Commercial Mortgage Backed Securities (CMBS)

... • Savings and loan Associations • Commercial Banks • Life Insurance Companies • Mortgage Companies • Mortgage Brokers ...

... • Savings and loan Associations • Commercial Banks • Life Insurance Companies • Mortgage Companies • Mortgage Brokers ...

The crisis

... What is the chronology of the events below? 1. Poor borrowers go bankrupt, so houses are returned to lenders. 2. Central banks help to prevent system collapse. 3. Poor borrowers can no longer repay their loans. 4. Some lenders go bust as they cannot sell the property, and some lenders sell loan obl ...

... What is the chronology of the events below? 1. Poor borrowers go bankrupt, so houses are returned to lenders. 2. Central banks help to prevent system collapse. 3. Poor borrowers can no longer repay their loans. 4. Some lenders go bust as they cannot sell the property, and some lenders sell loan obl ...

The Traditional Securitization Process Bank

... participants to reduce its own loan exposure. Thus, the borrower is guaranteed the full face value of the loan. – Best Efforts deals: The size of the loan is determined by the commitments of banks that agree to participate in the syndication. The borrower is not guaranteed the full face value of the ...

... participants to reduce its own loan exposure. Thus, the borrower is guaranteed the full face value of the loan. – Best Efforts deals: The size of the loan is determined by the commitments of banks that agree to participate in the syndication. The borrower is not guaranteed the full face value of the ...

Bailout Bill

... In the late 90’s and early 2000’s interest rates were low and banks had large amounts of cash on hand At the same time the housing market was doing very well Due to this home ownership became very attractive, increasing the demand for mortgages and increasing competition among mortgage lenders To ca ...

... In the late 90’s and early 2000’s interest rates were low and banks had large amounts of cash on hand At the same time the housing market was doing very well Due to this home ownership became very attractive, increasing the demand for mortgages and increasing competition among mortgage lenders To ca ...

Statement of Financial Position Form

... reached where any candidate beginning ordained ministry has been required to repay a government student loan taken out prior to ordination training. This is because the Student Loan Scheme, up until September 1998, stipulated that a loan need not be repaid in any year where a graduate’s income falls ...

... reached where any candidate beginning ordained ministry has been required to repay a government student loan taken out prior to ordination training. This is because the Student Loan Scheme, up until September 1998, stipulated that a loan need not be repaid in any year where a graduate’s income falls ...

CORPORATE SOURCES AND USES OF FUNDS F. Globalization of

... -due to use of swaps. a financial instrument which gives 2 parties the right to exchange streams of income over time. ...

... -due to use of swaps. a financial instrument which gives 2 parties the right to exchange streams of income over time. ...

Baca abstrak - Data Mahasiswa | Atdikbud London

... Abstract Loan loss provision is an account consisting of money set aside by banks’ managers to cover potential losses. This paper seeks to examine the determinants of loan loss provisions in Indonesian banking system over the period of 2006-2011 with regard to banks’ efficiency. Efficiency is estima ...

... Abstract Loan loss provision is an account consisting of money set aside by banks’ managers to cover potential losses. This paper seeks to examine the determinants of loan loss provisions in Indonesian banking system over the period of 2006-2011 with regard to banks’ efficiency. Efficiency is estima ...

How to Develop a Downtown Plan

... institutions have suffered huge losses or no longer exist independently. Some of these companies are (or were) investors in and lenders to HTC deals. ...

... institutions have suffered huge losses or no longer exist independently. Some of these companies are (or were) investors in and lenders to HTC deals. ...

Europe`s bank loan funds – where now?

... quarter of this year saw a jump in US CLO issuance from $1.22 billion to $5.83 billion. April 2012 then saw a further upsurge in activity, taking the total for the year to over $10 billion by the end of the month. That compares with a total of $12.3 billion for the whole of 2011. Over the three mont ...

... quarter of this year saw a jump in US CLO issuance from $1.22 billion to $5.83 billion. April 2012 then saw a further upsurge in activity, taking the total for the year to over $10 billion by the end of the month. That compares with a total of $12.3 billion for the whole of 2011. Over the three mont ...

High street banks make way for Paxton fund

... specialising in short-term loans secured on UK property. The first closing was oversubscribed and declared successful on the first day of the new financial year. Fundraising will continue until the scheme's loan book reaches £10m. Traditional bankers’ current lack of appetite for property, with cons ...

... specialising in short-term loans secured on UK property. The first closing was oversubscribed and declared successful on the first day of the new financial year. Fundraising will continue until the scheme's loan book reaches £10m. Traditional bankers’ current lack of appetite for property, with cons ...

Direct Subsidized Loans are federal student loans offered to eligible

... Direct Subsidized Loans are federal student loans offered to eligible students who have financial need. Typically, interest does not accrue on subsidized loans until you are no longer enrolled part-time in an academic program. Direct Unsubsidized Loans are federal student loans offered to eligible s ...

... Direct Subsidized Loans are federal student loans offered to eligible students who have financial need. Typically, interest does not accrue on subsidized loans until you are no longer enrolled part-time in an academic program. Direct Unsubsidized Loans are federal student loans offered to eligible s ...

Microcredit vs. Microsaving

... Are BRI borrowers more likely to be deemed creditworthy? Comparison of assessments for a given borrower between credit officers with whom there is a lending relationship and others without prior relationship. ...

... Are BRI borrowers more likely to be deemed creditworthy? Comparison of assessments for a given borrower between credit officers with whom there is a lending relationship and others without prior relationship. ...

Third World Debt Default Announcements and Market Learning :

... Banks Co-authored with George Philippatos Managerial Finance, Volume 22 No. 7, 1996 ...

... Banks Co-authored with George Philippatos Managerial Finance, Volume 22 No. 7, 1996 ...

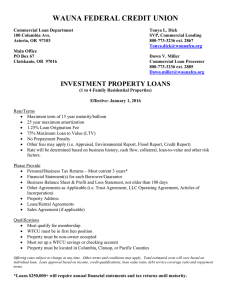

Investment - Wauna Federal Credit Union

... • Financial Statement(s) for each Borrower/Guarantor • Business Balance Sheet & Profit and Loss Statement, not older than 180 days • Other Agreements as Applicable (i.e. Trust Agreement, LLC Operating Agreement, Articles of Incorporation) • Property Address • Lease/Rental Agreements • Sales Agreemen ...

... • Financial Statement(s) for each Borrower/Guarantor • Business Balance Sheet & Profit and Loss Statement, not older than 180 days • Other Agreements as Applicable (i.e. Trust Agreement, LLC Operating Agreement, Articles of Incorporation) • Property Address • Lease/Rental Agreements • Sales Agreemen ...

Traded loans (borderline between securities and other financial

... maintained: that is, the loan should be reclassified as a security only if there is evidence of a market and there are quotations in the market. This change of category of financial instrument is achieved via a change in classification entry in the other changes in the volume of assets account and n ...

... maintained: that is, the loan should be reclassified as a security only if there is evidence of a market and there are quotations in the market. This change of category of financial instrument is achieved via a change in classification entry in the other changes in the volume of assets account and n ...