Investment

... its timberfarm in Bahama, announced that it would be temporarily suspending its dividend payments due to cash flow crunch associated with its investment program. The company’s stock price dropped 10% on the news. How would you interpret this change in the stock price? I.e what caused it? ...

... its timberfarm in Bahama, announced that it would be temporarily suspending its dividend payments due to cash flow crunch associated with its investment program. The company’s stock price dropped 10% on the news. How would you interpret this change in the stock price? I.e what caused it? ...

MODULE 5 – Lesson 3 CONTINUOUS COMPOUNDING 1. Mary is

... 5. Your family is trying to find a way to save for a vacation in Hawaii. A seven-day all inclusive vacation for two adults and three kids under the age of 18, costs $5,000. Your parents are customers at a bank that is offering an annual interest rate of 3.75% compounded continuously. The planned va ...

... 5. Your family is trying to find a way to save for a vacation in Hawaii. A seven-day all inclusive vacation for two adults and three kids under the age of 18, costs $5,000. Your parents are customers at a bank that is offering an annual interest rate of 3.75% compounded continuously. The planned va ...

ExamView Pro - Untitled.tst

... ____ 13. What condition is necessary for a fiat money system to work? a. Money owed must be paid on time. b. The government must control the money supply. c. Banks must hold sufficient gold to cover any paper money they give out. d. Customers with checking accounts cannot earn interest on those acco ...

... ____ 13. What condition is necessary for a fiat money system to work? a. Money owed must be paid on time. b. The government must control the money supply. c. Banks must hold sufficient gold to cover any paper money they give out. d. Customers with checking accounts cannot earn interest on those acco ...

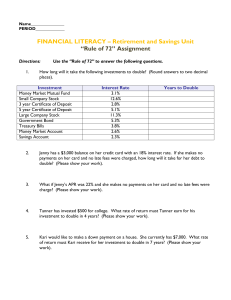

Rule of 72 Assignment

... Tanner has invested $500 for college. What rate of return must Tanner earn for his investment to double in 4 years? (Please show your work). ...

... Tanner has invested $500 for college. What rate of return must Tanner earn for his investment to double in 4 years? (Please show your work). ...

Rising Rates: The Fed Takes Next Step Toward Normal

... lines of credit, auto loans, credit cards, and other forms of consumer credit are often linked to the prime rate, so the rates on these types of loans may increase with the federal funds rate. Fed rate hikes may also put some upward pressure on interest rates for new fixed rate home mortgages. Altho ...

... lines of credit, auto loans, credit cards, and other forms of consumer credit are often linked to the prime rate, so the rates on these types of loans may increase with the federal funds rate. Fed rate hikes may also put some upward pressure on interest rates for new fixed rate home mortgages. Altho ...

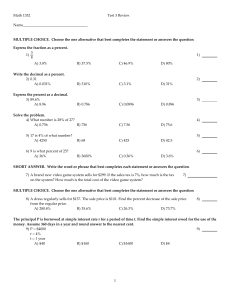

Quiz 1

... markets? Give two examples of financial instruments in each. Money market instruments have an original maturity of less than one year. Examples are: T-bills, Commercial paper, Large CDs, etc. Capital market instruments have an original maturity of more than one year. Examples are: Corporate bonds, m ...

... markets? Give two examples of financial instruments in each. Money market instruments have an original maturity of less than one year. Examples are: T-bills, Commercial paper, Large CDs, etc. Capital market instruments have an original maturity of more than one year. Examples are: Corporate bonds, m ...

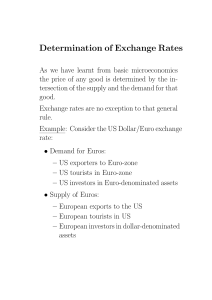

Determination of Exchange Rates

... money supply. Local prices gradually increase over time. Initially the increase in the money supply will drive interest rates down as investors buy more bonds with the excess cash on hand. As the interest rates are now lower capital begins to flow out of the country in search of higher returns. The ...

