* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Money

Survey

Document related concepts

Transcript

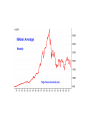

Money Dr. Green Wall Street • Lou – Easy money creates financial instability – Economic progress depends on fundamentals • Investment and innovation • Bud’s Father – Financial speculation is parasitic on the creation of economic value – Yet, it destroy that very economic value upon which it depends, symbolized by Blue Star Airlines Speculation • Made easier by a fiat money system • Since the creation of our fiat money system in 1972 a series of instabilities – – – – – – Dot.com IPOs (1990s and subsequent 2000 bust) Orange County bankruptcy (1994) S&L Crisis and junk bonds (mid-to-late 1980s) Oil industry (mid-1980s) Drysdale Securities and Penn Square Bank (1981-1982) the farm belt and LDC debt crisis (1980-1981) Fiat Money • Fiat money is so-called because it is not backed by any tangible asset such as gold, silver, or even seashells. • The issuing government has decreed by fiat that “this money is a legal exchange medium, and it is worth what we say.” • Lacking a gold backing or backing some other precious metal, what gives the currency value? Fiat Money • Fiat money holds its value – only as long as the people using that money continue to believe it has value – as long as they continue to find people who will accept the currency in exchange for goods and services. • The value of fiat money relies on confidence and expectation. History • All fiat money systems have collapsed • It encourages levels of debt and risks that become unsustainable • When it becomes unsustainable, confidence is lost in the currency • When confidence is lost, it collapses and becomes worthless Fiat Currencies • France – Mississippi Scheme – Became Worthless • England – South Sea Bubble • Germany and Italy – Hyperinflation • Argentina – Currency collapse US Fiat Currencies • Continental – no solid backing and being easily counterfeited, the continentals quickly lost their value • Greenbacks – The government’s paper money flooded the banks so that by July 1864 greenback dollars were worth a mere 35 cents in gold. • Bretton Woods – Unstable hybrid Federal Reserve • Controls money supply by – Open market operations • Buying government securities increases supply • Selling government securities decreases supply – Discount rate • The rate at which member banks may borrow short term funds directly from a Federal Reserve Bank • Lower rates makes credit cheaper – Reserve requirement (fractional reserve system) • Amount of money and liquid assets that Federal Reserve System member banks must hold in cash or on deposit with the Federal Reserve System – Lender of last resort Consequences • • • • Undermines sound banking practices Asset Bubbles Business Cycle Transfer of wealth to – Government – Big banks – Big contractors • War • Rising costs of living What kind of people does a system of easy money create? • Speculators (Using Aristotle’s Virtues) – – – – – – – Rashness Self-indulgent Tastelessness and vulgarity Empty vanity Destructive ambitiousness Untruthful Envious