general investment information

... ISSUER AGREES TO REPAY THE BONDHOLDER AT THE MATURITY DATE. (face value) THE COUPON RATE IS THE RATE OF INTEREST THAT THE ISSUER AGREES TO PAY EACH YEAR. (Example : a bond with an 8% coupon and a principal of $1000 will pay annual interest of $ 80 ) WHAT ARE ZERO-COUPON BONDS ? ...

... ISSUER AGREES TO REPAY THE BONDHOLDER AT THE MATURITY DATE. (face value) THE COUPON RATE IS THE RATE OF INTEREST THAT THE ISSUER AGREES TO PAY EACH YEAR. (Example : a bond with an 8% coupon and a principal of $1000 will pay annual interest of $ 80 ) WHAT ARE ZERO-COUPON BONDS ? ...

MODEL ANSWERS TO FINANCIAL ECONOMICS (IOBM

... Examples include regular deposits to a savings account (standing order), monthly rentals, pension income, mortgage payments etc (v) Amortization Is the process of decreasing or accounting for an amount over a period of time. It is the distribution of a single lump sum cash flow into many smaller cas ...

... Examples include regular deposits to a savings account (standing order), monthly rentals, pension income, mortgage payments etc (v) Amortization Is the process of decreasing or accounting for an amount over a period of time. It is the distribution of a single lump sum cash flow into many smaller cas ...

Math 11e

... nearest “hundredth” to create the number 3.14. Rounding is simply picking a place value you wish to round to, identifying that number, looking to the number to the right of that number and if that number is 4 or less, your place value number stays the same. ...

... nearest “hundredth” to create the number 3.14. Rounding is simply picking a place value you wish to round to, identifying that number, looking to the number to the right of that number and if that number is 4 or less, your place value number stays the same. ...

open market operations

... When banks need to borrow reserves from other banks they go to the Fed Funds Market. Banks offer their excess funds to other banks for overnight lending to meet their reserve requirements. The Federal Reserve does not decree this interest rate, but they use bonds to add or take from this pool of mon ...

... When banks need to borrow reserves from other banks they go to the Fed Funds Market. Banks offer their excess funds to other banks for overnight lending to meet their reserve requirements. The Federal Reserve does not decree this interest rate, but they use bonds to add or take from this pool of mon ...

Chapter 9 - McGraw Hill Higher Education

... 6. Show how a line of credit affects financial statements. 7. Explain how to account for bonds issued at face value and their related interest costs. 8. Use the straight-line method to amortize bond discounts and premiums. 9. Distinguish between current and noncurrent assets and liabilities. ...

... 6. Show how a line of credit affects financial statements. 7. Explain how to account for bonds issued at face value and their related interest costs. 8. Use the straight-line method to amortize bond discounts and premiums. 9. Distinguish between current and noncurrent assets and liabilities. ...

Exponential and Logarithmic Functions

... Back to Compound Interest Let’s return to the concept of compound interest. If the number of compounding periods in a year is increased indefinitely, we arrive at the concept of compounding continuously. Mathematically, we can do this by applying the limit concept to the expression r ...

... Back to Compound Interest Let’s return to the concept of compound interest. If the number of compounding periods in a year is increased indefinitely, we arrive at the concept of compounding continuously. Mathematically, we can do this by applying the limit concept to the expression r ...

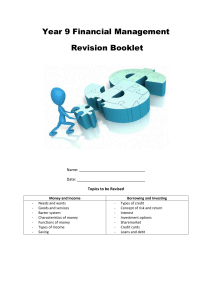

Year 9 Financial Management Revision Booklet Name: Date: Topics

... b) James later sold the shares when they reached a price of $27.16. Calculate the total amount James received and his total profit. 2000 x $27.16 = $54,320 Profit = $54,320 - $51,560 22. Define the term credit. Credit is an agreement in which you receive goods and services now and pay for it later g ...

... b) James later sold the shares when they reached a price of $27.16. Calculate the total amount James received and his total profit. 2000 x $27.16 = $54,320 Profit = $54,320 - $51,560 22. Define the term credit. Credit is an agreement in which you receive goods and services now and pay for it later g ...

