Mortgage Lending Discrimination - Fair Housing Center of West

... people with credit problems even though she told the loan officer she had a credit score that was higher than average. The White tester was not referred to a program for people with credit problems ...

... people with credit problems even though she told the loan officer she had a credit score that was higher than average. The White tester was not referred to a program for people with credit problems ...

The World Bank Group

... advising governments on attracting investment, sharing information through on-line investment information services, and mediating disputes between investors and governments. ...

... advising governments on attracting investment, sharing information through on-line investment information services, and mediating disputes between investors and governments. ...

“The Impact of Financial Institutions and Financial ‘Liquidity Lock’ ”

... commercial paper issuance responded to this shift, and the vast majority of new paper has been issued for maturities of just one to four days. These developments have unfortunate implications for the functioning of our capital markets. First, the “flight to Treasuries” has, of course, increased dema ...

... commercial paper issuance responded to this shift, and the vast majority of new paper has been issued for maturities of just one to four days. These developments have unfortunate implications for the functioning of our capital markets. First, the “flight to Treasuries” has, of course, increased dema ...

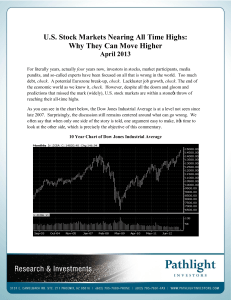

U.S. Stock Markets Nearing All Time Highs: Why They Can Move

... focus on risk management—that will never change. In fact, there is still plenty to worry about. However, in our opinion, this widely telegraph correction or market sell-off that many are waiting for is not preordained, no matter who is predicting it. In an improving environment that people don’t see ...

... focus on risk management—that will never change. In fact, there is still plenty to worry about. However, in our opinion, this widely telegraph correction or market sell-off that many are waiting for is not preordained, no matter who is predicting it. In an improving environment that people don’t see ...

Ride The Seller220512

... completely cleared. Unfortunately, as the RBA left rates on hold and the banks kept creeping their interest rates higher and higher, consumer confidence took another battering. The run-on in activity was not sustained and by March, last year’s gloom had all but taken back over. That was until early ...

... completely cleared. Unfortunately, as the RBA left rates on hold and the banks kept creeping their interest rates higher and higher, consumer confidence took another battering. The run-on in activity was not sustained and by March, last year’s gloom had all but taken back over. That was until early ...

Understanding Debt - UConn Financial Aid

... Account balance is $100. You make a purchase for $10, now your account then has $90 remaining ...

... Account balance is $100. You make a purchase for $10, now your account then has $90 remaining ...

Understanding Debt - UConn Financial Aid

... Account balance is $100. You make a purchase for $10, now your account then has $90 remaining ...

... Account balance is $100. You make a purchase for $10, now your account then has $90 remaining ...

Quarterly commentary - Principal Global Investors

... Global Investors. Principal Global Investors disclaims any and all express or implied warranties of reliability or accuracy arising out of any for error or omission attributable to any third party representation, example, or data provided herein. All figures shown in this document are in U.S. dollar ...

... Global Investors. Principal Global Investors disclaims any and all express or implied warranties of reliability or accuracy arising out of any for error or omission attributable to any third party representation, example, or data provided herein. All figures shown in this document are in U.S. dollar ...

Partner with a Leading Finance Company Ascentium Capital LLC

... Soft Costs: Soft costs such as sales tax, shipping, installation, training and software generally are not financed by a bank. Leasing may cover 100% financing so you avoid substantial out of pocket costs. Down Payment: Banks typically require 20% - 30% down on equipment financing due to concerns abo ...

... Soft Costs: Soft costs such as sales tax, shipping, installation, training and software generally are not financed by a bank. Leasing may cover 100% financing so you avoid substantial out of pocket costs. Down Payment: Banks typically require 20% - 30% down on equipment financing due to concerns abo ...

Summary Results 3Q 2011

... although the aggregate leverage ratio declined to 7.31% compared to 7.46% at 3Q10. The change is primarily the result of adjustments relating to conversion to the new International Financial Reporting Standards (IFRS) which became effective January 1, 2011 and in particular the accounting treatment ...

... although the aggregate leverage ratio declined to 7.31% compared to 7.46% at 3Q10. The change is primarily the result of adjustments relating to conversion to the new International Financial Reporting Standards (IFRS) which became effective January 1, 2011 and in particular the accounting treatment ...

DAMON-SILVERS - Americans for Financial Reform

... What Dodd-Frank Did • Dodd-Frank restored the principle that financial instruments and financial institutions should be regulated for what they are, not what lawyers call them– so derivatives regulated now like their underlying assets. • Dodd-Frank gave regulators some power over previously unregul ...

... What Dodd-Frank Did • Dodd-Frank restored the principle that financial instruments and financial institutions should be regulated for what they are, not what lawyers call them– so derivatives regulated now like their underlying assets. • Dodd-Frank gave regulators some power over previously unregul ...

Chapter 3 Interbank Lending Interbank lending forms a critical

... ranging from overnight to a few months. These interbank loans are the marginal source of funds for many banks. Even for banks that are mostly funded by deposits, interbank loans may be a critical source of additional funds. ...

... ranging from overnight to a few months. These interbank loans are the marginal source of funds for many banks. Even for banks that are mostly funded by deposits, interbank loans may be a critical source of additional funds. ...

