Problem 1: An individual estimates that the maintenance cost of a

... (In your calculations, don’t forget the values about the commercial building that you found in part (a).) ...

... (In your calculations, don’t forget the values about the commercial building that you found in part (a).) ...

Helpful Comments: Excel Financial functions perform common

... NPER(rate, pmt, pv, fv, type) - computes number of payment periods for a stated PV to equal a stated FV PMT(rate,nper,pv,fv,type) - computes periodic payment for an annuity IPMT(rate,per,nper,pv,fv,type) - computes interest portion of a specific payment for some period of time PPMT(rate,per,nper,pv, ...

... NPER(rate, pmt, pv, fv, type) - computes number of payment periods for a stated PV to equal a stated FV PMT(rate,nper,pv,fv,type) - computes periodic payment for an annuity IPMT(rate,per,nper,pv,fv,type) - computes interest portion of a specific payment for some period of time PPMT(rate,per,nper,pv, ...

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

... 12. Distinguish between Primary and Secondary markets? 13. Why do investors add real estate in their portfolio? Bring out its merits and demerits. 14. Briefly explain the economic analysis involved in investment. 15. As an investor you expect an interest of 12% p.a. Nungambakkam Benefit Fund promise ...

... 12. Distinguish between Primary and Secondary markets? 13. Why do investors add real estate in their portfolio? Bring out its merits and demerits. 14. Briefly explain the economic analysis involved in investment. 15. As an investor you expect an interest of 12% p.a. Nungambakkam Benefit Fund promise ...

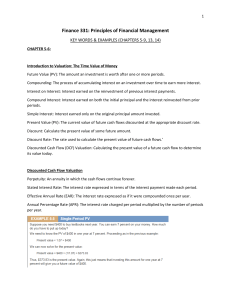

Present and Future Values

... These cashflows represent the amount of money that are expected to be received or paid over time on the back of an investment/debt decision If the cashflows are scheduled on different maturities, their value can’t be directly compared To be compared they need to be expressed on same ...

... These cashflows represent the amount of money that are expected to be received or paid over time on the back of an investment/debt decision If the cashflows are scheduled on different maturities, their value can’t be directly compared To be compared they need to be expressed on same ...

4.1 Exponential Functions

... price. [Hint: the price is the present value of $1000, 3 years from now at the stated interest rate] 11. General: Compound Interest - Which is better 10% interest compounded quarterly or 9.8% compounded continuously? 12. Personal Finance: Depreciation - A Toyota Corolla automobile lists for $15,450, ...

... price. [Hint: the price is the present value of $1000, 3 years from now at the stated interest rate] 11. General: Compound Interest - Which is better 10% interest compounded quarterly or 9.8% compounded continuously? 12. Personal Finance: Depreciation - A Toyota Corolla automobile lists for $15,450, ...

1 - BrainMass

... b. Since all firms borrow from the same financial markets, all firms have the same required returns on debt c. For any given firm, the required return on debt is always greater than the required return on equity 13. which of the following items is not considered a receipt in a cash budget? a. b. c. ...

... b. Since all firms borrow from the same financial markets, all firms have the same required returns on debt c. For any given firm, the required return on debt is always greater than the required return on equity 13. which of the following items is not considered a receipt in a cash budget? a. b. c. ...

IB SL WORD PROBLEMS Population of animals, people and

... What should the interest rate be if Michele’s initial investment were to double in value in 10 years? ...

... What should the interest rate be if Michele’s initial investment were to double in value in 10 years? ...

1 - TeacherWeb

... • An artifact originally had 12 grams of carbon14 present. The decay model A = 12e-0.000121t describes the amount of carbon-14 present after t years. How many grams of carbon-14 will be present in this artifact after 10,000 years? A = 12e-0.000121t A = 12e-0.000121(10,000) A = 12e-1.21 A = 3.58 ...

