Realize Higher Returns from Income-Producing Credit

... with unsecured lending, operational complexity, lengthy time to market, limited economies of scale and a challenging regulatory environment. What’s more, Corserv shares responsibility for credit card fraud losses with its partners. The Corserv Account Issuer solution empowers institutions to own the ...

... with unsecured lending, operational complexity, lengthy time to market, limited economies of scale and a challenging regulatory environment. What’s more, Corserv shares responsibility for credit card fraud losses with its partners. The Corserv Account Issuer solution empowers institutions to own the ...

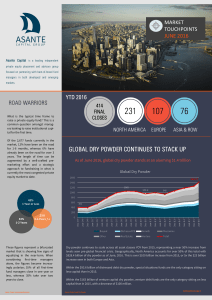

global dry powder continues to stack up

... As the market becomes increasingly bifurcated, the winners are closing oversubscribed funds faster than ever before. By the close of Q3, we expect the average number of months to final close to increase as funds that have been on the road for some time begin to close on capital. Source: Preqin Recen ...

... As the market becomes increasingly bifurcated, the winners are closing oversubscribed funds faster than ever before. By the close of Q3, we expect the average number of months to final close to increase as funds that have been on the road for some time begin to close on capital. Source: Preqin Recen ...

Thoughts on the Market - July 2007

... homeowners are falling behind on mortgage payments and losing their homes at one of the highest rates in the nation, offering a troubling glimpse of what experts fear may be in store for other parts of the country. The real estate slump here and elsewhere is likely to worsen, given that most of the ...

... homeowners are falling behind on mortgage payments and losing their homes at one of the highest rates in the nation, offering a troubling glimpse of what experts fear may be in store for other parts of the country. The real estate slump here and elsewhere is likely to worsen, given that most of the ...

Open

... The central bank has advised the tax authorities to make the revenue earned from investment in the zerocoupon bonds by banks, financial institutions (FIs) and insurance companies tax-free. The BB governor Dr Atiur Rahman made the suggestion in a recently-sent Demy Official (DO) letter to the Nationa ...

... The central bank has advised the tax authorities to make the revenue earned from investment in the zerocoupon bonds by banks, financial institutions (FIs) and insurance companies tax-free. The BB governor Dr Atiur Rahman made the suggestion in a recently-sent Demy Official (DO) letter to the Nationa ...

The Investment Environment

... Some industry grow faster than the GDP and are expected to continue in their growth. E.g IT industry has experienced higher rate than GDP in 1998. ...

... Some industry grow faster than the GDP and are expected to continue in their growth. E.g IT industry has experienced higher rate than GDP in 1998. ...

Sony illustrates risks facing Japanese consumer electronics industry

... Asian local-currency bonds. The amount of local-currency bond sales in Asia Ex-Japan reached record high levels so far this year, with most of the issuances stemming from investment grade corporations. Companies in Asia are also benefitting from the extra source of funding as bank loans have become ...

... Asian local-currency bonds. The amount of local-currency bond sales in Asia Ex-Japan reached record high levels so far this year, with most of the issuances stemming from investment grade corporations. Companies in Asia are also benefitting from the extra source of funding as bank loans have become ...

Five Ways to Ramp Up Fee Income

... Dodd-Frank act and new restrictions on overdraft fees. The changes may not be as costly as initially expected, and will likely be offset through new fees and products.” The race is on in 2010 for winning and retaining profitable customers and for finding new sources of non-interest income to replace ...

... Dodd-Frank act and new restrictions on overdraft fees. The changes may not be as costly as initially expected, and will likely be offset through new fees and products.” The race is on in 2010 for winning and retaining profitable customers and for finding new sources of non-interest income to replace ...

Dr. John*s Products, Ltd. Case Study

... Patent will not prevent other companies from developing similar tooth brushes since the patent is specific to angles and motions ...

... Patent will not prevent other companies from developing similar tooth brushes since the patent is specific to angles and motions ...

The Charlotte Regional Commercial Real Estate Capital Conference

... When you quote a spread or rate, for how long is the pricing good? Rich? Don? ...

... When you quote a spread or rate, for how long is the pricing good? Rich? Don? ...

