Q4 2015 ALM-Insights FINAL.indd - Financial Management Firms St

... short-end of the curve. (Less than two-years for example) While inflation and economic growth rates have more influence on the longer-end, it’s reasonable to expect continued on page 5... ...

... short-end of the curve. (Less than two-years for example) While inflation and economic growth rates have more influence on the longer-end, it’s reasonable to expect continued on page 5... ...

File

... • Congress passed the measures, but they were too limited in their scope to make a difference. • Many people in the government were against handouts or “welfare.” • The belief was that people wouldn’t work if they received help from the government. ...

... • Congress passed the measures, but they were too limited in their scope to make a difference. • Many people in the government were against handouts or “welfare.” • The belief was that people wouldn’t work if they received help from the government. ...

Hard Choices - Montecito Capital Management

... Planners who are leery of the volatility of gold funds yet unhappy with the illiquidity and carrying costs of bullion may be able to find other ways of owning gold directly. "We're using Central Fund of Canada Limited, which trades on the American Stock Exchange and in Canada," Evanson explains. "It ...

... Planners who are leery of the volatility of gold funds yet unhappy with the illiquidity and carrying costs of bullion may be able to find other ways of owning gold directly. "We're using Central Fund of Canada Limited, which trades on the American Stock Exchange and in Canada," Evanson explains. "It ...

Estimating the intensity of price and non

... of deposit or loan market structure, direct measures – such as the Panzar and Rosse (1987) H-statistic, loan or deposit interest margins, and Lerner indices – are increasingly relied upon as ancillary information. The H-statistic ranks current competitive behaviour on a scale from 1.0 (perfect compe ...

... of deposit or loan market structure, direct measures – such as the Panzar and Rosse (1987) H-statistic, loan or deposit interest margins, and Lerner indices – are increasingly relied upon as ancillary information. The H-statistic ranks current competitive behaviour on a scale from 1.0 (perfect compe ...

Financial Services & Public Policy Alert June 2009

... database for corporate bonds, would include ABS. This would enhance price discovery, but it may impair liquidity and the willingness of financial intermediaries to make a market in certain ABS. The proposal also calls for strengthening the regulation of credit rating agencies. Credit rating agencies ...

... database for corporate bonds, would include ABS. This would enhance price discovery, but it may impair liquidity and the willingness of financial intermediaries to make a market in certain ABS. The proposal also calls for strengthening the regulation of credit rating agencies. Credit rating agencies ...

What Money Market Mutual Fund Reform Means for Banks And

... investment companies18 as a short-term alternative to interest-bearing bank accounts.19 MMMFs typically generate greater yields on “idle funds” than interest-bearing bank accounts.20 For example, while funds in a bank savings deposit account accrue interest at “artificially low” rates set by the ban ...

... investment companies18 as a short-term alternative to interest-bearing bank accounts.19 MMMFs typically generate greater yields on “idle funds” than interest-bearing bank accounts.20 For example, while funds in a bank savings deposit account accrue interest at “artificially low” rates set by the ban ...

Combining active and passive managements in a portfolio

... of this boom for indexing and passive solutions—yet investor inflows into alternatives have been very strong. Another study, conducted by Cliffwater and Lyxor, found that the weighting of alternatives in U.S. state pension funds has more than doubled recently, from 10% in 2006 to 24% in 20132. Despi ...

... of this boom for indexing and passive solutions—yet investor inflows into alternatives have been very strong. Another study, conducted by Cliffwater and Lyxor, found that the weighting of alternatives in U.S. state pension funds has more than doubled recently, from 10% in 2006 to 24% in 20132. Despi ...

2. Overview of the Financial System

... bond market also allows credit risks to be spread over a wide range of investors, reducing the potential for concentration of credit risk to develop and providing borrowers with up-to-date information on the market views of their creditworthiness. Bonds also provide an investment opportunity for tho ...

... bond market also allows credit risks to be spread over a wide range of investors, reducing the potential for concentration of credit risk to develop and providing borrowers with up-to-date information on the market views of their creditworthiness. Bonds also provide an investment opportunity for tho ...

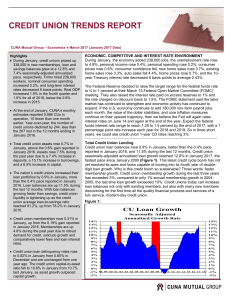

credit union trends report

... Credit union borrowings grew $17.7 billion in January, (Figure 7), the biggest one-month gain in credit union history, in order to take advantage of a recent riskless arbitrage profit opportunity. In December 2016, the Federal Reserve increased the interest rate paid on excess reserves to 0.75%. Thi ...