Downlaod File - Prince Mohammad Bin Fahd University

... 8. To pay for college, you have just taken out a $1,000 government loan that makes you pay $126 per year for 25 years. However, you don’t have to start making these payments until you graduate from college two years from now. Why is the yield to maturity necessarily less than 12%, the yield to matu ...

... 8. To pay for college, you have just taken out a $1,000 government loan that makes you pay $126 per year for 25 years. However, you don’t have to start making these payments until you graduate from college two years from now. Why is the yield to maturity necessarily less than 12%, the yield to matu ...

Interest Rate Swaps

... bank with a capital and reserves position greater than $1 billion. For all other defined financial institutions, the margin requirement shall be the market deficiency calculated in respect of the transaction on an item by item basis. For example, margin equal to the difference in market value betwee ...

... bank with a capital and reserves position greater than $1 billion. For all other defined financial institutions, the margin requirement shall be the market deficiency calculated in respect of the transaction on an item by item basis. For example, margin equal to the difference in market value betwee ...

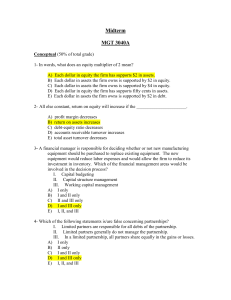

Answers to Midterm 3040A

... her account reaches $10,000. A decrease in the rate of return she earns will: A) Increase the value of her account faster. B) Cause her to wait longer before withdrawing her money. C) Cause the present value of her account to decrease. D) Allow her to withdraw more money sooner. E) Cause the compoun ...

... her account reaches $10,000. A decrease in the rate of return she earns will: A) Increase the value of her account faster. B) Cause her to wait longer before withdrawing her money. C) Cause the present value of her account to decrease. D) Allow her to withdraw more money sooner. E) Cause the compoun ...

Questions

... which makes them difficult to sell. There are readily available second-hand markets for cars and houses with plenty of buyers which make them easy to sell. There are likely to be few number plate buyers available at any time – the market is ‘thin’. This implies either taking some time to sell (e.g. ...

... which makes them difficult to sell. There are readily available second-hand markets for cars and houses with plenty of buyers which make them easy to sell. There are likely to be few number plate buyers available at any time – the market is ‘thin’. This implies either taking some time to sell (e.g. ...

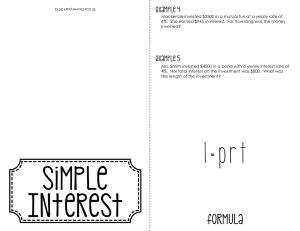

I = prt - SWMStbradford

... Mrs. Smith invested $4000 in a bond with a yearly interest rate of 4%. Her total interest on the investment was $800. What was the length of the investment? ...

... Mrs. Smith invested $4000 in a bond with a yearly interest rate of 4%. Her total interest on the investment was $800. What was the length of the investment? ...

as PDF

... Naturally, some areas and some years see the 6% appreciation rate go as high as 12%. A lot of investors (like myself) refinance after they have created an extra 20% equity (see year 5) and buy a new property with the money and start all over. If you held the property for 10 years, it would be worth ...

... Naturally, some areas and some years see the 6% appreciation rate go as high as 12%. A lot of investors (like myself) refinance after they have created an extra 20% equity (see year 5) and buy a new property with the money and start all over. If you held the property for 10 years, it would be worth ...

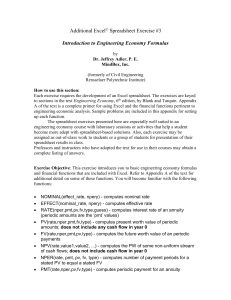

Additional Computer Exercise 3

... Number of periods (nper) – the total number of payments or periods of an investment. (n) Payment (pmt) – the amount paid periodically to an investment or loan. (A) Present value (pv) – the value of an investment or loan at the beginning of the investment period. For example, the present value of a l ...

... Number of periods (nper) – the total number of payments or periods of an investment. (n) Payment (pmt) – the amount paid periodically to an investment or loan. (A) Present value (pv) – the value of an investment or loan at the beginning of the investment period. For example, the present value of a l ...