doc

... writing a good algorithm to calculate IRR, that will be reviewed in Real Estate 631 when you write your own program to calculate IRRs in VBA). Another point we’ll discuss in some detail later, but which should be mentioned from the outset, is that if cash flows change sign more than once, there will ...

... writing a good algorithm to calculate IRR, that will be reviewed in Real Estate 631 when you write your own program to calculate IRRs in VBA). Another point we’ll discuss in some detail later, but which should be mentioned from the outset, is that if cash flows change sign more than once, there will ...

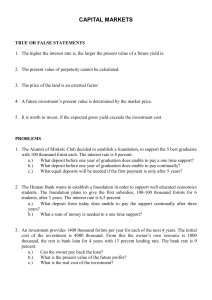

capital markets

... What is the cost of the investment? b.) Is it worth to rent, if the bank rate is 10 percent? 5. An entrepreneur wants to buy his previous workplace (a newsagent’s). The cost is 3 million forints. He wants to finance it from bank loan. He can choose a 3-year loan with 16 percent interest rate or he c ...

... What is the cost of the investment? b.) Is it worth to rent, if the bank rate is 10 percent? 5. An entrepreneur wants to buy his previous workplace (a newsagent’s). The cost is 3 million forints. He wants to finance it from bank loan. He can choose a 3-year loan with 16 percent interest rate or he c ...

Oct. 28 Homework/Test Review File

... Unit 4 Test Review: Financial Literacy 1. Kayla invested $3200 in each of two savings accounts. Account A pays 2.5% simple interest, while Account B pays 2.5% compound interest, with interest compounded annually (at the end of each year). a. ...

... Unit 4 Test Review: Financial Literacy 1. Kayla invested $3200 in each of two savings accounts. Account A pays 2.5% simple interest, while Account B pays 2.5% compound interest, with interest compounded annually (at the end of each year). a. ...

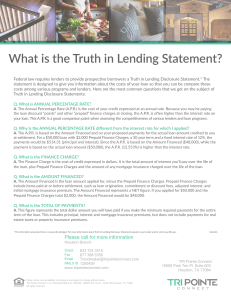

What is the Truth in Lending Statement?

... initial mortgage insurance premium. The Amount Financed represents a NET figure. If you applied for $50,000 and the Prepaid Finance Charges total $2,000, the Amount Financed would be $48,000. ...

... initial mortgage insurance premium. The Amount Financed represents a NET figure. If you applied for $50,000 and the Prepaid Finance Charges total $2,000, the Amount Financed would be $48,000. ...

Lecture 09 Practical Issues in Cash and Receivables: Disposition

... the event the debtor does not make payment. When a factor buys receivables without recourse, the factor assumes the risk of collectibility and absorbs any credit losses. Receivables that are factored with recourse should be accounted for as a sale, recognizing any gain or loss, if all three of the f ...

... the event the debtor does not make payment. When a factor buys receivables without recourse, the factor assumes the risk of collectibility and absorbs any credit losses. Receivables that are factored with recourse should be accounted for as a sale, recognizing any gain or loss, if all three of the f ...

types of investments - hrsbstaff.ednet.ns.ca

... A term deposit and a GIC used to be somewhat different but now the words are often used interchangeably Usually bought at a bank Typically the first kind of investment someone makes Similar to a savings account; 100% secure Good investment for an extra money you won’t need anytime soon or ...

... A term deposit and a GIC used to be somewhat different but now the words are often used interchangeably Usually bought at a bank Typically the first kind of investment someone makes Similar to a savings account; 100% secure Good investment for an extra money you won’t need anytime soon or ...

Chapters 15 and 16 Chapter 15

... c. the interest expense is deductible for tax purposes by the corporation. d. a higher earnings per share is guaranteed for existing common shareholders. 2. When the maturities of a bond issue are spread over several dates, the bonds are called a. serial bonds b. bearer bonds c. debenture bonds d. t ...

