and fun last year just as they do every year. First, our operating managers continue to run their businesses in splendid fashion, which allows me to spend my time allocating capit ...

... two objectives; the first will require some luck. It’s appropriate here to thank two groups that made my job both easy and fun last year just as they do every year. First, our operating managers continue to run their businesses in splendid fashion, which allows me to spend my time allocating capit ...

Alfjaneirtnjanjgahjktnm,brazjklhhjkznm

... 3. Gross debt service usually must be greater than 30% before a residential mortgage will be approved. Answer: False Page: 550 Level: Medium ...

... 3. Gross debt service usually must be greater than 30% before a residential mortgage will be approved. Answer: False Page: 550 Level: Medium ...

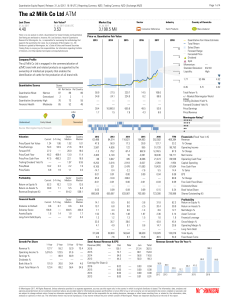

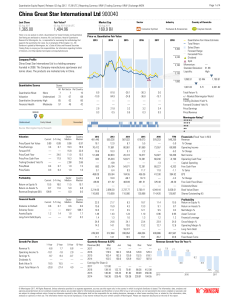

China Great Star International Ltd 900040

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

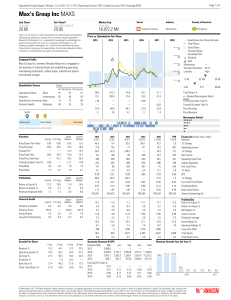

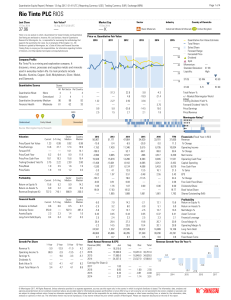

Rio Tinto PLC RIOS

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

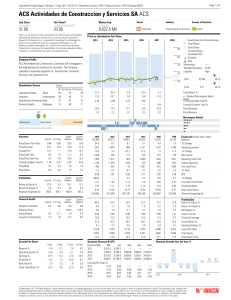

ACS Actividades de Construccion y Servicios SA ACS

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

0000897101-15-000290 - Investor Relations

... operations in “Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 18 “Revenue by Market” to the Company’s consolidated condensed financial statements included herein. Value Hearing Health Market The Company believes the value hearing health (VHH) ...

... operations in “Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 18 “Revenue by Market” to the Company’s consolidated condensed financial statements included herein. Value Hearing Health Market The Company believes the value hearing health (VHH) ...

Equity Risk Premiums (ERP)

... process, it affects the expected return on every risky investment and the value that we estimate for that investment. Consequently, it makes a difference in both how we allocate wealth across different asset classes and which specific assets or securities we invest in within each asset class. ...

... process, it affects the expected return on every risky investment and the value that we estimate for that investment. Consequently, it makes a difference in both how we allocate wealth across different asset classes and which specific assets or securities we invest in within each asset class. ...

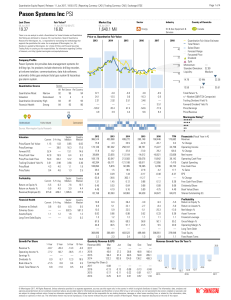

Pason Systems Inc PSI

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

Annual Report - Wilson Asset Management

... investment portfolio performance is the growth in the underlying portfolio of equities and cash before costs. A key objective of WAM Capital is to grow the investment portfolio at a greater rate than the S&P/ASX All Ordinaries Accumulation Index, which is called outperformance. NTA growth is the cha ...

... investment portfolio performance is the growth in the underlying portfolio of equities and cash before costs. A key objective of WAM Capital is to grow the investment portfolio at a greater rate than the S&P/ASX All Ordinaries Accumulation Index, which is called outperformance. NTA growth is the cha ...

word - Nasdaq`s INTEL Solutions

... The Company is committed to bringing the best user experience to its customers through its innovative hardware, software and services. The Company’s business strategy leverages its unique ability to design and develop its own operating systems, hardware, application software and services to provide ...

... The Company is committed to bringing the best user experience to its customers through its innovative hardware, software and services. The Company’s business strategy leverages its unique ability to design and develop its own operating systems, hardware, application software and services to provide ...