A CASE White Paper

... A community bank’s revenue can be broken down into two major components, interest income and non interest income. The first is interest income, which is revenue produced from extending loans to borrowers and investing in other earning assets, such as securities. Net interest income is the dollar dif ...

... A community bank’s revenue can be broken down into two major components, interest income and non interest income. The first is interest income, which is revenue produced from extending loans to borrowers and investing in other earning assets, such as securities. Net interest income is the dollar dif ...

EMW09_Vincent

... services to NGO’s and multi-national corporations doing business in the more difficult emerging markets for more than 25 years. ...

... services to NGO’s and multi-national corporations doing business in the more difficult emerging markets for more than 25 years. ...

Spanish mortgage finance

... • Multi-seller Cedulas were hit by Caja crisis, major incentive problems with individual issuers, • Jumbo market closed between June 2011 and September 2012, • Outside a few private banks, no pricing advantage of covered bonds over senior unsecured (chart), • Massive O/C (currently 100% and higher) ...

... • Multi-seller Cedulas were hit by Caja crisis, major incentive problems with individual issuers, • Jumbo market closed between June 2011 and September 2012, • Outside a few private banks, no pricing advantage of covered bonds over senior unsecured (chart), • Massive O/C (currently 100% and higher) ...

Krajowe Stowarzyszenie Funduszy Poręczeniowych

... meaning of the Community guidelines on State aid for rescuing and restructuring firms (firms in difficulty) excludes the possibility of sponsoring. 3) The funds provide guarantees for companies classified in the category of investment. The adoption of the so-called safe rates according to the Commis ...

... meaning of the Community guidelines on State aid for rescuing and restructuring firms (firms in difficulty) excludes the possibility of sponsoring. 3) The funds provide guarantees for companies classified in the category of investment. The adoption of the so-called safe rates according to the Commis ...

The Role and functions of a stock exchange

... Short-term debt instruments, usually unsecured, issued by corporations. Involve credit risk because the financial health of a corporation can deteriorate and jeopardize the repayment of the amount borrowed. – Sold at a discount from their face value – Maturities less than a year Because of the credi ...

... Short-term debt instruments, usually unsecured, issued by corporations. Involve credit risk because the financial health of a corporation can deteriorate and jeopardize the repayment of the amount borrowed. – Sold at a discount from their face value – Maturities less than a year Because of the credi ...

Moderate Rehabilitation (Mod Rehab) Supplemental

... Moderate Rehabilitation (Mod Rehab) Supplemental Mortgage Loan Fannie Mae Multifamily offers subordinate financing options for multifamily properties that have completed moderate rehabilitation. ...

... Moderate Rehabilitation (Mod Rehab) Supplemental Mortgage Loan Fannie Mae Multifamily offers subordinate financing options for multifamily properties that have completed moderate rehabilitation. ...

Capital Market Development

... Bank Assets / GNP = 85% in the Phil. Equity / GNP = 69% in the Phil. Bonds Outstanding / GNP = 88% in EuroLand Bonds Outstanding / GNP = 151% in the U.S. ...

... Bank Assets / GNP = 85% in the Phil. Equity / GNP = 69% in the Phil. Bonds Outstanding / GNP = 88% in EuroLand Bonds Outstanding / GNP = 151% in the U.S. ...

UK consumer credit

... (b) The maximum 0% balance transfer term available across all lenders. (c) The average 0% balance transfer term is the average of the maximum 0% balance transfer term available for each lender. ...

... (b) The maximum 0% balance transfer term available across all lenders. (c) The average 0% balance transfer term is the average of the maximum 0% balance transfer term available for each lender. ...

Unauthorised - ACT Legislation Register

... The credit facility is for a purpose consistent with the functions of LDA. LDA has advised the level of debt in its estimates for 2008-09 and beyond is driven by the following key items: ...

... The credit facility is for a purpose consistent with the functions of LDA. LDA has advised the level of debt in its estimates for 2008-09 and beyond is driven by the following key items: ...

October 2011 - Roof Advisory Group

... asset classes currently offer less-than-attractive alternatives. Short-term fixed income rates are at historic lows, providing little to no return. Mid-maturity bond rates have likewise dropped and the present modest yields of long-term bonds are insufficiently enticing for most investors to lock up ...

... asset classes currently offer less-than-attractive alternatives. Short-term fixed income rates are at historic lows, providing little to no return. Mid-maturity bond rates have likewise dropped and the present modest yields of long-term bonds are insufficiently enticing for most investors to lock up ...

November 2007 Testimony to Joint Economic Committee of Congress

... market for nonconforming mortgages remained significantly impaired, and survey information suggested that banks had tightened terms and standards for a range of credit products over recent months. In part because of the reduced availability of mortgage credit, the contraction in housing-related acti ...

... market for nonconforming mortgages remained significantly impaired, and survey information suggested that banks had tightened terms and standards for a range of credit products over recent months. In part because of the reduced availability of mortgage credit, the contraction in housing-related acti ...

local investment fund eligibility

... development, to stimulate entrepreneurship, to create and retain jobs in Laval, through funding for startup or expanding companies. ...

... development, to stimulate entrepreneurship, to create and retain jobs in Laval, through funding for startup or expanding companies. ...

Market Climate and Weather Forecast

... 1. They look at objective indicators. Removing the emotions from the investing process, they focus on data instead of reacting to events; ...

... 1. They look at objective indicators. Removing the emotions from the investing process, they focus on data instead of reacting to events; ...