Cost of borrowing and credit risk management

... in the lending markets rated debt of other entities that give a higher yield for a lower capital usage. The concept of the internal ratings model (IRM) was introduced by bank regulatory bodies to reduce the regulatory capital-induced distortions in the lending markets. This suggests that bank regula ...

... in the lending markets rated debt of other entities that give a higher yield for a lower capital usage. The concept of the internal ratings model (IRM) was introduced by bank regulatory bodies to reduce the regulatory capital-induced distortions in the lending markets. This suggests that bank regula ...

Global Asset Class: Cash and Fixed Interest

... Current Pricing - Sovereign Bonds still Appear Expensive Disaggregating the US 10 Year Bond Yield ...

... Current Pricing - Sovereign Bonds still Appear Expensive Disaggregating the US 10 Year Bond Yield ...

bank loans and private placements

... Generally no CUSIP number Not subject to some of the laws/requirements designed to protect investors U.S. Supreme Court Case Reves vs. Ernst & Young, Inc., 494 U.S. 56 (1990) ...

... Generally no CUSIP number Not subject to some of the laws/requirements designed to protect investors U.S. Supreme Court Case Reves vs. Ernst & Young, Inc., 494 U.S. 56 (1990) ...

Banking Services

... Interest = price paid to use borrowed money Principal = initial amount of borrowed money Simple interest is only applied on the ...

... Interest = price paid to use borrowed money Principal = initial amount of borrowed money Simple interest is only applied on the ...

Slide 1

... banking sector it subsidizes and the banking sector (the old investment banks) that compete in the mergers and acquisition markets. 3. Large firms are not allowed to fail- moral hazard is alive and well 4. Orderly markets (transparent, defined, enforceable property rights) are not required for all f ...

... banking sector it subsidizes and the banking sector (the old investment banks) that compete in the mergers and acquisition markets. 3. Large firms are not allowed to fail- moral hazard is alive and well 4. Orderly markets (transparent, defined, enforceable property rights) are not required for all f ...

15-2

... • Important advisory services in the area of mergers, leveraged buyouts and corporate restructuring are also offered. ...

... • Important advisory services in the area of mergers, leveraged buyouts and corporate restructuring are also offered. ...

English

... payments due (loans for principal and interest). Company C Group appropriated the loans from Credit Cooperative A as funds for repayments on other loans. According to Article 6(1) of the then Act on Financing Business by Cooperative Associations, and Article 13 of the Banking Act applied mutatis mut ...

... payments due (loans for principal and interest). Company C Group appropriated the loans from Credit Cooperative A as funds for repayments on other loans. According to Article 6(1) of the then Act on Financing Business by Cooperative Associations, and Article 13 of the Banking Act applied mutatis mut ...

Management Challenge an exploration of business

... • your objective, while competing against the other teams, is to operate your business in an efficient way ...

... • your objective, while competing against the other teams, is to operate your business in an efficient way ...

Investor Presentation May 2014

... • Community banks (e.g., Titan Bank and Congressional Bank) have begun purchasing loans through the Lending Club platform and Titan Bank started to offer personal loans to their customers through Lending Club. ...

... • Community banks (e.g., Titan Bank and Congressional Bank) have begun purchasing loans through the Lending Club platform and Titan Bank started to offer personal loans to their customers through Lending Club. ...

China’s Troubled Stock Markets* C.P. Chandrasekhar and Jayati Ghosh

... growing economy relaxed, China became the new frontier for international finance. IPOs by Bank of China and Industrial and Commercial Bank of China (ICBC), two of the country’s four big banks were a roaring success, mobilizing more capital than expected and evincing huge investor interest. This poin ...

... growing economy relaxed, China became the new frontier for international finance. IPOs by Bank of China and Industrial and Commercial Bank of China (ICBC), two of the country’s four big banks were a roaring success, mobilizing more capital than expected and evincing huge investor interest. This poin ...

Bank Loans vs. Global High Yield

... All information obtained from sources believed to be accurate and reliable. In rendering portfolio management services, Brandywine Global Investment Management, LLC may use the portfolio management services, research and other resources of Brandywine Global Investment (Europe) Limited, an affiliate. ...

... All information obtained from sources believed to be accurate and reliable. In rendering portfolio management services, Brandywine Global Investment Management, LLC may use the portfolio management services, research and other resources of Brandywine Global Investment (Europe) Limited, an affiliate. ...

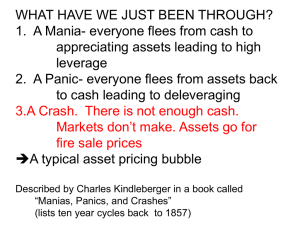

Troubled Times: How We Got There and What Lies Ahead

... Credit default swaps (CDS’s)—some firms sell “insurance” that a bond will not default—if it does, they’ll trade it for a good bond or cash. AND you can buy a CDS even if you don’t own the bond... so some bonds have 10x (or more) volume of CDS’s issued against them. AIG had over $1 trillion in CDS po ...

... Credit default swaps (CDS’s)—some firms sell “insurance” that a bond will not default—if it does, they’ll trade it for a good bond or cash. AND you can buy a CDS even if you don’t own the bond... so some bonds have 10x (or more) volume of CDS’s issued against them. AIG had over $1 trillion in CDS po ...