Grad Finale PPT - Valparaiso University

... Exit Counseling for Other Loans • Perkins Loan: www.myloancounseling.com • Institutional Loans: www.myloancounseling.com • Private Loans: Done through your lender ...

... Exit Counseling for Other Loans • Perkins Loan: www.myloancounseling.com • Institutional Loans: www.myloancounseling.com • Private Loans: Done through your lender ...

Yankee bonds – a British invasion?

... the US in 1998 was in the BBB or A ratthe risks of investing in UK companies accounts. Though US investor demand ing category. are minimal when compared to other drove the size and pricing of these non-US investments. Transparency of deals, European institutional and retail Sell, sell, sell financia ...

... the US in 1998 was in the BBB or A ratthe risks of investing in UK companies accounts. Though US investor demand ing category. are minimal when compared to other drove the size and pricing of these non-US investments. Transparency of deals, European institutional and retail Sell, sell, sell financia ...

Atlas - Atlas - Paying for College

... 9.1.12.C.3 Compute and assess the accumulating effect of interest paid over time when using a variety of sources of credit. Copyright © State of New Jersey, 1996 - 2016. ...

... 9.1.12.C.3 Compute and assess the accumulating effect of interest paid over time when using a variety of sources of credit. Copyright © State of New Jersey, 1996 - 2016. ...

Debt Financing in a Challenging Regulatory and Market Environment

... Secondary market liquidity for CMBS bonds is thinning due to regulations preventing Wall Street from “making markets” for their bonds ...

... Secondary market liquidity for CMBS bonds is thinning due to regulations preventing Wall Street from “making markets” for their bonds ...

BANK OF ISRAEL Office of the Spokesperson and Economic

... banks, and in particularly by the large banks in Israel. This was always the case, but as banks have receded from granting credit to large corporations, they have increased credit to consumers. Indeed during the past decade, retail credit, including mortgages, has grown much faster than any other ty ...

... banks, and in particularly by the large banks in Israel. This was always the case, but as banks have receded from granting credit to large corporations, they have increased credit to consumers. Indeed during the past decade, retail credit, including mortgages, has grown much faster than any other ty ...

20. Transition in Practice

... • decontrolling prices (except energy), free entry into all economic activity, reforming the legal system ...

... • decontrolling prices (except energy), free entry into all economic activity, reforming the legal system ...

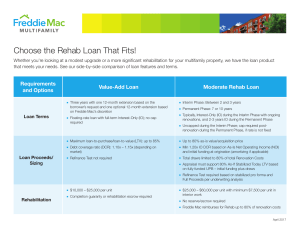

Mod Rehab vs Value-Add Chart

... Choose the Rehab Loan That Fits! Whether you’re looking at a modest upgrade or a more significant rehabilitation for your multifamily property, we have the loan product that meets your needs. See our side-by-side comparison of loan features and terms. ...

... Choose the Rehab Loan That Fits! Whether you’re looking at a modest upgrade or a more significant rehabilitation for your multifamily property, we have the loan product that meets your needs. See our side-by-side comparison of loan features and terms. ...

The Causes of the Great Depression

... were worth more than the value of the corporation selling them. With the cut back of production they began to sell their stocks. “Black Thursday,” Oct. 24, 1929, a record 13 million shares were sold. Market lost over $30 billion. When brokers made their margin calls because the worth of the stock fe ...

... were worth more than the value of the corporation selling them. With the cut back of production they began to sell their stocks. “Black Thursday,” Oct. 24, 1929, a record 13 million shares were sold. Market lost over $30 billion. When brokers made their margin calls because the worth of the stock fe ...

5. International Debt Crisis:a

... new bonds. Many Brady Bonds have their principal and two or three semi-annual interest payments , which roll over, collateralized by 30-year zero-coupon bonds and by high quality assets.Should a Brady bond whose principal is collateralized default, investors can only collect the principal when the b ...

