The Origins of the Financial Crisis

... small until the late 1990s. In this fashion, Wall Street investors effectively financed homebuyers on Main Street. Banks, thrifts, and a new industry of mortgage brokers originated the loans but did not keep them, which was the “old” way of financing home ownership. Over the past decade, private se ...

... small until the late 1990s. In this fashion, Wall Street investors effectively financed homebuyers on Main Street. Banks, thrifts, and a new industry of mortgage brokers originated the loans but did not keep them, which was the “old” way of financing home ownership. Over the past decade, private se ...

quiz no 5

... Name\ ------------------------------------------------------- Univ. No.\--------------------Serial No.\ -----------------1. In the market for reserves, when the federal funds rate is above the interest rate paid on excess reserves, the demand curve for reserves is ________. A) vertical B) horizontal ...

... Name\ ------------------------------------------------------- Univ. No.\--------------------Serial No.\ -----------------1. In the market for reserves, when the federal funds rate is above the interest rate paid on excess reserves, the demand curve for reserves is ________. A) vertical B) horizontal ...

rental market conditions - Harvard Joint Center for Housing Studies

... conservator of the GSEs) has signaled its intent to set a ceiling on the amount of multifamily lending that the GSEs can back in 2013. While the caps are fairly high—$30 billion for Fannie Mae and $26 billion for Freddie Mac—FHFA intends to further reduce GSE lending volumes over the next several ye ...

... conservator of the GSEs) has signaled its intent to set a ceiling on the amount of multifamily lending that the GSEs can back in 2013. While the caps are fairly high—$30 billion for Fannie Mae and $26 billion for Freddie Mac—FHFA intends to further reduce GSE lending volumes over the next several ye ...

FCA staff - The Farm Credit Council

... a security under Federal securities law The institution cannot purchase the bond unless it can be and is recorded as an investment under GAAP Bond offering must be independent of any institution that may purchase the bond and must also be offered to accredited investors in the offer’s local area ...

... a security under Federal securities law The institution cannot purchase the bond unless it can be and is recorded as an investment under GAAP Bond offering must be independent of any institution that may purchase the bond and must also be offered to accredited investors in the offer’s local area ...

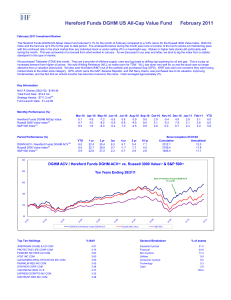

Click to download DGHM ACV FEBRUARY 2011

... (e) Share Class A is German tax registered from 27/5/10 and has applied for UK Reporting Fund Status for the year to September 2011. (f) Share Class D is German tax registered from 1/10/10. This document is for information purposes and internal use only. It is neither an advice nor a recommendation ...

... (e) Share Class A is German tax registered from 27/5/10 and has applied for UK Reporting Fund Status for the year to September 2011. (f) Share Class D is German tax registered from 1/10/10. This document is for information purposes and internal use only. It is neither an advice nor a recommendation ...

Appendix 3

... of a “reference” rate of interest. The reference rate should contain no service element and reflect the risk and maturity structure of deposits and loans. The rate prevailing for interbank borrowing and lending may be a suitable choice as a reference rate. A single rate should be used for transactio ...

... of a “reference” rate of interest. The reference rate should contain no service element and reflect the risk and maturity structure of deposits and loans. The rate prevailing for interbank borrowing and lending may be a suitable choice as a reference rate. A single rate should be used for transactio ...

Credit Risk and the Performance of Nigerian Banks

... management of risk involving loan and other advances to prevent reoccurrences. A high level of financial leverage is usually associated with high risk. This can easily be seen in a situation where adverse rumours, whether founded or precipitated financial panic and by extension a run on a bank. Acco ...

... management of risk involving loan and other advances to prevent reoccurrences. A high level of financial leverage is usually associated with high risk. This can easily be seen in a situation where adverse rumours, whether founded or precipitated financial panic and by extension a run on a bank. Acco ...

DENZIO L IKUNGWA - Institute of Bankers in Malawi

... Discount instruments are instruments that do not pay interest to the holder, but are purchased at a discount on the nominal value. They include: (2.5 marks) ...

... Discount instruments are instruments that do not pay interest to the holder, but are purchased at a discount on the nominal value. They include: (2.5 marks) ...

Factsheet-WisdomTree Germany Equity UCITS ETF - USD

... fluctuations of the value of the Euro relative to US Dollar. The Index consists of dividend-paying companies incorporated in Germany that trade primarily on German Exchanges and derive less than 80% of their revenue from sources in Germany. By excluding companies that derive 80% or more of their rev ...

