* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download MODULE 5 – Lesson 3 CONTINUOUS COMPOUNDING 1. Mary is

Survey

Document related concepts

Transcript

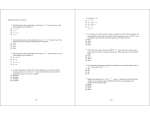

MODULE 5 – Lesson 3 CONTINUOUS COMPOUNDING 1. Mary is sixteen and over the summer she worked in a grocery store. She saved $2,450 and she would like to invest this money in an account that earns 4.15 % interest. Assuming that Mary does not withdraw or deposit any money into this account for two years until she turns 18 and starts college, how much money will Mary’s account have if the interest was compounded: a) semi-annually b) quarterly c) monthly d) daily e) hourly f) one million times per year g) continuously Did you notice that the amount of money that Mary has in the account increases as the number of times that the interest is calculated (compounded) increases? Was the amount of money in the account that compounded interest hourly significantly smaller that the amount of money in the account that continuously compounded the interest? Explain. 2. A one time $16,000 deposit is made into your account. Find the accumulated balance after 15 years assuming an APR of 4.5% compounded: a) annually b) quarterly c) monthly d) daily e) continuously 3. Suppose that Trevor invests in an account that earns interest at an APR of 3.75% compounded continuously. Trevor decides that it will be a one time deposit and he will not withdraw or add more money to this account. After 8 years Trevor’s account balance is $12,300. How much money did Trevor invest? 4. Janet plans to make an investment into an account with an annual interest rate of 3.125 % compounded continuously. In 5 years she would like to have enough money to buy a $25,000 car. How much money should Janet invest right now into the account? 5. Your family is trying to find a way to save for a vacation in Hawaii. A seven-day all inclusive vacation for two adults and three kids under the age of 18, costs $5,000. Your parents are customers at a bank that is offering an annual interest rate of 3.75% compounded continuously. The planned vacation would be in 18 months from now. How much money would your parents need to deposit right now in order to achieve the goal of $5,000? (Assume that no additional deposits or withdrawals will be made to the account.) 6. How long will it take for your money to quadruple if it is deposited in an account earning 5.75% compounded: a) monthly b) quarterly c) annually d) continuously 7. Mark wants to invest $3,500 in an account that earns 6.2% compounded monthly. He would like to accumulate $5,000 in that account. a) How long will it take Mark to accomplish this? a) Would it make a big difference if the interest in his account is compounded continuously? 8. Becky is 48 years old and she would like to retire when she is 60. Over the last twenty years she saved $75,000. She is planning to deposit this sum in a bank account earning a fixed interest rate. She hopes to have $200,000 in savings when she retires. What interest rate does Becky need to get from the bank to achieve this goal, assuming that the interest is compounded: a) daily b) monthly c) continuously Is Becky’s goal reasonable? 9. Susan graduated college and her parents gave her a gift of $5,000. Susan is very eager to start saving for a brand new $18,700 car and hopes that she can purchase it in 4 years without getting a loan. In addition to her parents’ gift, she already has $10,000 saved up from working in summers during her college years. She plans to put all her money into an interest earning account. She visits a few banks/credit unions. This is what Susan finds out: Bank A: Susan can open an account with an interest rate of 4.35% compounded annually Bank B: Susan can open an account with an interest rate of 4.15% compounded monthly Credit Union A: Susan can open an account with a simple interest rate of 5.5% Credit Union B: Susan can open an account with an interest rate of 4% compounded continuously a) Find the balance for all four accounts (4 years later). b) What choice will give Susan the highest balance? c) Will Susan be able to purchase the car in 4 years if she chooses the institution that gave her the best deal? If not, estimate how much longer will she need to keep her money in that account in order to accomplish her goal? 10. How long will it take for your money to grow to 2.75 times the original deposit if you are receiving an interest rate of 5.45% compounded: a) monthly b) quarterly c) continuously 11. What rate do you need to receive if you would like your deposit to triple within 5 years, assuming that the interest is compounded: a) daily b) semi-annually c) continuously