Description of Financial Instruments and

... Money market is a market for short-term debt securities with maturity of one year or less and often 30 days or less. Money market securities include certificates of deposit, bankers acceptances, commercial paper, repos (repurchase agreements) and treasury bills. Money market securities are generally ...

... Money market is a market for short-term debt securities with maturity of one year or less and often 30 days or less. Money market securities include certificates of deposit, bankers acceptances, commercial paper, repos (repurchase agreements) and treasury bills. Money market securities are generally ...

Investment Update February 2011

... The information and opinions contained in this presentation have been obtained from sources of Elstree Investment Management Limited (ABN 20 079 036 810) believed to be reliable, but no representation or warranty, express or implied, is made that such information is accurate or complete and it shoul ...

... The information and opinions contained in this presentation have been obtained from sources of Elstree Investment Management Limited (ABN 20 079 036 810) believed to be reliable, but no representation or warranty, express or implied, is made that such information is accurate or complete and it shoul ...

Does PE Create Value.Apr 08

... Forced to invest substantial portion of wealth in stock – bears large undiversified risk Thomas Lee had 50% + for over 10 years ...

... Forced to invest substantial portion of wealth in stock – bears large undiversified risk Thomas Lee had 50% + for over 10 years ...

"THE JUNCKER PLAN" Keynote Speech

... Promotional Banks (NBPs) or commercial banks for intermediation; dedicated platforms. The risks taken by the operations of the Plan will range from equity, mezzanine, and subordinated debt to senior loans. Operation supported by the EFSI guarantee will typically have a different risk profile than no ...

... Promotional Banks (NBPs) or commercial banks for intermediation; dedicated platforms. The risks taken by the operations of the Plan will range from equity, mezzanine, and subordinated debt to senior loans. Operation supported by the EFSI guarantee will typically have a different risk profile than no ...

Structured for long-term investment success

... Have you ever wondered what it takes for an investment management firm to be successful? You’re not alone, because a great deal of research has been conducted on this very question. This research finds that there are some very specific structural and investment approach attributes that successful in ...

... Have you ever wondered what it takes for an investment management firm to be successful? You’re not alone, because a great deal of research has been conducted on this very question. This research finds that there are some very specific structural and investment approach attributes that successful in ...

October 17 2014 “From Extraordinary to Ordinary” Publications

... The likelihood of QE has risen, but we still stick to our base case scenario: Growth figures overall don’t indicate a recession, not to say a deflationary scenario. What we have seen at equity markets during the last few days seems to be primarily driven by the fact that markets were too complacent ...

... The likelihood of QE has risen, but we still stick to our base case scenario: Growth figures overall don’t indicate a recession, not to say a deflationary scenario. What we have seen at equity markets during the last few days seems to be primarily driven by the fact that markets were too complacent ...

Official PDF , 10 pages

... are available to offset the losses incurred on small scale loans), implying that credit is provided below its accounting cost; b) the provision of capital to agricultural lenders on soft terms, including an interest rate below going rates; or c) agricultural interest rates which are below those char ...

... are available to offset the losses incurred on small scale loans), implying that credit is provided below its accounting cost; b) the provision of capital to agricultural lenders on soft terms, including an interest rate below going rates; or c) agricultural interest rates which are below those char ...

The Crash of 2008: Cause and Aftermath

... house or condo with a lower down payment than was the case a decade earlier. The Federal National Mortgage Association and Federal Home Loan Mortgage Corporation, commonly known as Fannie Mae and Freddie Mac, played a central role in this relaxation of mortgage lending standards. These two entities ...

... house or condo with a lower down payment than was the case a decade earlier. The Federal National Mortgage Association and Federal Home Loan Mortgage Corporation, commonly known as Fannie Mae and Freddie Mac, played a central role in this relaxation of mortgage lending standards. These two entities ...

Accessing Finance: A Guide for Food and Drink Companies

... Where the perceived funding risk is less and indeed security may very well be available, bank funding is normally the most appropriate method of finance. At the upper end of the risk spectrum, equity investment is normally the most appropriate method of funding a business. However, Mezzanine Funding ...

... Where the perceived funding risk is less and indeed security may very well be available, bank funding is normally the most appropriate method of finance. At the upper end of the risk spectrum, equity investment is normally the most appropriate method of funding a business. However, Mezzanine Funding ...

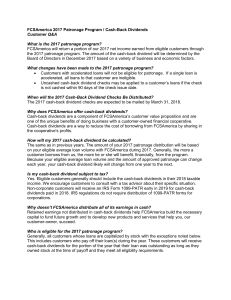

FCSAmerica 2017 Patronage Program / Cash

... What changes have been made to the 2017 patronage program? • Customers with accelerated loans will not be eligible for patronage. If a single loan is accelerated, all loans to that customer are ineligible. • Uncashed cash-back dividend checks may be applied to a customer’s loans if the check is not ...

... What changes have been made to the 2017 patronage program? • Customers with accelerated loans will not be eligible for patronage. If a single loan is accelerated, all loans to that customer are ineligible. • Uncashed cash-back dividend checks may be applied to a customer’s loans if the check is not ...

