Joao Carlos Ferraz (ES)

... Each Development Bank is a singular institution. No role model exists. As market based finance can be relied only partially for development financing, a stronger configuration for a national financial industry is where private and public institutions co-live . But… attention!!! Time and place do mat ...

... Each Development Bank is a singular institution. No role model exists. As market based finance can be relied only partially for development financing, a stronger configuration for a national financial industry is where private and public institutions co-live . But… attention!!! Time and place do mat ...

Public Policy and Financial Crises

... although there are buyers willing to pay a higher price for higher quality. Lenders will lend less than otherwise, negatively affecting investment and growth ...

... although there are buyers willing to pay a higher price for higher quality. Lenders will lend less than otherwise, negatively affecting investment and growth ...

Campus SBB

... 2. Interest will accrue from date of purchase. Choosing this option will increase the total amount of interest you pay. 3. Gas Card offer is from AutoMax Ocala and only when you purchase a vehicle at the sale. 4. Mention this ad at time of application. Only one gift card per household. 5. Credit app ...

... 2. Interest will accrue from date of purchase. Choosing this option will increase the total amount of interest you pay. 3. Gas Card offer is from AutoMax Ocala and only when you purchase a vehicle at the sale. 4. Mention this ad at time of application. Only one gift card per household. 5. Credit app ...

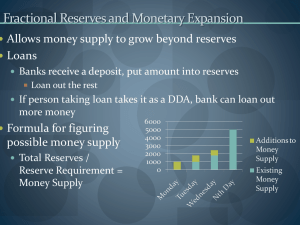

Money and Banking

... Reserve Requirement Fed can change this rate Lower reserve requirement, more money can be loaned Open Market Operations Buying and selling of government securities in financial markets Operations conducted by Federal Open Market Committee Set targets, tell trading desk to take over ...

... Reserve Requirement Fed can change this rate Lower reserve requirement, more money can be loaned Open Market Operations Buying and selling of government securities in financial markets Operations conducted by Federal Open Market Committee Set targets, tell trading desk to take over ...

DebtCeilingC_15600

... The ceiling’s up and the stocks are down. Where will the American economy go from here? by W.B. King At extreme high speeds, a jetliner requires a full five miles to reverse course—an abrupt turn would end in disaster. The U.S. government has proven to be an even more complicated machine, as would-b ...

... The ceiling’s up and the stocks are down. Where will the American economy go from here? by W.B. King At extreme high speeds, a jetliner requires a full five miles to reverse course—an abrupt turn would end in disaster. The U.S. government has proven to be an even more complicated machine, as would-b ...

Foreign Liquidity pushing market higher Market opened the week

... Market opened the week down mirroring the Wall Street worries but pulled up slowly on back of huge year end liquidity gush flooding the financial markets. FPI’s have made a record equity purchases in the month of March amounting to Rs 27000/- Crs, unseen in last ten years. DIIs have played contra an ...

... Market opened the week down mirroring the Wall Street worries but pulled up slowly on back of huge year end liquidity gush flooding the financial markets. FPI’s have made a record equity purchases in the month of March amounting to Rs 27000/- Crs, unseen in last ten years. DIIs have played contra an ...

The New Hard Times

... • The Rural Mainstreet Index dipped to 32.0 in August from 32.6 in July and 34.0 in June. It is, however, significantly higher than the index's record low of 16.9 in February. • The index ranges from 0 to 100. A score below 50 suggests the economy will contract in the next three to six months, while ...

... • The Rural Mainstreet Index dipped to 32.0 in August from 32.6 in July and 34.0 in June. It is, however, significantly higher than the index's record low of 16.9 in February. • The index ranges from 0 to 100. A score below 50 suggests the economy will contract in the next three to six months, while ...

Financial system in B&H in combination with the financial crises and

... Many new Banks at country level - no umbrella bank / uncoordinated practice by banks commercially based - different strategies (retail, treasury, large, foreign companies etc…) ...

... Many new Banks at country level - no umbrella bank / uncoordinated practice by banks commercially based - different strategies (retail, treasury, large, foreign companies etc…) ...

Lecture / Chapter 3

... 3. Lender obtains credit reports of borrower from three sources 4. Borrower provides to the lender W-2 tax information, income statements, verification of employment and history, proof of assets (bank ...

... 3. Lender obtains credit reports of borrower from three sources 4. Borrower provides to the lender W-2 tax information, income statements, verification of employment and history, proof of assets (bank ...

CHAPTER 1

... We can imagine the financial manager doing several things on behalf of the firm’s stockholders. For example, the manager might: a. Make shareholders as wealthy as possible by investing in real assets with positive NPVs. b. Modify the firm’s investment plan to help shareholders achieve a particular t ...

