* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

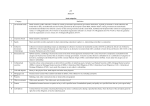

Download CAM Government Securities Investment Fund ANNUAL REPORT

Private equity secondary market wikipedia , lookup

Present value wikipedia , lookup

Business valuation wikipedia , lookup

Fund governance wikipedia , lookup

Securitization wikipedia , lookup

Shadow banking system wikipedia , lookup

Global saving glut wikipedia , lookup

Systemic risk wikipedia , lookup

Global financial system wikipedia , lookup

Financial literacy wikipedia , lookup

Financial economics wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Financial crisis wikipedia , lookup

Systemically important financial institution wikipedia , lookup

Investment fund wikipedia , lookup