... Credit union borrowings grew $17.7 billion in January, (Figure 7), the biggest one-month gain in credit union history, in order to take advantage of a recent riskless arbitrage profit opportunity. In December 2016, the Federal Reserve increased the interest rate paid on excess reserves to 0.75%. Thi ...

Cidel Canadian Preferred Shares

... Toron AMI Canadian Preferred Shares Portfolio Fund For distribution only to accredited investors as defined by regulatory authorities in your resident jurisdiction. Historic performance should not be interpreted as a guarantee of future results. Performance figures are based on total returns which a ...

... Toron AMI Canadian Preferred Shares Portfolio Fund For distribution only to accredited investors as defined by regulatory authorities in your resident jurisdiction. Historic performance should not be interpreted as a guarantee of future results. Performance figures are based on total returns which a ...

Role of Financial Institutions - We can offer most test bank and

... begun to offer services that were previously offered only by certain types. Consequently, many financial institutions are becoming more similar. Nevertheless, performance levels still differ significantly among types of financial institutions. Why? ANSWER: Depository institutions include commercial ...

... begun to offer services that were previously offered only by certain types. Consequently, many financial institutions are becoming more similar. Nevertheless, performance levels still differ significantly among types of financial institutions. Why? ANSWER: Depository institutions include commercial ...

Corporate financing in Austria in the run-up to capital

... criteria for classifying companies. Hence, SMEs are businesses with fewer than 250 employees and whose sales do not exceed EUR 50 million per year or whose balance sheet amounts to no more than EUR 43 million. The international Eurostat and OECD tables on which table 1 is based use employee figures ...

... criteria for classifying companies. Hence, SMEs are businesses with fewer than 250 employees and whose sales do not exceed EUR 50 million per year or whose balance sheet amounts to no more than EUR 43 million. The international Eurostat and OECD tables on which table 1 is based use employee figures ...

SmartMoney - Dyan Machan.com

... at adapting to trouble. Indeed, during the bungee-cord drop and rebound of the past 12 months, U.S. stock funds that have had the same manager for 10 years or longer lost slightly less money than their peers, according to data from Morningstar. And they’ve also been more likely to show positive retu ...

... at adapting to trouble. Indeed, during the bungee-cord drop and rebound of the past 12 months, U.S. stock funds that have had the same manager for 10 years or longer lost slightly less money than their peers, according to data from Morningstar. And they’ve also been more likely to show positive retu ...

Senior Loan Term Sheet

... the Borrower and each existing and each subsequently acquired or organized wholly-owned subsidiary of Holdings (collectively, the "Collateral"), including but not limited to (a) a security interest in all the capital stock of the Borrower and each other existing and each subsequently acquired or org ...

... the Borrower and each existing and each subsequently acquired or organized wholly-owned subsidiary of Holdings (collectively, the "Collateral"), including but not limited to (a) a security interest in all the capital stock of the Borrower and each other existing and each subsequently acquired or org ...

Chapter 22: Borrowing Models Simple Interest

... Example: You borrow $8000 to buy a used car and your neighborhood loan office offers a 5% discounted loan to be repaid in monthly installments over 4 years. How much would your payment be? Answer: The total to be paid over 4 years is P = $8000. Four years equates to 48 months. The monthly paymen ...

... Example: You borrow $8000 to buy a used car and your neighborhood loan office offers a 5% discounted loan to be repaid in monthly installments over 4 years. How much would your payment be? Answer: The total to be paid over 4 years is P = $8000. Four years equates to 48 months. The monthly paymen ...

Abstract

... Miyajima, Madhusudan and Chan (2012) comment on the diversification possibilities of emerging market bonds by stating that emerging market bonds should not appeal to international investors if their yields are driven by global factors. In order to be an effective alternative investment asset, emergi ...

... Miyajima, Madhusudan and Chan (2012) comment on the diversification possibilities of emerging market bonds by stating that emerging market bonds should not appeal to international investors if their yields are driven by global factors. In order to be an effective alternative investment asset, emergi ...

