Lecture 27: CAPM and Risk Premium

... i. Where LV is the loan value, FP is the fixed payment and i is the interest rate. ii. Note the difference fixed payment loans make. With an interest rate of 7% and a LV of $100,000, the fixed payment over a 25 year period is $9,439.29 (or $235,982.25 total). The pendulum of compound interest rates ...

... i. Where LV is the loan value, FP is the fixed payment and i is the interest rate. ii. Note the difference fixed payment loans make. With an interest rate of 7% and a LV of $100,000, the fixed payment over a 25 year period is $9,439.29 (or $235,982.25 total). The pendulum of compound interest rates ...

financial market 2 - Institute of Bankers in Malawi

... Net Asset Value is net worth of the fund/scheme translated per each outstanding share holding. (1Mark) ...

... Net Asset Value is net worth of the fund/scheme translated per each outstanding share holding. (1Mark) ...

How the Federal Reserve uses Fiscal and Monetary Policy to

... By lowering interest rates, it becomes cheaper to borrow money and less lucrative to save, encouraging individuals and corporations to spend. So, as interest rates are lowered, savings decline, more money is borrowed, and more money is spent. Moreover, as borrowing increases, the total supply of mon ...

... By lowering interest rates, it becomes cheaper to borrow money and less lucrative to save, encouraging individuals and corporations to spend. So, as interest rates are lowered, savings decline, more money is borrowed, and more money is spent. Moreover, as borrowing increases, the total supply of mon ...

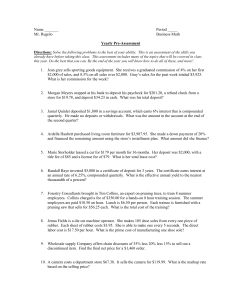

Business Math Yearly Pre

... this year. Do the best that you can. By the end of the year you will know how to do all of these, and more! ...

... this year. Do the best that you can. By the end of the year you will know how to do all of these, and more! ...

Problem Set - Kanit Kuevibulvanich

... - Money Demand and Money Supply: Definition, determinants, shifts, money market equilibrium and interest rate, review of interest rate and bond price - Federal Reserve and Monetary Policy: Policy interest rates, effects on money supply - Monetary Policy and Aggregate Demand: Transmission mechanism, ...

... - Money Demand and Money Supply: Definition, determinants, shifts, money market equilibrium and interest rate, review of interest rate and bond price - Federal Reserve and Monetary Policy: Policy interest rates, effects on money supply - Monetary Policy and Aggregate Demand: Transmission mechanism, ...

The Rivoli Company has no debt outstanding and

... If it moves to a capital structure with 30% debt based on market values, its cost of equity, rs, will increase to 11% to reflect the increased risk. Bonds can be sold at a cost , rd, of 7%. Rivoli is a no-growth firm. Hence, all its earnings ate paid out as dividends, and earnings are expectationall ...

... If it moves to a capital structure with 30% debt based on market values, its cost of equity, rs, will increase to 11% to reflect the increased risk. Bonds can be sold at a cost , rd, of 7%. Rivoli is a no-growth firm. Hence, all its earnings ate paid out as dividends, and earnings are expectationall ...

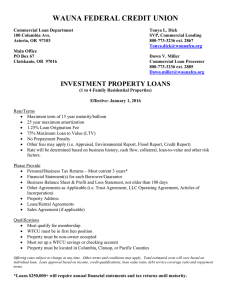

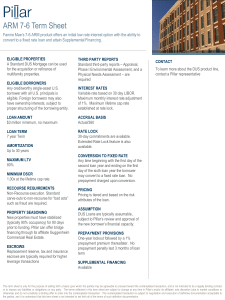

ARM 7-6 Term Sheet

... PROPERTY SEASONING New properties must have stabilized (typically 90% occupancy) for 90 days prior to funding. Pillar can offer bridge financing through its affiliate Guggenheim Commercial Real Estate. ESCROWS Replacement reserve, tax and insurance escrows are typically required for higher leverage ...

... PROPERTY SEASONING New properties must have stabilized (typically 90% occupancy) for 90 days prior to funding. Pillar can offer bridge financing through its affiliate Guggenheim Commercial Real Estate. ESCROWS Replacement reserve, tax and insurance escrows are typically required for higher leverage ...

Answers to Chapter 22 Questions

... an FI=s capital, or owners= equity stake, is the difference between the market values of its assets and its liabilities. This is also called an FI=s market value. This is the economic meaning of capital. A problem with book value accounting is that current market values may be different from book va ...

... an FI=s capital, or owners= equity stake, is the difference between the market values of its assets and its liabilities. This is also called an FI=s market value. This is the economic meaning of capital. A problem with book value accounting is that current market values may be different from book va ...

How does a monetary policy affect the economy

... Again historically monetary policy has been used to target different measures. In Bretton Woods it kept the pegged exchange rate, then it Ms was used directly as a target believing in stable velocity. Now inflation target of around 2.5% annually is used. It is best because it is the actual monetary ...

... Again historically monetary policy has been used to target different measures. In Bretton Woods it kept the pegged exchange rate, then it Ms was used directly as a target believing in stable velocity. Now inflation target of around 2.5% annually is used. It is best because it is the actual monetary ...

How to Perform a Statistical Hypothesis Test

... 2 times the area to the left of test statistic (if test statistic is -). ...

... 2 times the area to the left of test statistic (if test statistic is -). ...

Review of Statistics in Finance

... The expected value measures the most likely outcome and is one measure of central tendency. However, it should be noted that expected value may or may not be an element in the population. For example, say a share price one year from now can be either $75 or $125, each with .5 or 50% probability. Alt ...

... The expected value measures the most likely outcome and is one measure of central tendency. However, it should be noted that expected value may or may not be an element in the population. For example, say a share price one year from now can be either $75 or $125, each with .5 or 50% probability. Alt ...

Note Maturity Date - MGMT-026

... Term bonds are scheduled for maturity on one specified date. Serial bonds mature at more than one date. ...

... Term bonds are scheduled for maturity on one specified date. Serial bonds mature at more than one date. ...

Presentation - Appalachian College Association

... … there are less tickets being sold in 2010 than in 2000. Quantity (amount) vs number The quotient of this was 4,563,492 which was the amount of people that would be able to go Disney World for ten days by purchasing the ten day pass. The simple interest plan is the worst of option of all three, bec ...

... … there are less tickets being sold in 2010 than in 2000. Quantity (amount) vs number The quotient of this was 4,563,492 which was the amount of people that would be able to go Disney World for ten days by purchasing the ten day pass. The simple interest plan is the worst of option of all three, bec ...

MG 6863 Engineering Economics – Puzzles UNIT

... A. The amounts of all payments are equal. B. The payments are made at equal interval of time. C. The first payment is made at the beginning of the first period. D. Compound interest is paid on all amounts in the annuity. ...

... A. The amounts of all payments are equal. B. The payments are made at equal interval of time. C. The first payment is made at the beginning of the first period. D. Compound interest is paid on all amounts in the annuity. ...

Chapter 5

... Ex. A bank has determined that the Radlers can afford monthly house payments of at most $750. The bank charges interest at a rate of 8% per year on the unpaid balance, with interest computations made at the end of each month. If the loan is to be amortized in equal monthly installments over 15 years ...

... Ex. A bank has determined that the Radlers can afford monthly house payments of at most $750. The bank charges interest at a rate of 8% per year on the unpaid balance, with interest computations made at the end of each month. If the loan is to be amortized in equal monthly installments over 15 years ...