Quarterly Newsletter - December 2001 : Pinney and Scofield : http

... been imagined before the attacks, and the worst very much worse. The inevitable consequence is that the stock market has been and will continue to be volatile. The immediate aftermath of the attacks was a sharp market sell-off. Share volume set an all-time record on the day the market reopened after ...

... been imagined before the attacks, and the worst very much worse. The inevitable consequence is that the stock market has been and will continue to be volatile. The immediate aftermath of the attacks was a sharp market sell-off. Share volume set an all-time record on the day the market reopened after ...

US History Standard 6.3

... pursued easy credit policies. By charging low interest rates on its loans to member banks, the Fed helped to fuel the stock market speculation mania. In the late 1920s, the Federal Reserve initiated a tight money strategy in an effort to curb stock market speculation. ...

... pursued easy credit policies. By charging low interest rates on its loans to member banks, the Fed helped to fuel the stock market speculation mania. In the late 1920s, the Federal Reserve initiated a tight money strategy in an effort to curb stock market speculation. ...

BlueBay Asset Management LLP Ireland Corporate Credit Internship

... is in response to the financing gap created by the retrenchment and deleveraging of traditional bank lenders, who have been reducing their corporate loan books (in particular loans to small and mediumsized enterprises) in response to stricter capital and liquidity regulation as well as legacy issues ...

... is in response to the financing gap created by the retrenchment and deleveraging of traditional bank lenders, who have been reducing their corporate loan books (in particular loans to small and mediumsized enterprises) in response to stricter capital and liquidity regulation as well as legacy issues ...

Long-term Investing as asset prices rise

... safety and invest for the long-term The factors that influence whether management of these companies achieve good long term returns are numerous and complicated. While macro-economic and geopolitical factors are an important input, our thinking on such matters is much ...

... safety and invest for the long-term The factors that influence whether management of these companies achieve good long term returns are numerous and complicated. While macro-economic and geopolitical factors are an important input, our thinking on such matters is much ...

new market tax credits - Massachusetts Institute of Technology

... existing organization, the Massachusetts Housing and Investment Corporation (MHIC), the process is greatly simplified. The following explains how this program works behind the scenes, and what it means to our project if we are able to receive tax credit funding through MHIC’s. The new market tax cre ...

... existing organization, the Massachusetts Housing and Investment Corporation (MHIC), the process is greatly simplified. The following explains how this program works behind the scenes, and what it means to our project if we are able to receive tax credit funding through MHIC’s. The new market tax cre ...

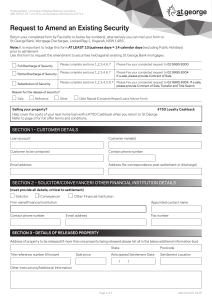

St George

... I/We authorise to release the above security and to: • clear and reduce my/our loan(s) • charge the applicable fees in accordance with my/our loan agreement(s) • discuss this request with the solicitor/conveyancer/other financial institution nominated in Section 2 • cancel all facilities linked ...

... I/We authorise to release the above security and to: • clear and reduce my/our loan(s) • charge the applicable fees in accordance with my/our loan agreement(s) • discuss this request with the solicitor/conveyancer/other financial institution nominated in Section 2 • cancel all facilities linked ...

All You Need to Know about the Credit Crunch

... worsen throughout 2006 and into 2007. Debts often get sold to other financial companies around the world to help create one of their sources of money which can then be invested or lent to people or companies. With little debt being paid off, financial institutions like mortgage providers and banks h ...

... worsen throughout 2006 and into 2007. Debts often get sold to other financial companies around the world to help create one of their sources of money which can then be invested or lent to people or companies. With little debt being paid off, financial institutions like mortgage providers and banks h ...

smarterinsightTM - Donald Wealth Management

... the exit and sell out of equities and hold cash. Every decision to move out of the market is coupled to a decision to get back in again. Evidence shows that investors are very unskilled at making these timing decisions - private and institutional investors alike. Stick with your portfolio strategy. ...

... the exit and sell out of equities and hold cash. Every decision to move out of the market is coupled to a decision to get back in again. Evidence shows that investors are very unskilled at making these timing decisions - private and institutional investors alike. Stick with your portfolio strategy. ...

Investor empowerment - a survival essential

... part to another whenever a transaction takes place. Fresh spending generates new income which generates further spending and additional new income and so on. Spending and income continue to circulate around the macro economy in what is referred to as the circular flow of income. Saving led growth in ...

... part to another whenever a transaction takes place. Fresh spending generates new income which generates further spending and additional new income and so on. Spending and income continue to circulate around the macro economy in what is referred to as the circular flow of income. Saving led growth in ...

Presentation Title

... And this is now…………. FICO is vital, but only part of equation Direct to consumer loans are all but gone While interest rates are low, margins are much higher Associate level & below schools have limited private loan availability Securitization market is weak for student loans; lenders still in the g ...

... And this is now…………. FICO is vital, but only part of equation Direct to consumer loans are all but gone While interest rates are low, margins are much higher Associate level & below schools have limited private loan availability Securitization market is weak for student loans; lenders still in the g ...

Chapter 2 Practice Problems MULTIPLE CHOICE. Choose the one

... B) higher expected future stock prices. C) of a lowered expected dividend growth rate. D) of a lowered required return on investment in equity. ...