The Great Recession

... • Combined return can be high • But what happens if the high risk mortgages go bad? • No one wants to buy them—so their “real” value is uncertain • If there is no market, there is no price • As assets, CDOs suddenly become worthless • Banks don’t know how much money they have ...

... • Combined return can be high • But what happens if the high risk mortgages go bad? • No one wants to buy them—so their “real” value is uncertain • If there is no market, there is no price • As assets, CDOs suddenly become worthless • Banks don’t know how much money they have ...

FINAL The Sword of Damocles FOR ADOBE

... As you may recall, our instinctive reaction to the events of the market last year was to intensify our efforts begun three years earlier, emphasizing investment in companies with excellent managements, growing markets, and good business models able to self-finance reasonable growth. We declined to i ...

... As you may recall, our instinctive reaction to the events of the market last year was to intensify our efforts begun three years earlier, emphasizing investment in companies with excellent managements, growing markets, and good business models able to self-finance reasonable growth. We declined to i ...

Risk Based Capital for Mortgage Securitization Firms

... regulatory, standards infrastructure, but also more limited ALM capacities (and more capital needed). ...

... regulatory, standards infrastructure, but also more limited ALM capacities (and more capital needed). ...

Heikki Vitie

... Finnish Cooperative Movement Conference: The Competitiveness of Cooperatives in Changing Business ...

... Finnish Cooperative Movement Conference: The Competitiveness of Cooperatives in Changing Business ...

national securities

... Efforts to restrict costs were not particularly successful, given that personnel and administrative expenses increased by 5.8%, while provision and depreciation charges went up by 9.9% and 19.6% respectively. These expenses vindicate management efforts to restructure and improve both IT and human re ...

... Efforts to restrict costs were not particularly successful, given that personnel and administrative expenses increased by 5.8%, while provision and depreciation charges went up by 9.9% and 19.6% respectively. These expenses vindicate management efforts to restructure and improve both IT and human re ...

November 15th, 2013

... • Equity vs. Fixed Income = stakeholder in firm vs. lender to firm • Parts of a bond: ...

... • Equity vs. Fixed Income = stakeholder in firm vs. lender to firm • Parts of a bond: ...

Of the Subprime Mess and Securitization

... Auto loans Current account and liabilities Caters to trade needs and cash needs of the customers ...

... Auto loans Current account and liabilities Caters to trade needs and cash needs of the customers ...

[Int`lFinance]FinalPaper_KWAKJeeEun5

... investment banks and mortgage companies. Value crash in the financial market led two hedge funds owned by Bear Stearns who mainly invested in subprime CDOs filed for bankruptcy in July 2007. Many mortgage loan companies filed for bankruptcy and this starting crisis did not stay at sub-prime mortgage ...

... investment banks and mortgage companies. Value crash in the financial market led two hedge funds owned by Bear Stearns who mainly invested in subprime CDOs filed for bankruptcy in July 2007. Many mortgage loan companies filed for bankruptcy and this starting crisis did not stay at sub-prime mortgage ...

This PDF is a selection from a published volume from... Economic Research

... The authors have developed a model to explain why underpricing of risk is not detected by bank shareholders and that its persistence results in compression in the spread between lending and deposit rates, lending booms, inflated asset prices, excess building, and real estate crashes. The model may b ...

... The authors have developed a model to explain why underpricing of risk is not detected by bank shareholders and that its persistence results in compression in the spread between lending and deposit rates, lending booms, inflated asset prices, excess building, and real estate crashes. The model may b ...

financial prudential norms

... b) reporting date – the last day of the reporting period for which the association is submitting a financial statement to the National Commission on Financial Market (hereinafter – National Commission); c) group of members acting together means two or more members who are exposed to the same risk du ...

... b) reporting date – the last day of the reporting period for which the association is submitting a financial statement to the National Commission on Financial Market (hereinafter – National Commission); c) group of members acting together means two or more members who are exposed to the same risk du ...

![[Int`lFinance]FinalPaper_KWAKJeeEun5](http://s1.studyres.com/store/data/020902525_1-8b3bd67b6fcbe05022cd6ab5ab1a1f0a-300x300.png)