Illuminating Markets - a vision for cash and collateral

... funding against 50% of the value of the reverse-repo. For example, a bank transacting a $100 million overnight reverse in AAA government bonds with an insurance company or hedge fund would carry a requirement for $50 million of (long term) stable funding, even if this reverse was match-funded by rep ...

... funding against 50% of the value of the reverse-repo. For example, a bank transacting a $100 million overnight reverse in AAA government bonds with an insurance company or hedge fund would carry a requirement for $50 million of (long term) stable funding, even if this reverse was match-funded by rep ...

SEC Proposes Two New Event Notices for Municipal Bond

... current bondholders and potential investors. Similarly, issuers will need to evaluate the materiality of covenants, events of default, remedies, priority rights or other similar terms that they may typically agree to in a bank loan or direct placement to decide if such agreements should be disclosed ...

... current bondholders and potential investors. Similarly, issuers will need to evaluate the materiality of covenants, events of default, remedies, priority rights or other similar terms that they may typically agree to in a bank loan or direct placement to decide if such agreements should be disclosed ...

[Presentation Subject]

... upon, by you for the purpose of avoiding any tax penalties and (ii) may have been written in connection with the "promotion or marketing" of any transaction contemplated hereby ("Transaction"). Accordingly, you should seek advice based on your particular circumstances from an independent tax advisor ...

... upon, by you for the purpose of avoiding any tax penalties and (ii) may have been written in connection with the "promotion or marketing" of any transaction contemplated hereby ("Transaction"). Accordingly, you should seek advice based on your particular circumstances from an independent tax advisor ...

Chapter 3. Securities Markets

... Therefore, “Block houses” have evolved to aid in the placement of larger block trades. Block houses are brokerage firms that specialize in matching block buyers and sellers. ...

... Therefore, “Block houses” have evolved to aid in the placement of larger block trades. Block houses are brokerage firms that specialize in matching block buyers and sellers. ...

Deepening diversification in trust portfolios

... bank trust executives expect to increase engagement with third-party asset managers during the next 3 years. While 27% of banks still maintain a largely closed architecture arrangement, even those “use external managers for selective needs, such as gaining exposure to alternative investments.”5 In e ...

... bank trust executives expect to increase engagement with third-party asset managers during the next 3 years. While 27% of banks still maintain a largely closed architecture arrangement, even those “use external managers for selective needs, such as gaining exposure to alternative investments.”5 In e ...

With the floats market set to re-open with a bang Simon

... once confidence returns (see table, left, and October 2006 at 0.38p and the stock subsequently delisted in 2008. analysis on page 19). Unfortunately it is far from easy for private Despite such setbacks, the number of gainers comfortably outweighed the losers, by 99 to 66. On average investors to ge ...

... once confidence returns (see table, left, and October 2006 at 0.38p and the stock subsequently delisted in 2008. analysis on page 19). Unfortunately it is far from easy for private Despite such setbacks, the number of gainers comfortably outweighed the losers, by 99 to 66. On average investors to ge ...

Addressing market failures in the resolution of non

... methods investors may use in due diligence, resulting in heightened uncertainty concerning asset values and additional costs associated with collecting sufficient data to facilitate workout, resulting in commensurately lower bid prices. Ineffective legal frameworks governing debt recovery and collat ...

... methods investors may use in due diligence, resulting in heightened uncertainty concerning asset values and additional costs associated with collecting sufficient data to facilitate workout, resulting in commensurately lower bid prices. Ineffective legal frameworks governing debt recovery and collat ...

chapter 32 institutional investors

... sophisticated Kalman-filter based model to uncover the unobservable factors on which timevarying factor exposures of mutual funds may depend. These authors find that using their method reveals significant timing ability in about a fifth of the total set of mutual funds in the Center for Research on ...

... sophisticated Kalman-filter based model to uncover the unobservable factors on which timevarying factor exposures of mutual funds may depend. These authors find that using their method reveals significant timing ability in about a fifth of the total set of mutual funds in the Center for Research on ...

