Sample of HSFOL Problems – Year 10

... as a decimal to three paces, that you will pick a black jack and that the product of the two dice results is greater than 20? ...

... as a decimal to three paces, that you will pick a black jack and that the product of the two dice results is greater than 20? ...

April 2016 - Paragon East Advisors

... There is a good reason for holding some cash. Everyone should have an emergency fund. Ideally, one should have at least 6 months worth of expenses saved in order to deal with any unforeseen event(s). Outside of the emergency fund, however, better opportunities exist for cash. In this low interest ra ...

... There is a good reason for holding some cash. Everyone should have an emergency fund. Ideally, one should have at least 6 months worth of expenses saved in order to deal with any unforeseen event(s). Outside of the emergency fund, however, better opportunities exist for cash. In this low interest ra ...

Personal Finance and Portfolio Management Strategies Module Exam

... expected to increase in value 5 percent each year, (a) what is the appropriate value seven years from now? (b) If his income is $30,000 per year for a family of three, and prices increase by four percent a year for the next three years, what amount will the family need for living expenses? ...

... expected to increase in value 5 percent each year, (a) what is the appropriate value seven years from now? (b) If his income is $30,000 per year for a family of three, and prices increase by four percent a year for the next three years, what amount will the family need for living expenses? ...

Suppose that you plan to need $10,000 in thirty

... 7. Lu Electronics offers you your very first credit card that charges 12.49 % interest to its customers and compounds that interest monthly. Within one day of getting your first credit card, you max out the credit limit by spending $1,200.00. If you do not buy anything else on the card and you do n ...

... 7. Lu Electronics offers you your very first credit card that charges 12.49 % interest to its customers and compounds that interest monthly. Within one day of getting your first credit card, you max out the credit limit by spending $1,200.00. If you do not buy anything else on the card and you do n ...

rate_note

... • Assumption: All cash–flows occur within one year • Approximation: The compound–interest accumulation function is approximated by simple–interest accumulation function Remark: Since the simple interest rate that solves the equation of value depends on the reference time, the reference time is alway ...

... • Assumption: All cash–flows occur within one year • Approximation: The compound–interest accumulation function is approximated by simple–interest accumulation function Remark: Since the simple interest rate that solves the equation of value depends on the reference time, the reference time is alway ...

1) - Catalyst

... 4) A salesperson finds that her sales average 40 cases per store when she visits 20 stores a week. Each time she visits an additional store per week, the average sales per store decrease by 1 case. How many stores should she visit each week if she wants to maximize her sales? 5) You have already inv ...

... 4) A salesperson finds that her sales average 40 cases per store when she visits 20 stores a week. Each time she visits an additional store per week, the average sales per store decrease by 1 case. How many stores should she visit each week if she wants to maximize her sales? 5) You have already inv ...

Chapter 4

... Financial markets channel consumer savings to companies for major projects through the sale of financial assets TM 4-2 Slide 1 of 2 ...

... Financial markets channel consumer savings to companies for major projects through the sale of financial assets TM 4-2 Slide 1 of 2 ...

MBF 3CI Personal Finance: Some Investment Alternatives Basic

... Basic Investment Terminology: Investment: the use of money in hopes to make more money. One who invests money is an investor. Risk: The probability that an investment will lose its value. Note: High risk investments usually have a higher interest rate than low risk investments. (Do you know why?) Te ...

... Basic Investment Terminology: Investment: the use of money in hopes to make more money. One who invests money is an investor. Risk: The probability that an investment will lose its value. Note: High risk investments usually have a higher interest rate than low risk investments. (Do you know why?) Te ...

Should the Riksbank issue e-krona?

... • Should those living in Sweden who do not want to, may not or cannot have access to the banks’ services also be able to manage their payments? ...

... • Should those living in Sweden who do not want to, may not or cannot have access to the banks’ services also be able to manage their payments? ...

HW02

... fund with a guaranteed return of 10% per year. Assuming that your only other investment alternative is a savings account, should you buy? Yes. 4.27 Suppose a young newlywed couple is planning to buy a home two years from now. To save the down payment required at the time of purchasing a home worth $ ...

... fund with a guaranteed return of 10% per year. Assuming that your only other investment alternative is a savings account, should you buy? Yes. 4.27 Suppose a young newlywed couple is planning to buy a home two years from now. To save the down payment required at the time of purchasing a home worth $ ...

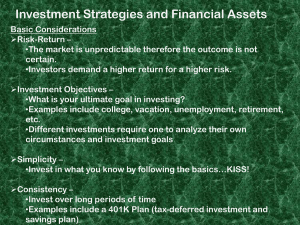

Investment Strategies and Financial Assets

... etc. •Different investments require one to analyze their own circumstances and investment goals Simplicity – •Invest in what you know by following the basics…KISS! Consistency – •Invest over long periods of time •Examples include a 401K Plan (tax-deferred investment and savings plan) ...

... etc. •Different investments require one to analyze their own circumstances and investment goals Simplicity – •Invest in what you know by following the basics…KISS! Consistency – •Invest over long periods of time •Examples include a 401K Plan (tax-deferred investment and savings plan) ...