Yale School of Management

... Development of the Mortgage Market Residential Mortgage had been one of the standard services since the beginning of banks. However, before 1930s, the term of Residential Mortgage was capped by 5 years. The mortgage payment structure was also flawed. For example, prior to maturity, the borrowe ...

... Development of the Mortgage Market Residential Mortgage had been one of the standard services since the beginning of banks. However, before 1930s, the term of Residential Mortgage was capped by 5 years. The mortgage payment structure was also flawed. For example, prior to maturity, the borrowe ...

Sample Chapter

... market securities are short-term government debt securities, such as U.S. Treasury bills, and time deposits at banks, that are referred to in different countries as fixed deposits, term deposits, or certificates of deposit (CDs). In contrast, the fixed-income capital market includes long-term securi ...

... market securities are short-term government debt securities, such as U.S. Treasury bills, and time deposits at banks, that are referred to in different countries as fixed deposits, term deposits, or certificates of deposit (CDs). In contrast, the fixed-income capital market includes long-term securi ...

Clean Tech - GreenWorld Capital, LLC

... Issuer negotiates with a limited group of investors. Security is issued under an existing and effective registration statement. Essentially a traditional add-on offering marketed to, and negotiated with, a select investor universe vs. broad marketing from an institutional and retail sales force. • E ...

... Issuer negotiates with a limited group of investors. Security is issued under an existing and effective registration statement. Essentially a traditional add-on offering marketed to, and negotiated with, a select investor universe vs. broad marketing from an institutional and retail sales force. • E ...

NEI Northwest Emerging Markets Fund

... *Series F units are only available if the registered dealer has entered into a Series F Distribution Agreement with NEI Investments. No direct sales commissions or redemption charges are payable by the investor to NEI Investments on the purchase or sale of Series F units. **MER for the period ended ...

... *Series F units are only available if the registered dealer has entered into a Series F Distribution Agreement with NEI Investments. No direct sales commissions or redemption charges are payable by the investor to NEI Investments on the purchase or sale of Series F units. **MER for the period ended ...

Clear perspectives on bond market liquidity

... make payments. Investments in Target Retirement Funds are subject to the risks of their underlying funds. The year in the fund name refers to the approximate year (the target date) when an investor in the fund would retire and leave the workforce. The fund will gradually shift its emphasis from more ...

... make payments. Investments in Target Retirement Funds are subject to the risks of their underlying funds. The year in the fund name refers to the approximate year (the target date) when an investor in the fund would retire and leave the workforce. The fund will gradually shift its emphasis from more ...

Clear perspectives on bond market liquidity

... make payments. Investments in Target Retirement Funds are subject to the risks of their underlying funds. The year in the fund name refers to the approximate year (the target date) when an investor in the fund would retire and leave the workforce. The fund will gradually shift its emphasis from more ...

... make payments. Investments in Target Retirement Funds are subject to the risks of their underlying funds. The year in the fund name refers to the approximate year (the target date) when an investor in the fund would retire and leave the workforce. The fund will gradually shift its emphasis from more ...

The Impact of High Lending Rates on Borrowers` Ability to pay Back

... and credit availability and upward pressure on market interest rates. (Leisenring 1980) 2.1 Demand for credit The role of credit in a society is to bridge the gap between financial requirements of businesses and the financial assets of businesses. It can also be seen as an important instrument for i ...

... and credit availability and upward pressure on market interest rates. (Leisenring 1980) 2.1 Demand for credit The role of credit in a society is to bridge the gap between financial requirements of businesses and the financial assets of businesses. It can also be seen as an important instrument for i ...

JPM US Value X (acc)

... in this document that is misleading, inaccurate or inconsistent with the relevant parts of the Prospectus. JPMorgan Funds consists of separate Sub-Funds, each of which issues one or more Share Classes. This document is prepared for a specific Share Class. The Prospectus and annual and semiannual fin ...

... in this document that is misleading, inaccurate or inconsistent with the relevant parts of the Prospectus. JPMorgan Funds consists of separate Sub-Funds, each of which issues one or more Share Classes. This document is prepared for a specific Share Class. The Prospectus and annual and semiannual fin ...

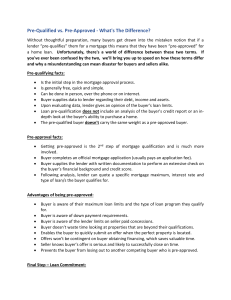

Pre-Qualified vs. Pre-Approved - What`s The

... Buyer is aware of their maximum loan limits and the type of loan program they qualify for. Buyer is aware of down payment requirements. Buyer is aware of the lender limits on seller paid concessions. Buyer doesn’t waste time looking at properties that are beyond their qualifications. Enables the buy ...

... Buyer is aware of their maximum loan limits and the type of loan program they qualify for. Buyer is aware of down payment requirements. Buyer is aware of the lender limits on seller paid concessions. Buyer doesn’t waste time looking at properties that are beyond their qualifications. Enables the buy ...

2005 Market Street Philadelphia, PA 19103-7094

... symbol “DEX,” declares a monthly dividend of $0.0750 per share. The dividend is payable June 27, 2014, to shareholders of record at the close of business on June 13, 2014. The ex-dividend date will be June 11, 2014. The Fund's primary investment objective is to seek current income, with a secondary ...