CHAPTER 1 An Overview of Financial Management

... Another benefit made possible by the FI’s low transaction costs is that they can help reduce the exposure of investors to risk, through a process known as risk sharing ادارة المخاطر ...

... Another benefit made possible by the FI’s low transaction costs is that they can help reduce the exposure of investors to risk, through a process known as risk sharing ادارة المخاطر ...

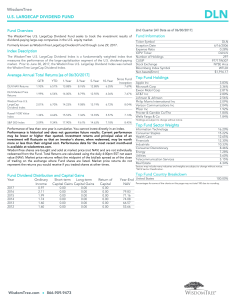

WisdomTree LargeCap Dividend Fund

... Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. To obtain a prospectus containing this and other important information, please call 866.909.9473, or visit WisdomTree.com WisdomTree.com to view or download a prospectus. Investo ...

... Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. To obtain a prospectus containing this and other important information, please call 866.909.9473, or visit WisdomTree.com WisdomTree.com to view or download a prospectus. Investo ...

Introduction to Bloomberg

... function. Within the DES pages, there are links to many other functions, including those described below. The RELS function provides a list of related securities, subsidiaries, etc. ...

... function. Within the DES pages, there are links to many other functions, including those described below. The RELS function provides a list of related securities, subsidiaries, etc. ...

RBC Emerging Markets Bond Fund

... Deposit Insurance Corporation or by any other government deposit insurer. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per unit at a constant amount or that the full amount of your investment in the fund will be returned to you. The va ...

... Deposit Insurance Corporation or by any other government deposit insurer. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per unit at a constant amount or that the full amount of your investment in the fund will be returned to you. The va ...

Macro-economic environment - February 2015

... The opinions expressed in this report reflect the personal opinions of the analysts about the securities and issuers mentioned in this document. No portion of the remuneration of the analysts has been, is or shall be directly or indirectly linked to the inclusion of specific recommendations or opini ...

... The opinions expressed in this report reflect the personal opinions of the analysts about the securities and issuers mentioned in this document. No portion of the remuneration of the analysts has been, is or shall be directly or indirectly linked to the inclusion of specific recommendations or opini ...

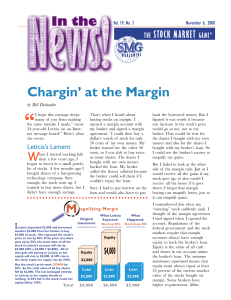

Chargin` at the Margin

... margin as the edge or border of something, such as the edge or border of this page. In margin buying, the margin is the amount an investor must deposit up front (on the front “edge” of a stock purchase) when borrowing from a broker to buy stock. For example, Leticia wanted to buy $4,000 worth of sto ...

... margin as the edge or border of something, such as the edge or border of this page. In margin buying, the margin is the amount an investor must deposit up front (on the front “edge” of a stock purchase) when borrowing from a broker to buy stock. For example, Leticia wanted to buy $4,000 worth of sto ...

Manual for municipalities: Part 1: Becoming creditworthy

... For a minority of urban areas, where there is a well-run municipality with a reasonable tax base, and an appropriate national legislative framework, the possibility exists that the municipality may take out loans to finance some of its infrastructure requirements. This manual is directed primarily a ...

... For a minority of urban areas, where there is a well-run municipality with a reasonable tax base, and an appropriate national legislative framework, the possibility exists that the municipality may take out loans to finance some of its infrastructure requirements. This manual is directed primarily a ...

Did the Commercial Funding Paper Facility Prevent a Great

... quarterly models of first differences of CPFC having a large outlier in that quarter. To control for this a 0-1 dummy (Break1973q1) was included in all short-run quarterly models. The other measure of security-funded credit, CPBLMIX¸ is the ratio of domestic issued commercial paper to itself plus ba ...

... quarterly models of first differences of CPFC having a large outlier in that quarter. To control for this a 0-1 dummy (Break1973q1) was included in all short-run quarterly models. The other measure of security-funded credit, CPBLMIX¸ is the ratio of domestic issued commercial paper to itself plus ba ...

