* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download DISCOUNT RATES IN PERSONAL INJURY CLAIMS

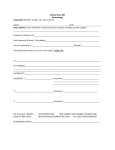

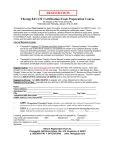

Survey

Document related concepts

Financial economics wikipedia , lookup

Rate of return wikipedia , lookup

Merchant account wikipedia , lookup

Monetary policy wikipedia , lookup

Continuous-repayment mortgage wikipedia , lookup

Credit rationing wikipedia , lookup

Interbank lending market wikipedia , lookup

Internal rate of return wikipedia , lookup

Present value wikipedia , lookup

Business valuation wikipedia , lookup

Adjustable-rate mortgage wikipedia , lookup

Credit card interest wikipedia , lookup

Transcript