Asia Deadwood Equity

... contributed far more than money. Financial advice Strategic guidance Management recruitment ...

... contributed far more than money. Financial advice Strategic guidance Management recruitment ...

Why Has Inequality Increased in China?

... – so borrowers have to scale back activities that depended on these loans – thus will have harder time repaying loans from other banks ...

... – so borrowers have to scale back activities that depended on these loans – thus will have harder time repaying loans from other banks ...

Federal Direct PLUS Loans The Direct Parent PLUS Loan is a

... out a loan in their name for their students. You can learn more about how to apply for a PLUS Loan at Student Financial Services. • Direct PLUS loans are credit-based loan in the parent's name on behalf of their student. ONLY parents of dependent undergraduate students may apply. •Parent's are credi ...

... out a loan in their name for their students. You can learn more about how to apply for a PLUS Loan at Student Financial Services. • Direct PLUS loans are credit-based loan in the parent's name on behalf of their student. ONLY parents of dependent undergraduate students may apply. •Parent's are credi ...

Past performance does not guarantee future results.

... An investor should consider the Funds’ investment objectives, risks, and charges and expenses carefully before investing or sending money. This and other important information can be found in the Funds’ prospectus. To obtain a prospectus, please call 800-432-7856 or visit heartlandadvisors.com. Plea ...

... An investor should consider the Funds’ investment objectives, risks, and charges and expenses carefully before investing or sending money. This and other important information can be found in the Funds’ prospectus. To obtain a prospectus, please call 800-432-7856 or visit heartlandadvisors.com. Plea ...

Bonds Payable * A corporate debt

... If market rate > stated rate, issue at a discount If market rate < stated rate, issue at a premium ...

... If market rate > stated rate, issue at a discount If market rate < stated rate, issue at a premium ...

Olivia de Posson joins DWC LLP as Head of Marketing

... We are pleased to announce the arrival of Olivia de Posson as Head of Marketing at Digital World Capital. Prior to DWC, Olivia led Sales and Marketing at Acheron Capital, an Alternative Asset Manager with a focus on Private Debt. Previously, she setup a Financial Executive Search business and lectur ...

... We are pleased to announce the arrival of Olivia de Posson as Head of Marketing at Digital World Capital. Prior to DWC, Olivia led Sales and Marketing at Acheron Capital, an Alternative Asset Manager with a focus on Private Debt. Previously, she setup a Financial Executive Search business and lectur ...

The Burgeoning Crisis of Student Loans: What to Do and Where to Go!

... Federation of America (CFA) released a recent study finding that millions of people had not made a payment on the more than $137 billion in federal student loans for at least nine months, a 14 percent increase in defaults from a year earlier. According to the CFA report, the average amount owed per ...

... Federation of America (CFA) released a recent study finding that millions of people had not made a payment on the more than $137 billion in federal student loans for at least nine months, a 14 percent increase in defaults from a year earlier. According to the CFA report, the average amount owed per ...

Higher rates after Trump win mean good things for bank loan yields

... rates like the three-month LIBOR, which hit new 52-week highs early in the third quarter ahead of money market reforms in mid-October. Both moves should alleviate pressure on banks’ security and loan portfolios, particularly with the yield curve steepening. The spread between the 2-year and 10-year ...

... rates like the three-month LIBOR, which hit new 52-week highs early in the third quarter ahead of money market reforms in mid-October. Both moves should alleviate pressure on banks’ security and loan portfolios, particularly with the yield curve steepening. The spread between the 2-year and 10-year ...

Answers to Chapter 24 Questions

... short-term loans. The accessibility of commercial paper by more and more corporations has reduced the volume of these short-term loans for loan sales purposes. 3. Commercial paper issuers are generally blue chip corporations that have the best credit ratings. Banks may sell the loans of less creditw ...

... short-term loans. The accessibility of commercial paper by more and more corporations has reduced the volume of these short-term loans for loan sales purposes. 3. Commercial paper issuers are generally blue chip corporations that have the best credit ratings. Banks may sell the loans of less creditw ...

neophotonics corporation

... NeoPhotonics Corporation (the “ Company ”), entered into certain loan agreements and related special agreements (collectively, the “ Loan Documents ”) with The Bank of Tokyo-Mitsubishi UFJ, Ltd. (the “ Bank ”) that provided for (i) a term loan in the aggregate principal amount of 500 million Japanes ...

... NeoPhotonics Corporation (the “ Company ”), entered into certain loan agreements and related special agreements (collectively, the “ Loan Documents ”) with The Bank of Tokyo-Mitsubishi UFJ, Ltd. (the “ Bank ”) that provided for (i) a term loan in the aggregate principal amount of 500 million Japanes ...

Negotiating Better Bank Loans

... the judgment is granted. This procedure has been ruled unconstitutional (as a denial of the right to due process) in most states, and severely limited in those states where it is still allowed, such as Pennsylvania. However, for a confession of judgment to be used by the lender, the borrower must gr ...

... the judgment is granted. This procedure has been ruled unconstitutional (as a denial of the right to due process) in most states, and severely limited in those states where it is still allowed, such as Pennsylvania. However, for a confession of judgment to be used by the lender, the borrower must gr ...

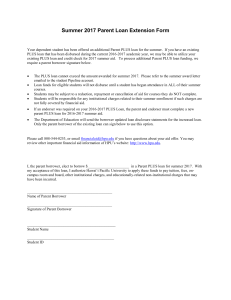

Summer Parent PLUS Loan Extension Form

... Students may be subject to a reduction, repayment or cancellation of aid for courses they do NOT complete. Students will be responsible for any institutional charges related to their summer enrollment if such charges are not fully covered by financial aid. ...