... We can imagine the financial manager doing several things on behalf of the firm’s stockholders. For example, the manager might: a. Make shareholders as wealthy as possible by investing in real assets with positive NPVs. b. Modify the firm’s investment plan to help shareholders achieve a particular t ...

Causes of bank distress during the Austro

... demise in the repo (repurchase agreements) market. Inspired by the failure of Lehman Brothers, a US investment bank which was forced to suspend payments and face bankruptcy when its shortterm repo funding suddenly dried up in autumn 2008, economists have attempted to pin down necessary and/or suffic ...

... demise in the repo (repurchase agreements) market. Inspired by the failure of Lehman Brothers, a US investment bank which was forced to suspend payments and face bankruptcy when its shortterm repo funding suddenly dried up in autumn 2008, economists have attempted to pin down necessary and/or suffic ...

See the Presentation

... avoid “the worst banking crisis since 1931.” They saved that otherwise expendable lender because banks and government regulators did not want the CDOs that IKB held to be exposed to market pricing, which could unwind the entire sector. How many more of those situations await exposure? One assessment ...

... avoid “the worst banking crisis since 1931.” They saved that otherwise expendable lender because banks and government regulators did not want the CDOs that IKB held to be exposed to market pricing, which could unwind the entire sector. How many more of those situations await exposure? One assessment ...

download soal

... Wells Fargo spokeswoman Julia Tunis says the change was meant to help borrowers. "The extra time helps avoid having loans charged off when better solutions might be available for our customers," she says. In a securities filing, Wells Fargo said that the 180-day charge-off standard is "consistent wi ...

... Wells Fargo spokeswoman Julia Tunis says the change was meant to help borrowers. "The extra time helps avoid having loans charged off when better solutions might be available for our customers," she says. In a securities filing, Wells Fargo said that the 180-day charge-off standard is "consistent wi ...

Long-term Causes of the Great Depression

... purchased – This was cyclical- No payments to banks = banks fail = foreclosure – Banks foreclosed homes and now “owned” houses- tried to resell but no one had the money to buy! – Housing Bubble- 2007/8 and the Credit Crisis ...

... purchased – This was cyclical- No payments to banks = banks fail = foreclosure – Banks foreclosed homes and now “owned” houses- tried to resell but no one had the money to buy! – Housing Bubble- 2007/8 and the Credit Crisis ...

Getting a Handle of our Agricultural Lending

... • Write the policies and procedures of the participants’ traditional agricultural lending product (regular agri loan); • Answer questions on whether the bank has reached the farmers and has effectively served them with the bank’s existing agricultural loan product. ...

... • Write the policies and procedures of the participants’ traditional agricultural lending product (regular agri loan); • Answer questions on whether the bank has reached the farmers and has effectively served them with the bank’s existing agricultural loan product. ...

EIB GEEREF and REPIN ppt

... • Interesting dealflow outside of classical GEEREF focus • Mostly: offgrid RE access to energy: solar lanterns, SHS • Interesting complement to GEEREF • Higher return and risk than classical GEEREF ...

... • Interesting dealflow outside of classical GEEREF focus • Mostly: offgrid RE access to energy: solar lanterns, SHS • Interesting complement to GEEREF • Higher return and risk than classical GEEREF ...

An Asian Investment Fund - Global Clearinghouse for Development

... ▪ Alternatively, it could be organized as a public- ...

... ▪ Alternatively, it could be organized as a public- ...

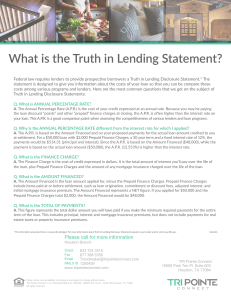

What is the Truth in Lending Statement?

... A. The A.P.R. is based on the Amount Financed and on your proposed payments for the actual loan amount credited to you at settlement. For a $50,000 loan with $2,000 Prepaid Finance Charges, a 30 year term and a fixed interest rate of 12%, the payments would be $514.31 (principal and interest). Since ...

... A. The A.P.R. is based on the Amount Financed and on your proposed payments for the actual loan amount credited to you at settlement. For a $50,000 loan with $2,000 Prepaid Finance Charges, a 30 year term and a fixed interest rate of 12%, the payments would be $514.31 (principal and interest). Since ...

On June 23 the ECB allowed European banks and

... in what is now the largest capital injection into the European banking sector since the financial crisis began. The banks that took the loans will be required to repay them with one percent interest, within one year. The size and generous terms of the loans mean that Europe will not see massive bank ...

... in what is now the largest capital injection into the European banking sector since the financial crisis began. The banks that took the loans will be required to repay them with one percent interest, within one year. The size and generous terms of the loans mean that Europe will not see massive bank ...