... symbol “DEX,” declares a monthly dividend of $0.0750 per share. The dividend is payable June 27, 2014, to shareholders of record at the close of business on June 13, 2014. The ex-dividend date will be June 11, 2014. The Fund's primary investment objective is to seek current income, with a secondary ...

RBC High Yield Bond Fund - RBC Global Asset Management

... Deposit Insurance Corporation or by any other government deposit insurer. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per unit at a constant amount or that the full amount of your investment in the fund will be returned to you. The va ...

... Deposit Insurance Corporation or by any other government deposit insurer. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per unit at a constant amount or that the full amount of your investment in the fund will be returned to you. The va ...

2016-lecture-15

... risk on its owners. This concentration occurs because debtholders who receive fixed interest payments bear none of the business risk. ...

... risk on its owners. This concentration occurs because debtholders who receive fixed interest payments bear none of the business risk. ...

Discover

... Continued losses in DFS's U.K. business due to UK’s weak economy. Lack of global diversification: Recently inaugurated joint programs with China UnionPay and JCB in Japan. Has no plans to expand in Europe or Latin America, where the usage of card is growing at double digit rate in selecting coun ...

... Continued losses in DFS's U.K. business due to UK’s weak economy. Lack of global diversification: Recently inaugurated joint programs with China UnionPay and JCB in Japan. Has no plans to expand in Europe or Latin America, where the usage of card is growing at double digit rate in selecting coun ...

Financial Crises and the Composition of Cross-Border Lending

... lender-borrower country-pair level using the same aggregation criteria as the BIS IBS. We also make several other adjustments to obtain estimates of cross-border SLEs that are comparable to the BIS loan claims.5 Our study expands on two branches of the international banking literature. First, we add ...

... lender-borrower country-pair level using the same aggregation criteria as the BIS IBS. We also make several other adjustments to obtain estimates of cross-border SLEs that are comparable to the BIS loan claims.5 Our study expands on two branches of the international banking literature. First, we add ...

Investing in the desert

... the very long term (50 years +), investing in government bonds has also generated positive real returns, but typically 3 – 5% pa lower than that of investing in equities. Returns from government bonds of course haven’t been as volatile as equity investing, and it might be fairly concluded that the l ...

... the very long term (50 years +), investing in government bonds has also generated positive real returns, but typically 3 – 5% pa lower than that of investing in equities. Returns from government bonds of course haven’t been as volatile as equity investing, and it might be fairly concluded that the l ...

Mutual Fund Intermediation, Equity Issues, and the Real Economy

... Potential alternative explanation I ...

... Potential alternative explanation I ...

Bank-customer relations

... to adopt a target core capital adequacy ratio of at least 7.5 percent. These measures enhanced the system's ability to absorb unexpected shocks, and brought its capital up to a level and a quality that are accepted in many countries. As part of an examination of the capital adequacy of the banking c ...

... to adopt a target core capital adequacy ratio of at least 7.5 percent. These measures enhanced the system's ability to absorb unexpected shocks, and brought its capital up to a level and a quality that are accepted in many countries. As part of an examination of the capital adequacy of the banking c ...

Q3 2010 - Spears Abacus

... Microsoft is under no obligation to preserve their cash hoard, or protect their balance sheet for the benefit of the debt holder. The bondholder is buying a senior interest and will receive 4.5% per annum. No matter the level of inflation or general interest rates, or Microsoft profits, or if additi ...

... Microsoft is under no obligation to preserve their cash hoard, or protect their balance sheet for the benefit of the debt holder. The bondholder is buying a senior interest and will receive 4.5% per annum. No matter the level of inflation or general interest rates, or Microsoft profits, or if additi ...

The totalising market and the Marxist theory of the state NB: This is a

... For Miliband, there is, indeed, an objective coercion operating on states deriving from the simple fact that economic power is concentrated in private hands. The state cannot function without private investment, and it is the capitalist class that decides how much of that goes on. This means that, i ...

... For Miliband, there is, indeed, an objective coercion operating on states deriving from the simple fact that economic power is concentrated in private hands. The state cannot function without private investment, and it is the capitalist class that decides how much of that goes on. This means that, i ...

The financial system: Strengths and weaknesses

... Given how costly financial crises may prove, preventive action is important. This needs to be based on signals which suggest the presence of risk in good time. Following the financial crises in Asia, a number of studies have been published attempting to identify the indicators that herald a financia ...

... Given how costly financial crises may prove, preventive action is important. This needs to be based on signals which suggest the presence of risk in good time. Following the financial crises in Asia, a number of studies have been published attempting to identify the indicators that herald a financia ...

Fixed Income Opportunity

... The preceding discussion is general in nature, is intended for informational purposes only, and is not intended to provide specific advice or recommendations for any individual or organization. Because the facts and circumstances surrounding each situation differs, you should consult your attorney, ...

... The preceding discussion is general in nature, is intended for informational purposes only, and is not intended to provide specific advice or recommendations for any individual or organization. Because the facts and circumstances surrounding each situation differs, you should consult your attorney, ...