Characteristics of Money Market Instruments

... loans, floating-rate loans, or bankers’ acceptances. Except for the most creditworthy corporations, most bank lending is secured by the corporation’s physical assets or receivables. Credit facilities are tailored to suit the needs of the borrower. At any given time, a borrower does not usually requi ...

... loans, floating-rate loans, or bankers’ acceptances. Except for the most creditworthy corporations, most bank lending is secured by the corporation’s physical assets or receivables. Credit facilities are tailored to suit the needs of the borrower. At any given time, a borrower does not usually requi ...

CV sample

... XYZ Capital Ltd, London, UK Private equity firm with £100m AUM Senior Associate Reviewed and led c. 100 equity and mezzanine deals/investments of which 10 were completed (total deal size $1.5bn+) and 2, in manufacturing and consumer goods, were exited Managed projects and conducted financial and ...

... XYZ Capital Ltd, London, UK Private equity firm with £100m AUM Senior Associate Reviewed and led c. 100 equity and mezzanine deals/investments of which 10 were completed (total deal size $1.5bn+) and 2, in manufacturing and consumer goods, were exited Managed projects and conducted financial and ...

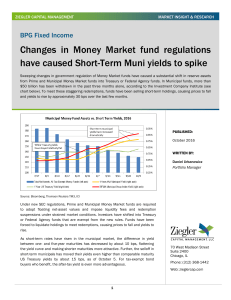

Changes In Money Market Fund Regulations

... use for liquidity, Variable-Rate Demand Notes (VRDNs), which have cheapened significantly. VRDNs are securities that typically have a longer-term final maturity and “for which the interest rate resets on a periodic basis and holders are able to liquidate their security through a ‘put’ or ‘tender’ fe ...

... use for liquidity, Variable-Rate Demand Notes (VRDNs), which have cheapened significantly. VRDNs are securities that typically have a longer-term final maturity and “for which the interest rate resets on a periodic basis and holders are able to liquidate their security through a ‘put’ or ‘tender’ fe ...

MATH-1410-6A Project 3

... Project on Student Debt in an effort to increase public awareness about rising student debt and its impact on our society. According to the program’s October 2012 report, Student Debt and the Class of 2011, recent graduates from public and private nonprofit 4-year colleges carried an average student ...

... Project on Student Debt in an effort to increase public awareness about rising student debt and its impact on our society. According to the program’s October 2012 report, Student Debt and the Class of 2011, recent graduates from public and private nonprofit 4-year colleges carried an average student ...

Real Estate Finance: An Overview

... and contributed richly to federal legislators who regulated them. The politicians and executives both benefited as regulations permitted/required Fannie & Freddie to purchase lower quality notes (“affordable housing” initiative bought good press/ votes for legislators) and allowed the firms to do mo ...

... and contributed richly to federal legislators who regulated them. The politicians and executives both benefited as regulations permitted/required Fannie & Freddie to purchase lower quality notes (“affordable housing” initiative bought good press/ votes for legislators) and allowed the firms to do mo ...

Lecture 3 securitization

... when the teaser rates ended. Others had negative equity and recognized that it was optimal for them to exercise their put options. U.S. real estate prices fell and products, created from the mortgages, that were previously thought to be safe began to be viewed as risky ...

... when the teaser rates ended. Others had negative equity and recognized that it was optimal for them to exercise their put options. U.S. real estate prices fell and products, created from the mortgages, that were previously thought to be safe began to be viewed as risky ...

S/CC Resource Disregards - page 327

... long as it is being used by the household. A second vehicle may be exempt if there is a medical need for it or it is being used for employment related activities. A third vehicle is also exempt if there is a child under 21 years of age in the household, and they are using this vehicle for school att ...

... long as it is being used by the household. A second vehicle may be exempt if there is a medical need for it or it is being used for employment related activities. A third vehicle is also exempt if there is a child under 21 years of age in the household, and they are using this vehicle for school att ...

Investing Against the Grain

... when the market is a good place to be but able to get out of the market when the risk to their assets is too great.” Guaranteed Income for the Retired and Nearly Retired One of Dubots Capital Management’s founding principles is financial education. He strongly advocates that clients understand their ...

... when the market is a good place to be but able to get out of the market when the risk to their assets is too great.” Guaranteed Income for the Retired and Nearly Retired One of Dubots Capital Management’s founding principles is financial education. He strongly advocates that clients understand their ...

open market operations

... When banks need to borrow reserves from other banks they go to the Fed Funds Market. Banks offer their excess funds to other banks for overnight lending to meet their reserve requirements. The Federal Reserve does not decree this interest rate, but they use bonds to add or take from this pool of mon ...

... When banks need to borrow reserves from other banks they go to the Fed Funds Market. Banks offer their excess funds to other banks for overnight lending to meet their reserve requirements. The Federal Reserve does not decree this interest rate, but they use bonds to add or take from this pool of mon ...

G.S. 58-7-173

... state, incorporated city, or legally constituted public corporation or commission, all within the United States or Canada, for the payment of the principal and interest of which a lawful sinking fund has been established and is being maintained and if no default by the issuer in payment of principal ...