... new bonds. Many Brady Bonds have their principal and two or three semi-annual interest payments , which roll over, collateralized by 30-year zero-coupon bonds and by high quality assets.Should a Brady bond whose principal is collateralized default, investors can only collect the principal when the b ...

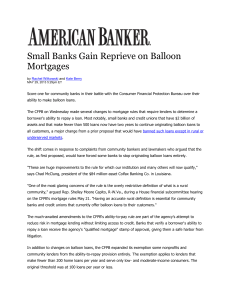

Small Banks Gain Reprieve on Balloon Mortgages

... Under its revised rule, the CFPB also said that compensation paid by a mortgage lender or broker to a loan originator employee does not count toward a 3% cap on points and fees. That cap had been a point of contention for many lenders and was a requirement of the Dodd-Frank Act. The CFPB did not ch ...

... Under its revised rule, the CFPB also said that compensation paid by a mortgage lender or broker to a loan originator employee does not count toward a 3% cap on points and fees. That cap had been a point of contention for many lenders and was a requirement of the Dodd-Frank Act. The CFPB did not ch ...

Banks and Interest

... 3. Cost of Administration of the Loanthis is the costs of executing the loan agreement, monitoring the loan, and collecting payments. The relative cost of administering a loan declines as the size of the loan increases, thus reducing the interest rate for larger loans. ...

... 3. Cost of Administration of the Loanthis is the costs of executing the loan agreement, monitoring the loan, and collecting payments. The relative cost of administering a loan declines as the size of the loan increases, thus reducing the interest rate for larger loans. ...

Newsletter-2007-12 - Patient Capital Management Inc

... It is this huge debt burden that deeply concerns us. Much of the debt that has been accumulated is unsustainable and unsound. As a result, a period of credit contraction and falling asset values will surely follow. It has been our observation that such contractions coupled with a large number of tro ...

... It is this huge debt burden that deeply concerns us. Much of the debt that has been accumulated is unsustainable and unsound. As a result, a period of credit contraction and falling asset values will surely follow. It has been our observation that such contractions coupled with a large number of tro ...

Investors want active management

... "This volatility also presents a strong case for active management to take advantage of price movements," Legg Mason Australia head Annalisa Clark said. Recent market volatility had also affected investors' view of the fixed-income market, with 80 per cent of respondents believing it was time to mov ...

... "This volatility also presents a strong case for active management to take advantage of price movements," Legg Mason Australia head Annalisa Clark said. Recent market volatility had also affected investors' view of the fixed-income market, with 80 per cent of respondents believing it was time to mov ...

Why do Financial Intermediaries Exist?

... (liabilities) Attempt to maintain an equal balance between maturities of assets and liabilities Adjustable rate on loans, mortgages, ...

... (liabilities) Attempt to maintain an equal balance between maturities of assets and liabilities Adjustable rate on loans, mortgages, ...

Chapter 23: Causes of the Great Depression

... automobile was the leading industry chemicals, appliances, radio, aviation, chain stores overproduction in textiles, farming, autos real wages increased only 11% 60% population less than $2000 poverty minimum top 5% earned 33% income - spending by the rich essential Andrew Mellon cut taxes ...

... automobile was the leading industry chemicals, appliances, radio, aviation, chain stores overproduction in textiles, farming, autos real wages increased only 11% 60% population less than $2000 poverty minimum top 5% earned 33% income - spending by the rich essential Andrew Mellon cut taxes ...

construction loans - Mt. McKinley Bank

... We will be happy to discuss your plans and answer any questions you may have regarding financing your construction project. Generally construction loans are for an 18 month period of time and require a 25% down payment or equity in the project before the construction loan is booked. Most owner build ...

... We will be happy to discuss your plans and answer any questions you may have regarding financing your construction project. Generally construction loans are for an 18 month period of time and require a 25% down payment or equity in the project before the construction loan is booked. Most owner build ...

Information regarding Private Student Loans

... person. Some choose a lender based on name recognition. Others prefer the immediate benefit of lower or no origination fees. For some the deciding factor is the long-term advantage of repayment savings programs, like an interest rate reduction as a reward for making payments on time. The interest ra ...

