THE CASE AGAINST INTEREST: IS IT COMPELLING?

... become complacent and do not monitor the banks carefully - do not demand transparency Banks rely on the crutches of collateral, which ensures the repayment of their loans - they do not evaluate the risks carefully - tend to extend credit excessively. This promotes: ...

... become complacent and do not monitor the banks carefully - do not demand transparency Banks rely on the crutches of collateral, which ensures the repayment of their loans - they do not evaluate the risks carefully - tend to extend credit excessively. This promotes: ...

THE CASE AGAINST INTEREST: IS IT COMPELLING?

... become complacent and do not monitor the banks carefully - do not demand transparency Banks rely on the crutches of collateral, which ensures the repayment of their loans - they do not evaluate the risks carefully - tend to extend credit excessively. This promotes: ...

... become complacent and do not monitor the banks carefully - do not demand transparency Banks rely on the crutches of collateral, which ensures the repayment of their loans - they do not evaluate the risks carefully - tend to extend credit excessively. This promotes: ...

Mortgage Loans

... • Comprehensive view of borrower’s creditworthiness; help with lower credit scores & financial assets • Potential portfolio mortgages for special situations • Home loans in Washington (new and existing members), Oregon and Alaska (existing members only) Per the Safe and Fair Enforcement (SAFE) Act, ...

... • Comprehensive view of borrower’s creditworthiness; help with lower credit scores & financial assets • Potential portfolio mortgages for special situations • Home loans in Washington (new and existing members), Oregon and Alaska (existing members only) Per the Safe and Fair Enforcement (SAFE) Act, ...

Small Business Financing at Big Banks and at

... Small business loan approval rates by big banks and institutional lenders reached post-recession highs in December 2014, according to the Biz2Credit Small Business Lending Index, a monthly analysis of 1,000 loan applications on Biz2Credit.com. Big banks ($10 billion+ in assets) approved 21.1% of sma ...

... Small business loan approval rates by big banks and institutional lenders reached post-recession highs in December 2014, according to the Biz2Credit Small Business Lending Index, a monthly analysis of 1,000 loan applications on Biz2Credit.com. Big banks ($10 billion+ in assets) approved 21.1% of sma ...

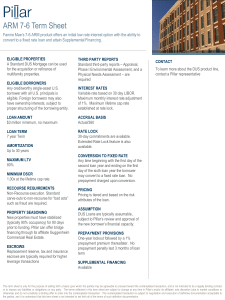

ARM 7-6 Term Sheet

... the new borrower’s financial capacity. PREPAYMENT PROVISIONS One-year lockout followed by a 1% prepayment premium thereafater. No prepayment penalty last 3 months of loan term ...

... the new borrower’s financial capacity. PREPAYMENT PROVISIONS One-year lockout followed by a 1% prepayment premium thereafater. No prepayment penalty last 3 months of loan term ...

14-June-Property-buyers-face-new-threat-from

... This is regularly resulting in maximum loans offered being reduced by 10 per cent. Other lenders are not taking into account certain types of income. For example, overtime, bonuses, commission payments are either being excluded, or only a percentage considered in calculating eligibility. Some lender ...

... This is regularly resulting in maximum loans offered being reduced by 10 per cent. Other lenders are not taking into account certain types of income. For example, overtime, bonuses, commission payments are either being excluded, or only a percentage considered in calculating eligibility. Some lender ...

Repricings May Increase in Volatile Market

... in repricing and refinancing transactions. In these credit agreements, reducing the pricing and extending maturities can be implemented only with the consent of all of the affected lenders. “Yank-a-bank” provisions allow the borrower to remove and replace lenders that do not consent to the credit ag ...

... in repricing and refinancing transactions. In these credit agreements, reducing the pricing and extending maturities can be implemented only with the consent of all of the affected lenders. “Yank-a-bank” provisions allow the borrower to remove and replace lenders that do not consent to the credit ag ...

Real Estate Investment

... Does not fund until after project is completed Returns through ongoing operational cash flows, Tax Savings, equity build up and property appreciation ...

... Does not fund until after project is completed Returns through ongoing operational cash flows, Tax Savings, equity build up and property appreciation ...

2016 Loan Generation Marketing Webinar Series

... A strategic approach to mortgage marketing can help you grow loans, control risk and develop member relationships with arguably the greatest potential to achieve Primary Financial Institution status by acquiring the member’s home loan! Learn how to refinance members from high mortgage rates, help ma ...

... A strategic approach to mortgage marketing can help you grow loans, control risk and develop member relationships with arguably the greatest potential to achieve Primary Financial Institution status by acquiring the member’s home loan! Learn how to refinance members from high mortgage rates, help ma ...

The crisis

... events below? Replace the red parts with the words from Slide 8: 1. Poor borrowers go bankrupt, so houses are returned to lenders. 2. Central banks help to prevent system collapse. 3. Poor borrowers can no longer repay their loans. 4. Some financial institutions go bust as they cannot sell the prope ...

... events below? Replace the red parts with the words from Slide 8: 1. Poor borrowers go bankrupt, so houses are returned to lenders. 2. Central banks help to prevent system collapse. 3. Poor borrowers can no longer repay their loans. 4. Some financial institutions go bust as they cannot sell the prope ...

The crisis

... cent of the deposits, but repays only investors who made unsecured loans to the bank, and not those who bought the bonds issued by the bank. d. The bank management borrows over their heads. ...

