Chapter 6

... Interest Rate Risk - Change in price due to changes in interest rates – Interest rates up, bond price down! – Long-term bonds have more interest rate risk than shortterm bonds • More-distant cash flows are more adversely affected by an increase in interest rates – Lower coupon rate bonds have more ...

... Interest Rate Risk - Change in price due to changes in interest rates – Interest rates up, bond price down! – Long-term bonds have more interest rate risk than shortterm bonds • More-distant cash flows are more adversely affected by an increase in interest rates – Lower coupon rate bonds have more ...

DOC - JMap

... doubles every seven years. The value of the investment, V, is determined by the equation , where t represents the number of years since the money was deposited. How many years, to the nearest tenth of a year, will it take the value of the investment to reach $1,000,000? ...

... doubles every seven years. The value of the investment, V, is determined by the equation , where t represents the number of years since the money was deposited. How many years, to the nearest tenth of a year, will it take the value of the investment to reach $1,000,000? ...

Factsheet Floating Rate Income Trust USD

... provider. Past performance is not indicative of future results. †If a Fund estimates that it has distributed more than its income and net realized capital gains in the current fiscal year; a portion of its distribution may be a return of capital. A return of capital may occur, for example, when some ...

... provider. Past performance is not indicative of future results. †If a Fund estimates that it has distributed more than its income and net realized capital gains in the current fiscal year; a portion of its distribution may be a return of capital. A return of capital may occur, for example, when some ...

3.3 E Poor Investment Decisions

... cash flows and the profits to be generated. The investment should either increase revenue or reduced costs in the long-term. Qualitative factors will also influence a firm’s decisions about capital investment. These include the current and expected state of the economy, possible impacts on image and ...

... cash flows and the profits to be generated. The investment should either increase revenue or reduced costs in the long-term. Qualitative factors will also influence a firm’s decisions about capital investment. These include the current and expected state of the economy, possible impacts on image and ...

UNIT 6: THE FINANCIAL PLAN When the company has more

... 1. If you deposit 4000€ into an account paying 6% annual interest, how much money will be in the account after 5 years? 2. If you deposit 6500€ into an account paying 8% annual interest, how much money will be in the account after 7 years? 3. How much money would you need to deposit today at 9% annu ...

... 1. If you deposit 4000€ into an account paying 6% annual interest, how much money will be in the account after 5 years? 2. If you deposit 6500€ into an account paying 8% annual interest, how much money will be in the account after 7 years? 3. How much money would you need to deposit today at 9% annu ...

It is not appropriate to discount the cash flows of a bond by the yield

... It is not appropriate to discount the cash flows of a bond by the yield to maturity of a Treasury security with corresponding time to maturity, because of differences in the timing and size of cash flows. Differences in the timing and size of cash flows will produce differences in duration, convexit ...

... It is not appropriate to discount the cash flows of a bond by the yield to maturity of a Treasury security with corresponding time to maturity, because of differences in the timing and size of cash flows. Differences in the timing and size of cash flows will produce differences in duration, convexit ...

FinancialCalculations_001

... One of the most important features of municipal bonds is that the interest on them may be exempt from federal taxes. Municipal bonds are generally exempt from state taxes if you are a resident of the state the bonds are issued from. Because of their tax-exempt status, the interest rates on municipal ...

... One of the most important features of municipal bonds is that the interest on them may be exempt from federal taxes. Municipal bonds are generally exempt from state taxes if you are a resident of the state the bonds are issued from. Because of their tax-exempt status, the interest rates on municipal ...

GLOSSARY

... Certificate of Deposit (CD) a certificate offered by a bank that guarantees payment of a specified interest rate until a designated date in the future (p. 87) charge card allows a consumer to make purchases now and pay the account in full at the end of the month (p. 129) charitable remainder trust ( ...

... Certificate of Deposit (CD) a certificate offered by a bank that guarantees payment of a specified interest rate until a designated date in the future (p. 87) charge card allows a consumer to make purchases now and pay the account in full at the end of the month (p. 129) charitable remainder trust ( ...

Homework 5

... a. Draw graphs of Hong Kong’s money market and Hong Kong’s foreign exchange market to show the impact of this event keeping in mind that it will be the policy of Hong Kong’s central bank to keep the exchange rate fixed. The lower US interest rates would make HK dollar deposits more attractive to bot ...

... a. Draw graphs of Hong Kong’s money market and Hong Kong’s foreign exchange market to show the impact of this event keeping in mind that it will be the policy of Hong Kong’s central bank to keep the exchange rate fixed. The lower US interest rates would make HK dollar deposits more attractive to bot ...

Lecture 7 a

... $41.67. With the plowback, the price rose to $75.00. The difference between these two numbers (75.00-41.67=33.33) is called the Present Value of Growth Opportunities (PVGO). ...

... $41.67. With the plowback, the price rose to $75.00. The difference between these two numbers (75.00-41.67=33.33) is called the Present Value of Growth Opportunities (PVGO). ...

Then … and Now – Let`s Not make the Same Mistakes

... the liquidity crisis the dollar appreciated, even though low U.S. interest rates should have driven money away from dollar assets. And the dollar price of gold fell. In a crisis people today prefer dollars to gold. The fact that the Fed’s latest interest rate cut and promise to inject more money int ...

... the liquidity crisis the dollar appreciated, even though low U.S. interest rates should have driven money away from dollar assets. And the dollar price of gold fell. In a crisis people today prefer dollars to gold. The fact that the Fed’s latest interest rate cut and promise to inject more money int ...

solve(A*m^NR*(m^N-1)/(m

... Now consider what happens with each monthly payment. Some of the payment is applied to interest on the outstanding principal amount, P, and some of the payment is applied to reduce the principal owed. The total amount, R, of the monthly payment, remains constant over the life of the loan. So if J de ...

... Now consider what happens with each monthly payment. Some of the payment is applied to interest on the outstanding principal amount, P, and some of the payment is applied to reduce the principal owed. The total amount, R, of the monthly payment, remains constant over the life of the loan. So if J de ...

REITs and Rising Interest Rates

... A REIT can be thought of as a portfolio of bonds, with each property owned being a bond, and the rental payments to the REIT being the bond’s coupons. With this in mind, one risk from an interest rate perspective is the maturity structure of the leases. Retail net lease properties (where the tenant ...

... A REIT can be thought of as a portfolio of bonds, with each property owned being a bond, and the rental payments to the REIT being the bond’s coupons. With this in mind, one risk from an interest rate perspective is the maturity structure of the leases. Retail net lease properties (where the tenant ...

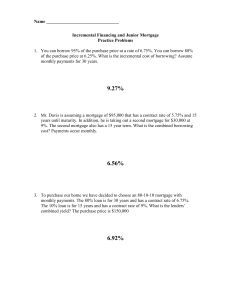

Adjustable Rate Mortgage

... 2. Mr. Davis is assuming a mortgage of $95,000 that has a contract rate of 5.75% and 15 years until maturity. In addition, he is taking out a second mortgage for $30,000 at 9%. The second mortgage also has a 15 year term. What is the combined borrowing cost? Payments occur monthly. ...

... 2. Mr. Davis is assuming a mortgage of $95,000 that has a contract rate of 5.75% and 15 years until maturity. In addition, he is taking out a second mortgage for $30,000 at 9%. The second mortgage also has a 15 year term. What is the combined borrowing cost? Payments occur monthly. ...