What Lenders Want in a Credit Crunch

... – Reduce your more expensive interest rate debt first – Reduce your fixed expenses, outsource where you can – Don’t forget about friends and family financing – Start your banking search earlier – Let time take care of this situation – Don’t panic! ...

... – Reduce your more expensive interest rate debt first – Reduce your fixed expenses, outsource where you can – Don’t forget about friends and family financing – Start your banking search earlier – Let time take care of this situation – Don’t panic! ...

The Bursting Bubble

... Declining yields combined with an excess of capital, lack of regulation, and political corruption are the breeding grounds for Bubbles. Innovation, either financial, technical, or both also needed to create a major Bubble. Bubbles have circular feed-back mechanisms, where growth continually creates ...

... Declining yields combined with an excess of capital, lack of regulation, and political corruption are the breeding grounds for Bubbles. Innovation, either financial, technical, or both also needed to create a major Bubble. Bubbles have circular feed-back mechanisms, where growth continually creates ...

Financial Crisis and Fed Policy Actions

... purchases of these securities to up to $1.25 trillion this year, and to increase its purchases of agency debt this year by up to $100 billion to a total of up to $200 billion. Moreover, to help improve conditions in private credit markets, the Committee decided to purchase up to $300 billion of long ...

... purchases of these securities to up to $1.25 trillion this year, and to increase its purchases of agency debt this year by up to $100 billion to a total of up to $200 billion. Moreover, to help improve conditions in private credit markets, the Committee decided to purchase up to $300 billion of long ...

This PDF is a selection from a published volume from... Bureau of Economic Research

... because the good borrower would not like to be caught by liquidity shortage in the middle of the project. My intuition also says that a lender, not a borrower, prefers short-term loans if it suspects that there are more bad borrowers than before, or if the monitoring technique is enhanced to pick ba ...

... because the good borrower would not like to be caught by liquidity shortage in the middle of the project. My intuition also says that a lender, not a borrower, prefers short-term loans if it suspects that there are more bad borrowers than before, or if the monitoring technique is enhanced to pick ba ...

Quarterly Investment Letter

... 54 which is the highest level in over 4 years. Economic growth could be as high as 1.5% in 2014 as the latest consensus predicts and maybe higher next year if this development continues. Researchers from Gavekal further point out that as the Eurozone policy has become less austere and even allows fo ...

... 54 which is the highest level in over 4 years. Economic growth could be as high as 1.5% in 2014 as the latest consensus predicts and maybe higher next year if this development continues. Researchers from Gavekal further point out that as the Eurozone policy has become less austere and even allows fo ...

Chapter 1

... How much money do we need? When do we need the money Where do we get money? (sources of funds) What is the least expensive money we can get? ...

... How much money do we need? When do we need the money Where do we get money? (sources of funds) What is the least expensive money we can get? ...

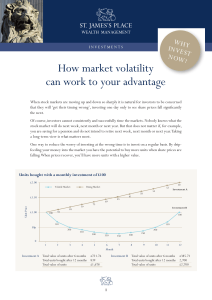

How market volatility can work to your advantage

... How ma rk et volatility c a n wor k to your a dva ntage ...

... How ma rk et volatility c a n wor k to your a dva ntage ...

Loan Intrest

... • Permits buying expensive items. • Permits you to use the item while paying for it. • Provides financial flexibility--spread payments over long period of time. ...

... • Permits buying expensive items. • Permits you to use the item while paying for it. • Provides financial flexibility--spread payments over long period of time. ...

Applying for and Managing Loans

... Switch payment plans - Students may switch to a payment plan with lower monthly payments Consolidation - Enables students to pay existing student loans in full with one loan, with one interest rate and repayment schedule. Could help lower overall payments (all though it could increase the overal ...

... Switch payment plans - Students may switch to a payment plan with lower monthly payments Consolidation - Enables students to pay existing student loans in full with one loan, with one interest rate and repayment schedule. Could help lower overall payments (all though it could increase the overal ...

page one economics - Federal Reserve Bank of St. Louis

... bank owns (its assets) and its obligations (its liabilities).4 This regulation is aimed at ensuring stability in the banking system by requiring banks to have a cushion against losses. Banks are also supported in the form of deposit insurance, which guarantees individual accounts up to $250,000 in t ...

... bank owns (its assets) and its obligations (its liabilities).4 This regulation is aimed at ensuring stability in the banking system by requiring banks to have a cushion against losses. Banks are also supported in the form of deposit insurance, which guarantees individual accounts up to $250,000 in t ...