... c. the interest expense is deductible for tax purposes by the corporation. d. a higher earnings per share is guaranteed for existing common shareholders. 2. When the maturities of a bond issue are spread over several dates, the bonds are called a. serial bonds b. bearer bonds c. debenture bonds d. t ...

Econ 306

... Interest rate on 1-year dollar denominated bonds: 5% Interest rate on 1-year euro denominated bonds: 4% a. Is the dollar at a forward premium or discount? b. Should a US investor make a covered investment in euro-denominated bonds? Explain why? c. If the covered interest parity holds, what should be ...

... Interest rate on 1-year dollar denominated bonds: 5% Interest rate on 1-year euro denominated bonds: 4% a. Is the dollar at a forward premium or discount? b. Should a US investor make a covered investment in euro-denominated bonds? Explain why? c. If the covered interest parity holds, what should be ...

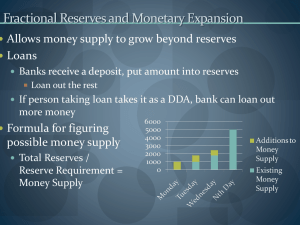

Money

... • Fiat money is so-called because it is not backed by any tangible asset such as gold, silver, or even seashells. • The issuing government has decreed by fiat that “this money is a legal exchange medium, and it is worth what we say.” • Lacking a gold backing or backing some other precious metal, wha ...

... • Fiat money is so-called because it is not backed by any tangible asset such as gold, silver, or even seashells. • The issuing government has decreed by fiat that “this money is a legal exchange medium, and it is worth what we say.” • Lacking a gold backing or backing some other precious metal, wha ...

29A.1 Deriving AD from the AE model

... following equation: Y = C + Ig + G + Xn where C = a(W, E, B, i) + b(Y – T), Ig = f(i, r(A, B, C, K, E)) + ∆V and Xn = Xn(Yf, t, P$). In words, consumption is assumed to be a linear function of disposable income, but the intercept is a function of household wealth, consumer expectations, household bo ...

... following equation: Y = C + Ig + G + Xn where C = a(W, E, B, i) + b(Y – T), Ig = f(i, r(A, B, C, K, E)) + ∆V and Xn = Xn(Yf, t, P$). In words, consumption is assumed to be a linear function of disposable income, but the intercept is a function of household wealth, consumer expectations, household bo ...

1. Consider a single period binomial setting where the

... 7. A firm has a senior bond obligation of $20 due this period and $100 next period. It also has a subordinated loan of $40 owed to Jack and Jill and due next period. It has no projects to provide cash flow this period. Therefore, if the firm cannot get a loan of $20, it must liquidate. The firm has ...

... 7. A firm has a senior bond obligation of $20 due this period and $100 next period. It also has a subordinated loan of $40 owed to Jack and Jill and due next period. It has no projects to provide cash flow this period. Therefore, if the firm cannot get a loan of $20, it must liquidate. The firm has ...

China Moves to Tighten the Money Supply

... doldrums. Last year, the country’s key index -- the Shanghai exchange -- rose 130 percent to close at 2,675, a record and the best performance of any major stock exchange in the world in 2006. The market reached a 16-year high in December, as millions of investors who had been sitting on the sidelin ...

... doldrums. Last year, the country’s key index -- the Shanghai exchange -- rose 130 percent to close at 2,675, a record and the best performance of any major stock exchange in the world in 2006. The market reached a 16-year high in December, as millions of investors who had been sitting on the sidelin ...

Financial Maths Solutions

... to account customers and a further 5% discount for accounts that are settled within 7 days. Calculate the price paid for the outdoor setting by an account customer who settles their account within 7 days. A $735 B $882 C $884.45 D $931 ...

... to account customers and a further 5% discount for accounts that are settled within 7 days. Calculate the price paid for the outdoor setting by an account customer who settles their account within 7 days. A $735 B $882 C $884.45 D $931 ...