... B) higher expected future stock prices. C) of a lowered expected dividend growth rate. D) of a lowered required return on investment in equity. ...

Measures of Total Debt Financing for Developing Countries

... Fee income transactions, not transactions requiring assets to be held for long periods Mergers & acquisitions and equity business, rather than traditional debt products ...

... Fee income transactions, not transactions requiring assets to be held for long periods Mergers & acquisitions and equity business, rather than traditional debt products ...

Agricultural finance for smallholder farmers

... 1 percentage point change of interest rate 0.79 US $ income change ...

... 1 percentage point change of interest rate 0.79 US $ income change ...

Treasury Management Strategy

... cash balances, it is considered more cost effective not to have an approved overdraft facility than to incur fees to keep a facility available. ...

... cash balances, it is considered more cost effective not to have an approved overdraft facility than to incur fees to keep a facility available. ...

Analysts foresee boost in market activities this week

... Analysts foresee boost in market activities this week Capital market analysts have said that the increase recorded in major market indicators of the Nigerian Stock Exchange towards the end of last week will be sustained this week. The analysts said specifically that the increased momentum in the ind ...

... Analysts foresee boost in market activities this week Capital market analysts have said that the increase recorded in major market indicators of the Nigerian Stock Exchange towards the end of last week will be sustained this week. The analysts said specifically that the increased momentum in the ind ...

The Current Financial Environment 1 The Current Financial

... Commercial banks and other depository institutions absorb interest rates from the regional Federal Reserve Bank lending facility. Otherwise known as the discount rate and the discount window. The three discount window programs offered by Federal Reserve banks to depository institutions include prima ...

... Commercial banks and other depository institutions absorb interest rates from the regional Federal Reserve Bank lending facility. Otherwise known as the discount rate and the discount window. The three discount window programs offered by Federal Reserve banks to depository institutions include prima ...

Subject: Economics with Financial Literacy

... credit score-and provide them to lenders. An applicant’s credit score can also be used by prospective employers, landlords, insurance companies, ...

... credit score-and provide them to lenders. An applicant’s credit score can also be used by prospective employers, landlords, insurance companies, ...

The market environment for 2015

... being very positive for the region. Although the environment looks strong for equities to have another good year, there are some headwinds that the global economy will have to face over the coming years – one of which is the eventual increase in the short-term interest rates known as the Federal Fun ...

... being very positive for the region. Although the environment looks strong for equities to have another good year, there are some headwinds that the global economy will have to face over the coming years – one of which is the eventual increase in the short-term interest rates known as the Federal Fun ...

SMALL BUSINESS ADMINISTRATION CHECK LIST OF REQUIRED

... (please attach written explanation as to how you expect to achieve same). 6. A list of names and addresses of any subsidiaries and affiliates, including concerns in which the applicant holds a controlling (but not necessarily a majority) interest and other concerns that may be affiliated by stock ow ...

... (please attach written explanation as to how you expect to achieve same). 6. A list of names and addresses of any subsidiaries and affiliates, including concerns in which the applicant holds a controlling (but not necessarily a majority) interest and other concerns that may be affiliated by stock ow ...

California Real Estate Finance, 10e - PowerPoint

... • Seller will pay off loans from monies received from buyer • Used when – In lieu of installment sales contract – When existing loan cannot be paid off until later date – Buyer wants income tax benefits – Seller has overpriced property – Low down payment – Low interest existing loan – Seller firm on ...

... • Seller will pay off loans from monies received from buyer • Used when – In lieu of installment sales contract – When existing loan cannot be paid off until later date – Buyer wants income tax benefits – Seller has overpriced property – Low down payment – Low interest existing loan – Seller firm on ...

Presentación de PowerPoint

... housing costs than other renters in the same areas • Atlanta: large private equity landlords have higher eviction rates than smaller landlords • US: vulture funds quick to foreclose on distressed mortgages • Dublin: Goldman Sachs threatening 200 households with eviction after purchase of defaulted d ...

... housing costs than other renters in the same areas • Atlanta: large private equity landlords have higher eviction rates than smaller landlords • US: vulture funds quick to foreclose on distressed mortgages • Dublin: Goldman Sachs threatening 200 households with eviction after purchase of defaulted d ...

Financial Market Infrastructures The Asia Pacific Financial Forum

... The Asia Pacific Financial Forum (APFF) Seattle Symposium, 7 July 2014 ...

... The Asia Pacific Financial Forum (APFF) Seattle Symposium, 7 July 2014 ...

Credit crisis

... ** EVCA (most accurate) figures for Europe not yet available. Alternative source used but this may understate the global total *** Cumulative uninvested capital since 2003, capital committed pre-2003 is unlikely to be invested at this point; assumes that 1/3 of capital on the road will close in Q4 ...

... ** EVCA (most accurate) figures for Europe not yet available. Alternative source used but this may understate the global total *** Cumulative uninvested capital since 2003, capital committed pre-2003 is unlikely to be invested at this point; assumes that 1/3 of capital on the road will close in Q4 ...

Topic: reference currency basket of the renminbi

... the market and may take a relatively longer-term view in their investments are unlikely to benefit from such volatility. Chances are they will be made worse off, particularly if they are highly leveraged. ...

... the market and may take a relatively longer-term view in their investments are unlikely to benefit from such volatility. Chances are they will be made worse off, particularly if they are highly leveraged. ...