* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download 11:1

Survey

Document related concepts

Transcript

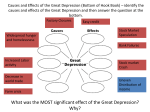

11:1 • Causes of the Great Depression – Election of 1928 – 31st President: Herbert Hoover (1929-1933) 11:1 • Stock Market Soars – “Bull Market” • A long period of rising stock prices – “Margin” • Buying stock with little money down – “Margin Call” • Demand the investor pay back loan immediately 11:1 • Causes of the Great Depression – “Speculation” (cause #1) • Betting the market will decline or rise • Way to make money quickly • People ‘bet’ the market would continue to rise in 1920’s 11:1 • The Stock Market Crash (1929) – Market ran out of new “buyers” (cause #2) • No “new money” to support the Bull Market – Oct 21: “margin call” • Stock Market falls – Oct 24: “Black Thursday” – market falls further – Oct 29: “Black Tuesday” – Mid-November: 30 billion dollars lost 11:1 11:1 • Causes of the Great Depression • Many banks failed after crash – Lent money to speculators – Banks Invested in Stock Market – “Bank Run” (cause #3) • Many depositors decide to withdraw all their money at one time 11:1 • Causes of the Great Depression – Uneven distribution of income Manufacturing output rose 32% • Workers wages only rose 8% – Less disposable income to buy goods 11:1 • Causes of the Great Depression – Loss of Export Sales (Cause #4) • Hawley-Smoot Tariff – Raised tariffs (taxes) on imported goods – Foreign countries do the same – American business unable to sell many goods overseas 11:1 • Causes of the Great Depression – Mistakes by the Federal Reserve • Failed to raise interest rates on loans (Cause #5) – Would have stopped speculation – Encouraged banks to issue risky loans • Low interest rates made economy look healthy • Raised interest rates too late – No access to loans; tight credit