The Economics of the Great Depression

... market). Bank Runs – panicked investors try to withdraw their money from banks, but the banks do not have ...

... market). Bank Runs – panicked investors try to withdraw their money from banks, but the banks do not have ...

Dr William Muhairwe

... being created. Meet country level objectives of deepening the capital market and set an example for other utilities ...

... being created. Meet country level objectives of deepening the capital market and set an example for other utilities ...

NPL resolution - World Bank Group

... The lack of economic understanding and experience of judges is also one of the causes for inefficient or even faulty auction procedures in some jurisdiction. Moreover, it can be observed that the smaller the jurisdiction is, the higher is the probability of having the auction process hampered by lo ...

... The lack of economic understanding and experience of judges is also one of the causes for inefficient or even faulty auction procedures in some jurisdiction. Moreover, it can be observed that the smaller the jurisdiction is, the higher is the probability of having the auction process hampered by lo ...

Non-performing loans: Peripheral countries finally on

... diverging from the much lower ratios in more “solid” countries such as France, Germany and the UK (or, for that matter, the US). Last year, however, NPL ratios in most of the troubled countries finally started to level off and even decline. Interestingly, the changes either way were almost always dr ...

... diverging from the much lower ratios in more “solid” countries such as France, Germany and the UK (or, for that matter, the US). Last year, however, NPL ratios in most of the troubled countries finally started to level off and even decline. Interestingly, the changes either way were almost always dr ...

Purchasing Performing Accounts

... • Student Credit Portfolios • They can be transacted in various ways: • Entire portfolio sales • Specific customer type or delinquency cycle ...

... • Student Credit Portfolios • They can be transacted in various ways: • Entire portfolio sales • Specific customer type or delinquency cycle ...

15 Mosec

... portfolios on their balance sheet. – Most often they don’t have the capital required for holding all such assets on their balance sheets. – They may not have an understanding/knowledge of sophisticated risk management practices to manage their balance sheet exposures . i.e. interest rate risk. • Org ...

... portfolios on their balance sheet. – Most often they don’t have the capital required for holding all such assets on their balance sheets. – They may not have an understanding/knowledge of sophisticated risk management practices to manage their balance sheet exposures . i.e. interest rate risk. • Org ...

FT: Hope remains for a little more resilience

... distressed sellers, particularly in Australia and Japan, while there are potentially good investments in unlisted funds looking for prime assets in the region, according to Adrian Baker, of CBRE Investors. "Such opportunities should produce strong annualised returns while taking on minimal risk," he ...

... distressed sellers, particularly in Australia and Japan, while there are potentially good investments in unlisted funds looking for prime assets in the region, according to Adrian Baker, of CBRE Investors. "Such opportunities should produce strong annualised returns while taking on minimal risk," he ...

The Indian Financial Market Is Touted as Benchmark in Today`s

... For making it more convienient SENSEX ( also called sensitive index) was introduced.it served as a barometer for securities , assets present in both banks and companies .NSE started its first operational business in 1994 and since then more than 1500 securities are being traded every day. It provide ...

... For making it more convienient SENSEX ( also called sensitive index) was introduced.it served as a barometer for securities , assets present in both banks and companies .NSE started its first operational business in 1994 and since then more than 1500 securities are being traded every day. It provide ...

Financial system

... (assets are any item of economic value owned by an individual or corporation, especially that which could be converted to cash) one may invest in. They include: – Savings accounts & certificates of deposit (specific term & interest rate) – 401(k) plans – Bonds – Treasury notes & bonds – Treasury bil ...

... (assets are any item of economic value owned by an individual or corporation, especially that which could be converted to cash) one may invest in. They include: – Savings accounts & certificates of deposit (specific term & interest rate) – 401(k) plans – Bonds – Treasury notes & bonds – Treasury bil ...

Debt crisis hits Europe`s retail credit markets

... 5. Deleveraging of non-financial companies reflects low business confidence in Europe’s periphery In 2011, the loans to non-financial companies increased in real terms for the first time since 2008 in the EA core and in new member states. However, corporations in countries hit by the sovereign crisi ...

... 5. Deleveraging of non-financial companies reflects low business confidence in Europe’s periphery In 2011, the loans to non-financial companies increased in real terms for the first time since 2008 in the EA core and in new member states. However, corporations in countries hit by the sovereign crisi ...