... fluctuations of the value of the Euro relative to US Dollar. The Index consists of dividend-paying companies incorporated in Germany that trade primarily on German Exchanges and derive less than 80% of their revenue from sources in Germany. By excluding companies that derive 80% or more of their rev ...

Financial Crisis of 2007–2010

... Bernanke, Ben S. (2005), “The Global Saving Glut and U.S. Current Account Deficit,” Federalreserve.gov. ...

... Bernanke, Ben S. (2005), “The Global Saving Glut and U.S. Current Account Deficit,” Federalreserve.gov. ...

money market fund

... Invests in investment grade domestic debt securities, taxable and tax-exempt, all US$ denominated; using yield curve, sector selection and security selection ...

... Invests in investment grade domestic debt securities, taxable and tax-exempt, all US$ denominated; using yield curve, sector selection and security selection ...

The Financial Electricity Market

... to the financial electricity market, particularly as regards the substantial, growing requirements placed on FI’s market regulation otherwise, where consumer-protection aspects in particular are very clear. The financial electricity market is dominated by a limited number of securities dealers. The ...

... to the financial electricity market, particularly as regards the substantial, growing requirements placed on FI’s market regulation otherwise, where consumer-protection aspects in particular are very clear. The financial electricity market is dominated by a limited number of securities dealers. The ...

Think active can`t outperform? Think again

... representing the highest commonality fund-benchmark relationship, was the used in the analysis. • Active share calculation. Active share measures the percentage of equity holdings in a fund that differ from the benchmark index. Higher active share indicates lower holdings similarity between a fund a ...

... representing the highest commonality fund-benchmark relationship, was the used in the analysis. • Active share calculation. Active share measures the percentage of equity holdings in a fund that differ from the benchmark index. Higher active share indicates lower holdings similarity between a fund a ...

Performance and Growth - delivering on our commitments

... • EPS growth above peer average (target 10+%) • ROE over 20% • Cost-income ratio comfortably in the 40’s • Inner Tier 1: ...

... • EPS growth above peer average (target 10+%) • ROE over 20% • Cost-income ratio comfortably in the 40’s • Inner Tier 1: ...

How do Interest Rates Work - Wealthcare Securities Pvt. Ltd.

... to be any investment, legal or taxation advice. The lesson is a conceptual representation and may not include several nuances that are associated and vital. The purpose of this lesson is to clarify the basics of the concept so that readers at large can relate and thereby take more interest in the pr ...

... to be any investment, legal or taxation advice. The lesson is a conceptual representation and may not include several nuances that are associated and vital. The purpose of this lesson is to clarify the basics of the concept so that readers at large can relate and thereby take more interest in the pr ...

Managing Banking Relationships

... companies and their advisors will have to negotiate with loan acquirers (Lonestar, Apollo, Goldman Sachs, Carval etc) and their administrators in relation to loans which they have purchased. In our experience, there is a significant variance between many of the loan acquirer’s objectives and how the ...

... companies and their advisors will have to negotiate with loan acquirers (Lonestar, Apollo, Goldman Sachs, Carval etc) and their administrators in relation to loans which they have purchased. In our experience, there is a significant variance between many of the loan acquirer’s objectives and how the ...

ifs_quickguide-0114

... Guidance and Advice Policy available at MyFRS.com or through the toll-free MyFRS Financial Guidance Line. Their services are based on the work of Nobel Prize winner Professor Bill Sharpe. More information about Financial Engines can be found in the Financial Engines Disclosure Statement that is incl ...

... Guidance and Advice Policy available at MyFRS.com or through the toll-free MyFRS Financial Guidance Line. Their services are based on the work of Nobel Prize winner Professor Bill Sharpe. More information about Financial Engines can be found in the Financial Engines Disclosure Statement that is incl ...

With Diverging Policy, Political Unrest and Market

... debt may feel the effects of developed market central bank policy shifts keenly. He believes investors should look to sovereign and corporate issuers that are less dependent on the cheap international financing that has been so abundant. With reduced liquidity and a strengthening dollar, differences ...

... debt may feel the effects of developed market central bank policy shifts keenly. He believes investors should look to sovereign and corporate issuers that are less dependent on the cheap international financing that has been so abundant. With reduced liquidity and a strengthening dollar, differences ...

“Risk-On” Sentiment Leads to Rally in 4th Quarter

... The Price of Safety The major theme of 2011 was sentiment-driven equity market volatility and the resultant investor “flight to safety”. Bearish on Eurozone growth prospects and worried about financial sector exposure to potential sovereign debt defaults, investors have flocked to US dollar-based “s ...

... The Price of Safety The major theme of 2011 was sentiment-driven equity market volatility and the resultant investor “flight to safety”. Bearish on Eurozone growth prospects and worried about financial sector exposure to potential sovereign debt defaults, investors have flocked to US dollar-based “s ...