... Students may be subject to a reduction, repayment or cancellation of aid for courses they do NOT complete. Students will be responsible for any institutional charges related to their summer enrollment if such charges are not fully covered by financial aid. ...

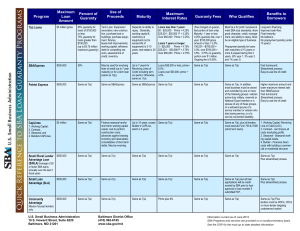

Program Maximum Loan Amount Percent of Guaranty Use of

... For-profit businesses that do not exceed $15 million in tangible net worth, and do not have an average two full fiscal year net income over $5 million. ...

... For-profit businesses that do not exceed $15 million in tangible net worth, and do not have an average two full fiscal year net income over $5 million. ...

CONDUCT, PERFORMANCE AND DISCIPLINARY PROCEDURE

... Lawyer (NQ – 4 years PQE) Role specific information: As part of a supportive, well established and high-performing team, to advise mainly borrowers, and occasionally lenders, on their debt financing arrangements including accessing the debt capital markets, secured funding, refinancing, banking cont ...

... Lawyer (NQ – 4 years PQE) Role specific information: As part of a supportive, well established and high-performing team, to advise mainly borrowers, and occasionally lenders, on their debt financing arrangements including accessing the debt capital markets, secured funding, refinancing, banking cont ...

Comparing Direct PLUS and Private Loans

... Borrow up to the cost of attendance minus any other financial aid you are awarded. ...

... Borrow up to the cost of attendance minus any other financial aid you are awarded. ...

Buying a home

... Where do we go from here? • Federal government’s role in the secondary market • Reduced federal support, but maintain federal presence ...

... Where do we go from here? • Federal government’s role in the secondary market • Reduced federal support, but maintain federal presence ...

After two slow years, mortgage refinancing market

... president & CEO of Home Financing Center, but now its starting to pick up again. What Im hearing is that people who were unemployed are now employed and qualifying again. She said borrowers who have been thinking about refinancing should do it now, because theres only a small window when rates ...

... president & CEO of Home Financing Center, but now its starting to pick up again. What Im hearing is that people who were unemployed are now employed and qualifying again. She said borrowers who have been thinking about refinancing should do it now, because theres only a small window when rates ...

It Was the Best of Times, It Was the Worst of Times…

... very attractive versus FHLB. However, two issues generally on this subject that I am going to cut to the chase on this one. cause banks to reconsider the use of swaps; namely, FAS133 If you want to continue paying up for time deposits, how can and, more recently, counterparty risk! you make up the d ...

... very attractive versus FHLB. However, two issues generally on this subject that I am going to cut to the chase on this one. cause banks to reconsider the use of swaps; namely, FAS133 If you want to continue paying up for time deposits, how can and, more recently, counterparty risk! you make up the d ...

Understanding the Bond Market

... “boring” in the general public and with some novice investors, debt instruments are anything but. When you understand them in more depth, you will gain new insights into many news stories from recent years, such as the subprimes market, the Eurozone financial crisis, the credit crunch, quantitative ...

... “boring” in the general public and with some novice investors, debt instruments are anything but. When you understand them in more depth, you will gain new insights into many news stories from recent years, such as the subprimes market, the Eurozone financial crisis, the credit crunch, quantitative ...

Economic Turmoil and Private Student Loans What it Means to Your Students

... What is an Alternative (or Private) Loan? • Private loans are those that exist outside the federal student loan system and are not guaranteed by the federal government. • Private loans may be provided by banks, non-profit agencies, or other financial institutions. • Private Loans for education were ...

... What is an Alternative (or Private) Loan? • Private loans are those that exist outside the federal student loan system and are not guaranteed by the federal government. • Private loans may be provided by banks, non-profit agencies, or other financial institutions. • Private Loans for education were ...

Amendment

... Start Ups and small businesses are responsible for a large percentage of new jobs. Federal Regulations and other factors have made it harder for Banks to make loans to small, start up businesses Start up presence in the economy is down 50% over the last 40 years There are market failures or gaps whi ...

... Start Ups and small businesses are responsible for a large percentage of new jobs. Federal Regulations and other factors have made it harder for Banks to make loans to small, start up businesses Start up presence in the economy is down 50% over the last 40 years There are market failures or gaps whi ...

Document

... outlays are financed by borrowing (including borrowing financed through credit cards or home equity loans), by selling investments or other assets, or by using savings from previous periods. ...

... outlays are financed by borrowing (including borrowing financed through credit cards or home equity loans), by selling investments or other assets, or by using savings from previous periods. ...

Topics – Student Loan Market – Financial Risk – Enrollment Risk

... Focus 2011 Awarding Strategies ...

... Focus 2011 Awarding Strategies ...

Causes of the Depression

... Margin call issued by broker when price fell. The investor was required to repay the loan immediately. Investors were sensitive to stock prices falling. ...

... Margin call issued by broker when price fell. The investor was required to repay the loan immediately. Investors were sensitive to stock prices falling. ...

What are assets?

... • Borrowers can receive cash quickly from the bank. • Borrowers do not require good credit. • It is good for new companies or companies without good borrowing record which they may not easy to get long-term loan. • However, since there is no credit check, companies can only borrow a relatively small ...

... • Borrowers can receive cash quickly from the bank. • Borrowers do not require good credit. • It is good for new companies or companies without good borrowing record which they may not easy to get long-term loan. • However, since there is no credit check, companies can only borrow a relatively small ...