... person. Some choose a lender based on name recognition. Others prefer the immediate benefit of lower or no origination fees. For some the deciding factor is the long-term advantage of repayment savings programs, like an interest rate reduction as a reward for making payments on time. The interest ra ...

(ENG) - CHG

... CHG-MERIDIAN is one of the world's leading non-captive providers of technology management in the fields of IT, telecommunications, industry, and healthcare. CHG-MERIDIAN has a workforce of approximately 800 professionals and offers one-stop management of customers' technology infrastructure. Its pro ...

... CHG-MERIDIAN is one of the world's leading non-captive providers of technology management in the fields of IT, telecommunications, industry, and healthcare. CHG-MERIDIAN has a workforce of approximately 800 professionals and offers one-stop management of customers' technology infrastructure. Its pro ...

CU Capital Market Solutions Workshop

... CU Capital Market Solutions Workshop The Federal Home Loan Bank System has been around since the 1930’s but it was not until 1989 that Credit Unions were able to gain access to the System. Since then, some 1300 Credit Unions have joined and are now using the services to fund their business. At the s ...

... CU Capital Market Solutions Workshop The Federal Home Loan Bank System has been around since the 1930’s but it was not until 1989 that Credit Unions were able to gain access to the System. Since then, some 1300 Credit Unions have joined and are now using the services to fund their business. At the s ...

Business Ethics - FIU College of Business

... ◦ Commercial banks, investment banks, and other financial institutions had less restrictions in what they were allowed to do (i.e. investment, banking activities) ◦ Deregulation had its upsides, but it also allowed greed and fraud to run rampant ...

... ◦ Commercial banks, investment banks, and other financial institutions had less restrictions in what they were allowed to do (i.e. investment, banking activities) ◦ Deregulation had its upsides, but it also allowed greed and fraud to run rampant ...

1 - CGC

... Korea Credit Guarantee Fund Act Article 6 ①The equity fund of KODIT shall be built up with resources falling under the followings: 1.Contributions from the government; 2.Contributions from financial institutions; 3.Contributions from enterprises; ③Financial institutions shall make contributions to K ...

... Korea Credit Guarantee Fund Act Article 6 ①The equity fund of KODIT shall be built up with resources falling under the followings: 1.Contributions from the government; 2.Contributions from financial institutions; 3.Contributions from enterprises; ③Financial institutions shall make contributions to K ...

Banks lend more as economy grows

... for additional eligible borrowing from banks During CY16, corporate lending also increased, due to higher credit demand for larger working capital to finance growing outputs. A number of them went for fixed investment. Senior bankers say that private sector companies, taking advantage of low intere ...

... for additional eligible borrowing from banks During CY16, corporate lending also increased, due to higher credit demand for larger working capital to finance growing outputs. A number of them went for fixed investment. Senior bankers say that private sector companies, taking advantage of low intere ...

Why use a cosigner for your private student loan?

... The information in this material is produced exclusively by Wells Fargo Bank, N.A. and is not endorsed or published on behalf of any higher education institution. Wells Fargo encourages everyone to review the education financing options available to them carefully and make decisions in their own bes ...

... The information in this material is produced exclusively by Wells Fargo Bank, N.A. and is not endorsed or published on behalf of any higher education institution. Wells Fargo encourages everyone to review the education financing options available to them carefully and make decisions in their own bes ...

Teaching students how to manage money can pay off

... executive of Future Finance, a new private student loan lender in the UK, says that he has devised a way to cut defaults and to get borrowers into the repayment habit early: the company requires its customers to pay back small monthly amounts as soon as they take out a loan rather than wait until th ...

... executive of Future Finance, a new private student loan lender in the UK, says that he has devised a way to cut defaults and to get borrowers into the repayment habit early: the company requires its customers to pay back small monthly amounts as soon as they take out a loan rather than wait until th ...