... state, incorporated city, or legally constituted public corporation or commission, all within the United States or Canada, for the payment of the principal and interest of which a lawful sinking fund has been established and is being maintained and if no default by the issuer in payment of principal ...

Slide 1

... purchase of a risky chance of the same thing. Investment involves choosing among alternative risky assets, with different returns depending on the state of the world ...

... purchase of a risky chance of the same thing. Investment involves choosing among alternative risky assets, with different returns depending on the state of the world ...

chap008-- - MCST-CS

... “To reduce the risk of an investment by making an offsetting investment. There are a large number of hedging strategies that one can use. To give an example, one may take a long position on a security and then sell short the same or a similar security. This means that one will profit (or at least av ...

... “To reduce the risk of an investment by making an offsetting investment. There are a large number of hedging strategies that one can use. To give an example, one may take a long position on a security and then sell short the same or a similar security. This means that one will profit (or at least av ...

Joint Investment Activities Are Often Lawful, But

... sell their business. Thus, the antitrust laws consider this type of joint conduct to be lawful and beneficial to competition. The antitrust laws, however, are also designed to protect all forms of competition, including competition in the market for corporate control. Accordingly, agreements among i ...

... sell their business. Thus, the antitrust laws consider this type of joint conduct to be lawful and beneficial to competition. The antitrust laws, however, are also designed to protect all forms of competition, including competition in the market for corporate control. Accordingly, agreements among i ...

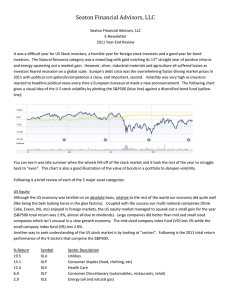

2011 - Seaton Financial Advisors, LLC

... Short term interest rates were kept artificially low by the Fed in order to assist banks in earning profits to shore up their balance sheets (the bailouts are never-ending). This resulted in interest rates on savings accounts, CDs and money market accounts being very close to zero. While these low r ...

... Short term interest rates were kept artificially low by the Fed in order to assist banks in earning profits to shore up their balance sheets (the bailouts are never-ending). This resulted in interest rates on savings accounts, CDs and money market accounts being very close to zero. While these low r ...

Did you notice - T3 Equity Labs LLC

... uncertainties and other factors could cause the actual results, financial position, development or performance to differ materially from the estimations presented herein. There is no guarantee; expressed or implied, investments involve risk. In making investment decisions it is your responsibility t ...

... uncertainties and other factors could cause the actual results, financial position, development or performance to differ materially from the estimations presented herein. There is no guarantee; expressed or implied, investments involve risk. In making investment decisions it is your responsibility t ...

Ch.1 - 13ed Overview of Fin Mgmt

... Country risk. Depends on the country’s economic, political, and social environment. Exchange rate risk. Non-dollar denominated investment’s value depends on what happens to exchange rate. Exchange rates affected ...

... Country risk. Depends on the country’s economic, political, and social environment. Exchange rate risk. Non-dollar denominated investment’s value depends on what happens to exchange rate. Exchange rates affected ...

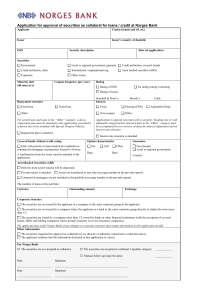

Søknadsskjema for godkjenning av obligasjoner og

... The securities are not issued by the applicant or a company in the same corporate group as the applicant. The securities are not issued by a company where the applicant or a bank in the same corporate group directly or indirectly owns more than 1/3. The securities are issued by a company more than 1 ...

... The securities are not issued by the applicant or a company in the same corporate group as the applicant. The securities are not issued by a company where the applicant or a bank in the same corporate group directly or indirectly owns more than 1/3. The securities are issued by a company more than 1 ...

as file - Meetings, agendas, and minutes

... at current levels on price earnings ratios of 8.4 for 2008 and 8.0 for 2009, but such earnings forecast are wildly optimistic. Historically, corporate earnings (profits) have fallen 25% on average in a downturn, and if, as seems probable, this recession is going to be more severe than the average, c ...

... at current levels on price earnings ratios of 8.4 for 2008 and 8.0 for 2009, but such earnings forecast are wildly optimistic. Historically, corporate earnings (profits) have fallen 25% on average in a downturn, and if, as seems probable, this recession is going to be more severe than the average, c ...

Financing Non-P3 Infrastructure Projects

... Returns from most projects will be tied in some way to cash flow generated from mining activities, projects or companies Equity markets are well-acquainted with mining sector ...

... Returns from most projects will be tied in some way to cash flow generated from mining activities, projects or companies Equity markets are well-acquainted with mining sector ...

MESSAGE TO INVESTORS Year 2003 in Review The year 2003

... The addition of this new class brings to eight the number of classes across which investors can switch on a tax-free basis, providing enhanced flexibility to make tax-efficient asset allocation decisions. We expect the current low inflation, low interest rate environment to continue throughout 2004, ...

... The addition of this new class brings to eight the number of classes across which investors can switch on a tax-free basis, providing enhanced flexibility to make tax-efficient asset allocation decisions. We expect the current low inflation, low interest rate environment to continue throughout 2004, ...