... money supply. Local prices gradually increase over time. Initially the increase in the money supply will drive interest rates down as investors buy more bonds with the excess cash on hand. As the interest rates are now lower capital begins to flow out of the country in search of higher returns. The ...

chapter 2 : markets and instruments

... If you had bought a November expiration call with exercise price 100, it would have cost $5.20 and the gross payoff at expiration would be: ($107 $100) = $7. The profit net of the cost of the call is: ($7 - $5.60) = $1.80 The rate of return over the holding period is: ($1.80/$5.20) = 0.3462 = 34.6 ...

... If you had bought a November expiration call with exercise price 100, it would have cost $5.20 and the gross payoff at expiration would be: ($107 $100) = $7. The profit net of the cost of the call is: ($7 - $5.60) = $1.80 The rate of return over the holding period is: ($1.80/$5.20) = 0.3462 = 34.6 ...

January 2011 - Cypress Financial Planning

... rates encouraged Greece to drive up borrowing, surmounting $500 billion in debt. In December of 2009, Prime Minister George Papandreou admitted that his predecessor had disguised the growing debt, and in early 2010, fears of a potential default turned into a full-fledged panic. Flash Crash — On May ...

... rates encouraged Greece to drive up borrowing, surmounting $500 billion in debt. In December of 2009, Prime Minister George Papandreou admitted that his predecessor had disguised the growing debt, and in early 2010, fears of a potential default turned into a full-fledged panic. Flash Crash — On May ...

Ch - Pearson Canada

... number of periods is N. Interest-bearing account into which regular deposits are made in order to accumulate some amount. The duration over which a loan agreement is valid. Denoted by (F/A,i,N), gives the future value, F, that is equivalent to a series of equalsized receipts or disburse ments, A, wh ...

... number of periods is N. Interest-bearing account into which regular deposits are made in order to accumulate some amount. The duration over which a loan agreement is valid. Denoted by (F/A,i,N), gives the future value, F, that is equivalent to a series of equalsized receipts or disburse ments, A, wh ...

Version A Exam 2 SAMPLE Problems FINAN420

... a) (4 pts.) Using the simple method, by how much will net interest income change during the first year if interest rates rise by 1 percentage point? b) (8 pts.) Using the more precise method that accounts for the timing of the repricing, by how much will net interest income change during the first y ...

... a) (4 pts.) Using the simple method, by how much will net interest income change during the first year if interest rates rise by 1 percentage point? b) (8 pts.) Using the more precise method that accounts for the timing of the repricing, by how much will net interest income change during the first y ...

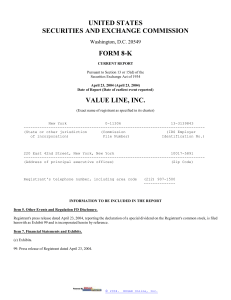

Form 8-K - Value Line

... Value Line, Inc. For Immediate Release Company Contact: Jean B. Buttner, CEO April 23, 2004 (212) 907-1500 Value Line, Inc. (VALU) Announces Special Dividend of $17.50 per Share Payable to Shareholders of Record May 7 Business Wire April 23, 2004 New York, NASDAQ - Value Line, Inc. (VALU) announced ...

... Value Line, Inc. For Immediate Release Company Contact: Jean B. Buttner, CEO April 23, 2004 (212) 907-1500 Value Line, Inc. (VALU) Announces Special Dividend of $17.50 per Share Payable to Shareholders of Record May 7 Business Wire April 23, 2004 New York, NASDAQ - Value Line, Inc. (VALU) announced ...

REVIEW NOTES FOR THE SECOND BENCHMARK TEST

... The inverse or opposite operation for addition is subtraction, for subtraction it is addition. The inverse or opposite operation for multiplication is division, for division it is multiplication. Remember: when inequalities are multiplied or divided by negative numbers, the inequality symbol reverse ...

... The inverse or opposite operation for addition is subtraction, for subtraction it is addition. The inverse or opposite operation for multiplication is division, for division it is multiplication. Remember: when inequalities are multiplied or divided by negative numbers, the inequality symbol reverse ...