Financial Institutions

... 908-0500. Fax: (212) 480-4435. Reproduction or retransmission in whole or in part is prohibited except by permission. All rights reserved. In issuing and maintaining its ratings, Fitch relies on factual information it receives from issuers and underwriters and from other sources Fitch believes to be ...

... 908-0500. Fax: (212) 480-4435. Reproduction or retransmission in whole or in part is prohibited except by permission. All rights reserved. In issuing and maintaining its ratings, Fitch relies on factual information it receives from issuers and underwriters and from other sources Fitch believes to be ...

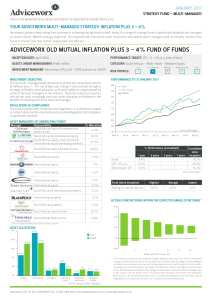

adviceworx old mutual inflation plus 3

... time to time, the total fees may vary. With effect from 1 January 2016, a new methodology in respect of the calculation of total expense ratios (TERs) was implemented by the unit trust industry. The key change in the methodology is that TERs used to be calculated on a rolling one-year basis, which h ...

... time to time, the total fees may vary. With effect from 1 January 2016, a new methodology in respect of the calculation of total expense ratios (TERs) was implemented by the unit trust industry. The key change in the methodology is that TERs used to be calculated on a rolling one-year basis, which h ...

disclosure quality on the polish alternative investment market

... investor relations. Secondary market for shares of these companies is typically characterized by low liquidity (wide spread) and high volatility in transactions. Nominated advisers usually develop the network of contacts with institutional and individual investors and advise many companies at the sa ...

... investor relations. Secondary market for shares of these companies is typically characterized by low liquidity (wide spread) and high volatility in transactions. Nominated advisers usually develop the network of contacts with institutional and individual investors and advise many companies at the sa ...

The Trillion Dollar Scandal

... The advertised theory for the Federal Reserve Act of 1913 that created the Federal Reserve System was to manage the financial system so that major financial crises would never occur again. In reality by the ability to greatly expand the money supply it enabled rampant price inflation and simultaneou ...

... The advertised theory for the Federal Reserve Act of 1913 that created the Federal Reserve System was to manage the financial system so that major financial crises would never occur again. In reality by the ability to greatly expand the money supply it enabled rampant price inflation and simultaneou ...

Chapter 5 The Time Value of Money

... Suppose a company that currently does not grant credit is considering adopting a credit policy that permits its customers to pay the full price for purchases (with no penalties) within 40 days of the purchase (i.e., the credit terms are net 40). The company estimates that it can increase the price o ...

... Suppose a company that currently does not grant credit is considering adopting a credit policy that permits its customers to pay the full price for purchases (with no penalties) within 40 days of the purchase (i.e., the credit terms are net 40). The company estimates that it can increase the price o ...

Document

... Expected losses are mean loss rate, i.e. amount that bank reasonably expects to lose. Expected losses are usually covered by loan loss provisions or loan impairment charges. It is called known part of losses. Unexpected losses represent volatility of losses, i.e. unknown part. Shareholders equity is ...

... Expected losses are mean loss rate, i.e. amount that bank reasonably expects to lose. Expected losses are usually covered by loan loss provisions or loan impairment charges. It is called known part of losses. Unexpected losses represent volatility of losses, i.e. unknown part. Shareholders equity is ...

LOGiQ ASSET MANAGEMENT INC. ANNOUNCES 2017 FIRST

... 1. Adjusted EBITDA and EBITDA: Adjusted EBITDA and EBITDA are not standardized earnings measures prescribed by IFRS; however, management believes that most of its shareholders, creditors, other stakeholders and investment analysts prefer to use these performance measures in analyzing LOGiQ's results ...

... 1. Adjusted EBITDA and EBITDA: Adjusted EBITDA and EBITDA are not standardized earnings measures prescribed by IFRS; however, management believes that most of its shareholders, creditors, other stakeholders and investment analysts prefer to use these performance measures in analyzing LOGiQ's results ...

Introduction to Real Estate

... about $1,520. Of this amount, in your first payment, $1.125 would be paid for interest, leaving only $395 for principal reduction (obviously each month the interest portion goes down slightly such that on the 360th payment it goes to zero and the loan is paid off). On that same house in California y ...

... about $1,520. Of this amount, in your first payment, $1.125 would be paid for interest, leaving only $395 for principal reduction (obviously each month the interest portion goes down slightly such that on the 360th payment it goes to zero and the loan is paid off). On that same house in California y ...