The Economic Value of ESG/SRI

... The overall split between retail assets and institutional assets has tilted further in favour of the la er, and now stands at 96.6% institutional. Part of this growth can be a ributed to the addition of Finland, Norway and Sweden to this data for 2013, but even correcting for this shows minimal grow ...

... The overall split between retail assets and institutional assets has tilted further in favour of the la er, and now stands at 96.6% institutional. Part of this growth can be a ributed to the addition of Finland, Norway and Sweden to this data for 2013, but even correcting for this shows minimal grow ...

Unconventional Wisdom

... not typically have a higher risk profile and may provide meaningful performance advantages over time. For the purposes of this paper, focused mutual funds are defined as portfolios that concentrate assets in managers’ best investment ideas. The research reviewed shows that: 1. High conviction inves ...

... not typically have a higher risk profile and may provide meaningful performance advantages over time. For the purposes of this paper, focused mutual funds are defined as portfolios that concentrate assets in managers’ best investment ideas. The research reviewed shows that: 1. High conviction inves ...

III-2 - Fannie Mae

... Whether the sales comparables and adjustments are acceptable and whether the adjustments accurately account for differences between the sales comparables and the Property. Whether the value conclusion based on sales comparables is reasonable. The appraiser's income estimate. Indicate whether rents a ...

... Whether the sales comparables and adjustments are acceptable and whether the adjustments accurately account for differences between the sales comparables and the Property. Whether the value conclusion based on sales comparables is reasonable. The appraiser's income estimate. Indicate whether rents a ...

Equipment Loan Agreement - Rogers State University

... Phone Number: _______________ Request Date (s): ___________ Return Date: _________ Time: _______ Purpose for Loaned Equipment/Materials: _____________________________________________________ The period of loan is from approved request date until approved return date. Borrower understands that any ex ...

... Phone Number: _______________ Request Date (s): ___________ Return Date: _________ Time: _______ Purpose for Loaned Equipment/Materials: _____________________________________________________ The period of loan is from approved request date until approved return date. Borrower understands that any ex ...

Prudential Short Duration High Yield Income Fund

... Source: The statistics stated above are derived from Morningstar Direct and Bloomberg Barclays, as of 6/30/2017. Calculated by PGIM Investments using data from Morningstar. All rights reserved. Used with permission. Source of default data: Moody’s as of 12/31/2016. Annualized returns and standard de ...

... Source: The statistics stated above are derived from Morningstar Direct and Bloomberg Barclays, as of 6/30/2017. Calculated by PGIM Investments using data from Morningstar. All rights reserved. Used with permission. Source of default data: Moody’s as of 12/31/2016. Annualized returns and standard de ...

US P3 Market Slowly Builds on Four Fronts

... Two states with relatively more established transportation P3 programs, Texas (Aaa stable) and Virginia (Aaa stable), passed P3-related legislation in 2015 that either refined the P3 procurement process or created a new government department to promote the effective use of P3s when warranted. One dr ...

... Two states with relatively more established transportation P3 programs, Texas (Aaa stable) and Virginia (Aaa stable), passed P3-related legislation in 2015 that either refined the P3 procurement process or created a new government department to promote the effective use of P3s when warranted. One dr ...

Consumer Loans in Cambodia - Munich Personal RePEc Archive

... stability, provides a positive outlook and expectation for the country and thus is a factor explaining higher demand for housing loans. Moreover, the change of family structure in Cambodia also contributes to higher demand for housing loans, as more newly-wedded couples prefer to move out and live ...

... stability, provides a positive outlook and expectation for the country and thus is a factor explaining higher demand for housing loans. Moreover, the change of family structure in Cambodia also contributes to higher demand for housing loans, as more newly-wedded couples prefer to move out and live ...

Why Dealers Are Struggling with Proposed Markup Disclosure

... endorsing that service's analysis as comparable to the economic model envisioned by the guidance. He said he is not sure if pricing services would be able to rise to the level of economic models. Meanwhile, Mary Simpkins, senior special counsel with the SEC's Office of Municipal Securities who was o ...

... endorsing that service's analysis as comparable to the economic model envisioned by the guidance. He said he is not sure if pricing services would be able to rise to the level of economic models. Meanwhile, Mary Simpkins, senior special counsel with the SEC's Office of Municipal Securities who was o ...

FRS 102 for leaders – in plain English Financial Reporting Standard

... Housing associations which have not already done so, may need at some point to reformat budgets and management accounts for consistency with the FRS 102 audited accounts as well, in time, regulatory financial returns should housing regulators remodel them for consistency with FRS 102. ...

... Housing associations which have not already done so, may need at some point to reformat budgets and management accounts for consistency with the FRS 102 audited accounts as well, in time, regulatory financial returns should housing regulators remodel them for consistency with FRS 102. ...

Chapter 8

... resources and technology • Improvements in our standard of living (or, simply, economic growth) requires increases in the availability of the above resources • And that in turn requires saving and investment ...

... resources and technology • Improvements in our standard of living (or, simply, economic growth) requires increases in the availability of the above resources • And that in turn requires saving and investment ...