Banking - mshsLyndaHampton

... With your authorization, or permission, your bank will withdraw the amount of your monthly payment or bill from your bank account. It is very important when using Automatic payments that you have enough money in your account for the payment. Arrange payments with when you receive your paycheck. Chec ...

... With your authorization, or permission, your bank will withdraw the amount of your monthly payment or bill from your bank account. It is very important when using Automatic payments that you have enough money in your account for the payment. Arrange payments with when you receive your paycheck. Chec ...

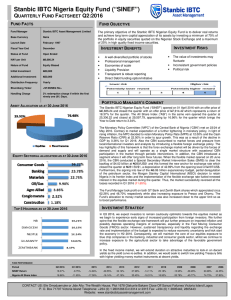

Nigerian Equity Fund - Stanbic IBTC Asset Management

... N6,686.24 and closed the quarter with an offer price of N7,914.42 which represents a return of 18.37% for the quarter. The All Share Index (“ASI”) in the same vein opened the quarter at 25,306.22 and closed at 29,597.79, appreciating by 16.96% for the quarter which brings the Year to Date return to ...

... N6,686.24 and closed the quarter with an offer price of N7,914.42 which represents a return of 18.37% for the quarter. The All Share Index (“ASI”) in the same vein opened the quarter at 25,306.22 and closed at 29,597.79, appreciating by 16.96% for the quarter which brings the Year to Date return to ...

EM Corporate Bonds – Cheap Again

... With lots of negative news and deteriorating sentiment around emerging markets related to the financial implications of lower commodity prices, currency devaluations and slower economic growth, might there be any value in those markets? We have repeatedly argued that poor liquidity has exaggerated p ...

... With lots of negative news and deteriorating sentiment around emerging markets related to the financial implications of lower commodity prices, currency devaluations and slower economic growth, might there be any value in those markets? We have repeatedly argued that poor liquidity has exaggerated p ...

DESIGN-AND-IMPLEMENTATION-OF-A

... shareholders. They are after the minimization of financial risks. Such strategies don’t leave much room for people on low income or even small organizations that strive for their survival. This research studied the loan disbursement control system used in Bank PHB Enugu. Loans are readily given to p ...

... shareholders. They are after the minimization of financial risks. Such strategies don’t leave much room for people on low income or even small organizations that strive for their survival. This research studied the loan disbursement control system used in Bank PHB Enugu. Loans are readily given to p ...

EY widescreen presentation

... grown its AUM base at the rate of 20% CAGR since FY03 ►Competitive landscape dominated by large players - The market share of the top 10 players amounted to 79.5% in March 2016, while the top 5 players held a 55.6% market share ►Increased retail participation - The industry has been successful in im ...

... grown its AUM base at the rate of 20% CAGR since FY03 ►Competitive landscape dominated by large players - The market share of the top 10 players amounted to 79.5% in March 2016, while the top 5 players held a 55.6% market share ►Increased retail participation - The industry has been successful in im ...

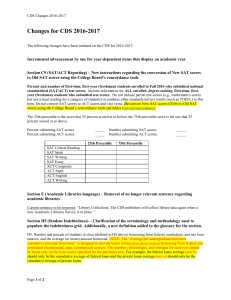

Changes for CDS 2016-2017 - Common Data Set Initiative

... standardized (SAT/ACT) test scores. Include information for ALL enrolled, degree-seeking, first-time, firstyear (freshman) students who submitted test scores. Do not include partial test scores (e.g., mathematics scores but not critical reading for a category of students) or combine other standardiz ...

... standardized (SAT/ACT) test scores. Include information for ALL enrolled, degree-seeking, first-time, firstyear (freshman) students who submitted test scores. Do not include partial test scores (e.g., mathematics scores but not critical reading for a category of students) or combine other standardiz ...

Capital and Money Market

... • However, these banks are not only lenders of money, but they also create credit. The Central Bank’s role is therefore important as controller of credit. ...

... • However, these banks are not only lenders of money, but they also create credit. The Central Bank’s role is therefore important as controller of credit. ...

Financing Infrastructure Through Capital Market

... Started in 1996 with $10 m Peaked in 2004 at of $1000 m Portfolio Started in response to government appeal to private sector Structured as intermediary between infrastructure providers and capital markets Listed and rated bonds on market Created two subsidiaries:non profit capacity building fund and ...

... Started in 1996 with $10 m Peaked in 2004 at of $1000 m Portfolio Started in response to government appeal to private sector Structured as intermediary between infrastructure providers and capital markets Listed and rated bonds on market Created two subsidiaries:non profit capacity building fund and ...

Fairbanks Coop One Page

... Co-op Market Grocery & Deli is the first ranchers, fishers, and producers in the region community-owned food coop in Alaska, to sell to their own community. For example, located just a half hour drive from the Arctic the Co-op offers local Northern Lights Dairy Circle. The 6,000 square-foot store op ...

... Co-op Market Grocery & Deli is the first ranchers, fishers, and producers in the region community-owned food coop in Alaska, to sell to their own community. For example, located just a half hour drive from the Arctic the Co-op offers local Northern Lights Dairy Circle. The 6,000 square-foot store op ...

What Agencies Can Expect Accessing Bank Capital in

... the look of both a line and a term loan whereby a line is advanced to cover the costs of the new producer during their ramp-up period. At the end of 12 to 18 months, the line balance is converted to a term loan to be repaid over three years. All bank loans will have covenants, which are promises mad ...

... the look of both a line and a term loan whereby a line is advanced to cover the costs of the new producer during their ramp-up period. At the end of 12 to 18 months, the line balance is converted to a term loan to be repaid over three years. All bank loans will have covenants, which are promises mad ...