Utility and Telecommunications Fund

... market and reduced liquidity for certain bonds held by the fund. In general, when interest rates rise, bond values fall and investors may lose principal value. Interest-rate changes and their impact on the fund and its share price can be sudden and unpredictable. The use of derivatives may reduce re ...

... market and reduced liquidity for certain bonds held by the fund. In general, when interest rates rise, bond values fall and investors may lose principal value. Interest-rate changes and their impact on the fund and its share price can be sudden and unpredictable. The use of derivatives may reduce re ...

Kaufmann Large Cap Fund - Investor Fact Sheet

... investment objectives, risks, charges and expenses before investing. To obtain a summary prospectus or prospectus containing this and other information, contact us or visit FederatedInvestors.com. Please carefully read the summary prospectus or the prospectus before investing. Past performance is no ...

... investment objectives, risks, charges and expenses before investing. To obtain a summary prospectus or prospectus containing this and other information, contact us or visit FederatedInvestors.com. Please carefully read the summary prospectus or the prospectus before investing. Past performance is no ...

RTF

... 10 years. The tranche sizes and the final terms will be determined over the next few days. The proceeds from the bond issuance will be used to fully redeem all existing bonds at IHO Holding totaling approximately EUR 1.7 billion equivalent with coupons ranging from 5.75% to 6.875%, to pay redemption ...

... 10 years. The tranche sizes and the final terms will be determined over the next few days. The proceeds from the bond issuance will be used to fully redeem all existing bonds at IHO Holding totaling approximately EUR 1.7 billion equivalent with coupons ranging from 5.75% to 6.875%, to pay redemption ...

- Munich Personal RePEc Archive

... & Li, 2003; H. Li et al., 2008; Cull et al., 2009; Gordon & Li, 2011). Song et al. (2011) argue that a reallocation of resources could address China’s serious inefficiency and lead to fast growth over a prolonged transition. However, others maintain that financial distortion cannot be an impediment ...

... & Li, 2003; H. Li et al., 2008; Cull et al., 2009; Gordon & Li, 2011). Song et al. (2011) argue that a reallocation of resources could address China’s serious inefficiency and lead to fast growth over a prolonged transition. However, others maintain that financial distortion cannot be an impediment ...

(Attachment: 5)Report (79K/bytes)

... previous short term asset allocation. The current political, economic and market conditions are similar to previous advice provided at meetings and do not suggest any need to make any major strategy changes. Currently, the key component when setting the short term asset allocation is the Bond yield ...

... previous short term asset allocation. The current political, economic and market conditions are similar to previous advice provided at meetings and do not suggest any need to make any major strategy changes. Currently, the key component when setting the short term asset allocation is the Bond yield ...

The Global Secondary Market: A Growing and Evolving Investment

... cross-section of the institutional investor community, reflecting growing acceptance of the secondary market across a wide range of investor types (see Chart 6). Looking at 2015 sales activity, the most active sellers were public/private pensions and sovereign wealth funds (SWFs), which together acc ...

... cross-section of the institutional investor community, reflecting growing acceptance of the secondary market across a wide range of investor types (see Chart 6). Looking at 2015 sales activity, the most active sellers were public/private pensions and sovereign wealth funds (SWFs), which together acc ...

English - Pictet Perspectives

... European banks in 2016 was a tale of two halves. In the first half, banks were the worst-performing sector on the Stoxx Europe 600 index. This was a period during which the ECB embarked on a new quantitative easing (QE) scheme and the British decided to leave the EU in the Brexit referendum, both fa ...

... European banks in 2016 was a tale of two halves. In the first half, banks were the worst-performing sector on the Stoxx Europe 600 index. This was a period during which the ECB embarked on a new quantitative easing (QE) scheme and the British decided to leave the EU in the Brexit referendum, both fa ...

![[Presentation Subject]](http://s1.studyres.com/store/data/004542315_1-1026bbe0061976fe5bee402d431f0480-300x300.png)