... • An artifact originally had 12 grams of carbon14 present. The decay model A = 12e-0.000121t describes the amount of carbon-14 present after t years. How many grams of carbon-14 will be present in this artifact after 10,000 years? A = 12e-0.000121t A = 12e-0.000121(10,000) A = 12e-1.21 A = 3.58 ...

Simple Interest:

... Principal (P) is the sum of money you borrow from or lend to a person. The Interest rate (r) is the fee you earn from lending money or a fee you pay for borrowing money. The interest rate, unless otherwise stated, is an annual rate. Simple Interest I Prt where P = Principal r = Annual simple inter ...

... Principal (P) is the sum of money you borrow from or lend to a person. The Interest rate (r) is the fee you earn from lending money or a fee you pay for borrowing money. The interest rate, unless otherwise stated, is an annual rate. Simple Interest I Prt where P = Principal r = Annual simple inter ...

Exponential Function

... price. [Hint: the price is the present value of $1000, 3 years from now at the stated interest rate] 11. General: Compound Interest - Which is better 10% interest compounded quarterly or 9.8% compounded continuously? 12. Personal Finance: Depreciation - A Toyota Corolla automobile lists for $15,450, ...

... price. [Hint: the price is the present value of $1000, 3 years from now at the stated interest rate] 11. General: Compound Interest - Which is better 10% interest compounded quarterly or 9.8% compounded continuously? 12. Personal Finance: Depreciation - A Toyota Corolla automobile lists for $15,450, ...

Finance Glossary

... Coupon Rate: The annual coupon divided by the face value of a bond. Maturity: The specified date on which the principal amount of a bond is paid. Yield to Maturity (YTM): The rate required in the market on a bond. Current Yield: A bond’s annual coupon divided by its price. Note: An unsecured debt, u ...

... Coupon Rate: The annual coupon divided by the face value of a bond. Maturity: The specified date on which the principal amount of a bond is paid. Yield to Maturity (YTM): The rate required in the market on a bond. Current Yield: A bond’s annual coupon divided by its price. Note: An unsecured debt, u ...

Fractions and Decimals

... earns 5% per year. Match each number to a variable in the simple interest formula: p= r= t= Step 2 The rate must be converted from a percent to a decimal before it is put into the formula. What is 5% as a decimal? Step 3 Substitute the values for p, t and the decimal value of r into the equation I = ...

... earns 5% per year. Match each number to a variable in the simple interest formula: p= r= t= Step 2 The rate must be converted from a percent to a decimal before it is put into the formula. What is 5% as a decimal? Step 3 Substitute the values for p, t and the decimal value of r into the equation I = ...

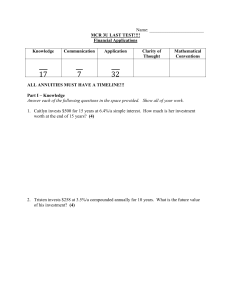

CALCULATING MATURITY VALUE

... 10. Karishma borrowed $5,000 for 145 days at 4.6% p.a. What is the future value of the loan? 11. What is the accumulated value of $1,900 after 14 months at 7.4% p.a.? 12. What is the accumulated value of $1,200 after 18 months at 5.3% p.a.? ...

... 10. Karishma borrowed $5,000 for 145 days at 4.6% p.a. What is the future value of the loan? 11. What is the accumulated value of $1,900 after 14 months at 7.4% p.a.? 12. What is the accumulated value of $1,200 after 18 months at 5.3% p.a.? ...

PowerPoint

... company. His total pension funds have an accumulated value of $200,000 and his life expectancy is 16 more years. His pension fund manager assumes he can earn a 12 percent return on his assets. What will be his yearly annuity for the next 16 years? We have a pool of money today, and are looking at to ...

... company. His total pension funds have an accumulated value of $200,000 and his life expectancy is 16 more years. His pension fund manager assumes he can earn a 12 percent return on his assets. What will be his yearly annuity for the next 16 years? We have a pool of money today, and are looking at to ...