... cent of the deposits, but repays only investors who made unsecured loans to the bank, and not those who bought the bonds issued by the bank. d. The bank management borrows over their heads. ...

Doral Financial Corp

... Only 30% of loans past due 240 days actually go to foreclosure. Borrowers come up with money sporadically. Bank works with them based on their income and debt load auer they make up 3 payments ...

... Only 30% of loans past due 240 days actually go to foreclosure. Borrowers come up with money sporadically. Bank works with them based on their income and debt load auer they make up 3 payments ...

C3 Guidelines - University of California | Office of The President

... obligated to utilize the full amount; however, the full amount will be counted against a given Participant’s debt capacity until actual utilization is known. Hence, approval of the authorization is subject to debt financing feasibility metrics. 5. Loan Characteristics. Minimum amortization is three ...

... obligated to utilize the full amount; however, the full amount will be counted against a given Participant’s debt capacity until actual utilization is known. Hence, approval of the authorization is subject to debt financing feasibility metrics. 5. Loan Characteristics. Minimum amortization is three ...

Choosing a Lender - kauai real estate, kauai hawaii real estate

... computer-loan origination systems and mortgage-reporting services – firms that survey major lenders in metropolitan areas every week or so and publish information sheets on who is offering what loans on what terms. Shop for lenders offering the best deals. Check with several mortgage companies and u ...

... computer-loan origination systems and mortgage-reporting services – firms that survey major lenders in metropolitan areas every week or so and publish information sheets on who is offering what loans on what terms. Shop for lenders offering the best deals. Check with several mortgage companies and u ...

China`s Stock Crash Is Spurring a Shakeout in Shadow Banks

... unregulated funding -- such as trust loans -- as part of his effort to wean the economy from debt-fueled growth after corporate defaults mounted. “The new regulations are making the industry more disciplined and transparent,” said Wei Hou, a senior equity analyst for Chinese banks at Sanford C. Bern ...

... unregulated funding -- such as trust loans -- as part of his effort to wean the economy from debt-fueled growth after corporate defaults mounted. “The new regulations are making the industry more disciplined and transparent,” said Wei Hou, a senior equity analyst for Chinese banks at Sanford C. Bern ...

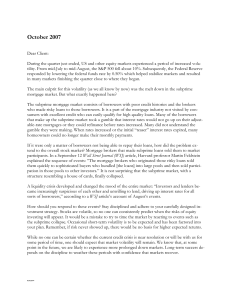

ARK_letter10-07 - ARK Financial Services

... How should you respond to these events? Stay disciplined and adhere to your carefully designed investment strategy. Stocks are volatile, so no one can consistently predict when the risks of equity investing will appear. It would be a mistake to try to time the market by reacting to events such as th ...

... How should you respond to these events? Stay disciplined and adhere to your carefully designed investment strategy. Stocks are volatile, so no one can consistently predict when the risks of equity investing will appear. It would be a mistake to try to time the market by reacting to events such as th ...

debt capital markets

... The supply/demand imbalance continued to be the theme within the ABL market in 4Q16. At just under $5.0 billion, new money ABL made up roughly one-third of total issuance in 4Q16. Of this total, financing to corporate lenders represented more than 60% of new-money issuance. Investors continued to sh ...

... The supply/demand imbalance continued to be the theme within the ABL market in 4Q16. At just under $5.0 billion, new money ABL made up roughly one-third of total issuance in 4Q16. Of this total, financing to corporate lenders represented more than 60% of new-money issuance. Investors continued to sh ...

1.06 Describe the nature of retail/business banking processes

... been a part of the lending process between businesses. With more institutions seeking credit, as well as the introduction of newer forms of technology, the scope of collateral management has grown. Increased risks in the field of finance have inspired greater responsibility on the part of borrowers, ...

... been a part of the lending process between businesses. With more institutions seeking credit, as well as the introduction of newer forms of technology, the scope of collateral management has grown. Increased risks in the field of finance have inspired greater responsibility on the part of borrowers, ...

Financing a Small Business 4.00 Explain the fundamentals of

... environmental conditions such as competition, growth, location, and economic outlook in which the business will operate. ...

... environmental conditions such as competition, growth, location, and economic outlook in which the business will operate. ...

Why Can`t My Bank Help Me?

... Banking regulations limit the types of consumer loans made. For example, collateralized loans are more acceptable than uncollateralized loans. Within collateralized loans, housing loans are more favorable than auto loans. Within housing loans, banks favor consumers with larger down payments. Lending ...

... Banking regulations limit the types of consumer loans made. For example, collateralized loans are more acceptable than uncollateralized loans. Within collateralized loans, housing loans are more favorable than auto loans. Within housing loans, banks favor consumers with larger down payments. Lending ...

Market Entry ServicesTM for unsecured personal loans

... Utilize scores only available to Experian such as: • Income InsightSM ...

... Utilize scores only available to Experian such as: • Income InsightSM ...

Credit Risk

... X4 = Market value equity/ book value LT debt. X5 = Sales/total assets. Problems: Only considers two extreme cases (default/no default). Weights need not be stationary over time. Ignores hard to quantify factors including business cycle effects. Database of defaulted loans is not available ...

... X4 = Market value equity/ book value LT debt. X5 = Sales/total assets. Problems: Only considers two extreme cases (default/no default). Weights need not be stationary over time. Ignores hard to quantify factors including business cycle effects. Database of defaulted loans is not available ...