Personal Finance 1200 Fall 2010 Exam #1

... 40. (p. 80) During the past month, Jennifer Ernet had income of $3,000 and during the month, her net worth declined by $200. If no other financial activities occurred, this means Jennifer's payments for the month were: A. $3,200. B. $3,000. C. $2,800. D. $200. 41. (p. 76) Kyle Burroughs has decided ...

... 40. (p. 80) During the past month, Jennifer Ernet had income of $3,000 and during the month, her net worth declined by $200. If no other financial activities occurred, this means Jennifer's payments for the month were: A. $3,200. B. $3,000. C. $2,800. D. $200. 41. (p. 76) Kyle Burroughs has decided ...

1 - BrainMass

... 8. The real risk-free rate is 2 percent. The rate of inflation is expected to be 3 percent a year for the next three years and then 4 percent a year thereafter. Assume that the default risk premium and liquidity premium on all Treasury securities equals zero. You observe that 10-year bonds yield 1 ...

... 8. The real risk-free rate is 2 percent. The rate of inflation is expected to be 3 percent a year for the next three years and then 4 percent a year thereafter. Assume that the default risk premium and liquidity premium on all Treasury securities equals zero. You observe that 10-year bonds yield 1 ...

chap010

... • Valuation of a financial asset is based on determining the present value of future cash flows – Required rate of return (the discount rate) • Depends on the market’s perceived level of risk associated with the individual security • It is also competitively determined among companies seeking financ ...

... • Valuation of a financial asset is based on determining the present value of future cash flows – Required rate of return (the discount rate) • Depends on the market’s perceived level of risk associated with the individual security • It is also competitively determined among companies seeking financ ...

Bond Issues

... • Bonds may be issued between interest dates. • Interest, for the period between the issue date and the last interest date, is collected with the issue price of the bonds (accrued interest). • At the specified interest date, interest is paid for the entire interest period (semiannual or annual). • P ...

... • Bonds may be issued between interest dates. • Interest, for the period between the issue date and the last interest date, is collected with the issue price of the bonds (accrued interest). • At the specified interest date, interest is paid for the entire interest period (semiannual or annual). • P ...

Emerging Market Carry Trades - FMT-HANU

... • An investor borrows EUR 20 million at an incredibly low rate, say 1.00% per annum or 0.50% for 180 days. • The EUR 20 million are then exchanged for Indian rupees (INR), the current spot rate being INR 60.4672 = EUR 1.00. • The resulting INR 1,209,344,000 are put into an interest bearing deposit w ...

... • An investor borrows EUR 20 million at an incredibly low rate, say 1.00% per annum or 0.50% for 180 days. • The EUR 20 million are then exchanged for Indian rupees (INR), the current spot rate being INR 60.4672 = EUR 1.00. • The resulting INR 1,209,344,000 are put into an interest bearing deposit w ...

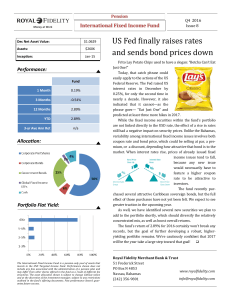

US Fed finally raises rates and sends bond prices down

... Federal Reserve. The Fed raised US interest rates in December by 0.25%, for only the second time in nearly a decade. However, it also indicated that it cannot—as the phrase goes— “Eat Just One” and predicted at least three more hikes in 2017. While the fixed income securities within the fund’s portf ...

... Federal Reserve. The Fed raised US interest rates in December by 0.25%, for only the second time in nearly a decade. However, it also indicated that it cannot—as the phrase goes— “Eat Just One” and predicted at least three more hikes in 2017. While the fixed income securities within the fund’s portf ...

Fun with Exponential Growth and Decay and e

... d) Does this example model exponential growth or exponential decay? Explain how you know and sketch a graph that might model this relationship. ...

... d) Does this example model exponential growth or exponential decay? Explain how you know and sketch a graph that might model this relationship. ...

Fun with Exponential Growth and Decay]

... d) Does this example model exponential growth or exponential decay? Explain how you know and sketch a graph that might model this relationship. ...

... d) Does this example model exponential growth or exponential decay? Explain how you know and sketch a graph that might model this relationship. ...

Document

... in either U.S. or British bank time deposits. It is assumed that both types of deposits are credit or default risk free and that the investment horizon is one year. The interest rate available on British pound time deposits, iUK, is 4.5% annually. The spot exchange rate is $1.94 per British pound, a ...

... in either U.S. or British bank time deposits. It is assumed that both types of deposits are credit or default risk free and that the investment horizon is one year. The interest rate available on British pound time deposits, iUK, is 4.5% annually. The spot exchange rate is $1.94 per British pound, a ...

A) income. B) profits. C) as

... C) debtors with an unindexed contract do not gain because they pay exactly what they contracted for in nominal terms. D) debtors with an indexed contract are hurt because they pay more than they contracted for in nominal terms. 26. If inflation is 6 percent and a worker receives a 4 percent wage inc ...

... C) debtors with an unindexed contract do not gain because they pay exactly what they contracted for in nominal terms. D) debtors with an indexed contract are hurt because they pay more than they contracted for in nominal terms. 26. If inflation is 6 percent and a worker receives a 4 percent wage inc ...

Key

... 7-year depreciation class and Dow’s tax rate is 35%, how will the purchase affect Dow’s incremental cash flows 3 years from today? (Note: use + to indicate an increase in cash flows and a – to indicate a decrease in cash flow). CF = +2,500,000(.1749)(.35) = +153,037.50 3. What is the name of the ana ...

... 7-year depreciation class and Dow’s tax rate is 35%, how will the purchase affect Dow’s incremental cash flows 3 years from today? (Note: use + to indicate an increase in cash flows and a – to indicate a decrease in cash flow). CF = +2,500,000(.1749)(.35) = +153,037.50 3. What is the name of the ana ...

SU12_Econ 2630_Study..

... 23. Suppose inflation is 1% and there is a recessionary gap of 4%. According to the Taylor rule, the Federal Funds rate should equal ____. ...

... 23. Suppose inflation is 1% and there is a recessionary gap of 4%. According to the Taylor rule, the Federal Funds rate should equal ____. ...

![Fun with Exponential Growth and Decay]](http://s1.studyres.com/store/data/010315583_1-c4286e94658106423eeb9e17ea548f0d-300x300.png)