Portfolio Breadth: The forgotten success factor in active management

... groups from which we gather information. Company Management: Company managers often have special insight into what is in store for their firms, and although they may not communicate this information directly to the public, monitoring how they manage capital can provide insight as to what lies ahead. ...

... groups from which we gather information. Company Management: Company managers often have special insight into what is in store for their firms, and although they may not communicate this information directly to the public, monitoring how they manage capital can provide insight as to what lies ahead. ...

Outlook June 2016 #68

... Due to these tendencies, it is not unusual for cash to sit on the sideline until support levels are retested, at which point money pours into the market, ending the decline and launching the next leg higher. The exact opposite is true of areas of resistance (a.k.a. overhead supply). Many investors ...

... Due to these tendencies, it is not unusual for cash to sit on the sideline until support levels are retested, at which point money pours into the market, ending the decline and launching the next leg higher. The exact opposite is true of areas of resistance (a.k.a. overhead supply). Many investors ...

Third Quarter Results, 2010

... Fees from securities brokerage services increased 94% as compared to the previous quarter, explained by an important increase in the number of customers during the quarter, the launching of Pershing to allow clients to invest abroad and other new services focus on corporate needs; meanwhile fees fro ...

... Fees from securities brokerage services increased 94% as compared to the previous quarter, explained by an important increase in the number of customers during the quarter, the launching of Pershing to allow clients to invest abroad and other new services focus on corporate needs; meanwhile fees fro ...

Portland International Jetport

... publicly available sources, the completeness and accuracy of which has not been independently verified, and cannot be assured by RBC CM. The information and any analyses in these materials reflect prevailing conditions and RBC CM’s views as of this date, all of which are subject to change. To the ex ...

... publicly available sources, the completeness and accuracy of which has not been independently verified, and cannot be assured by RBC CM. The information and any analyses in these materials reflect prevailing conditions and RBC CM’s views as of this date, all of which are subject to change. To the ex ...

Global Absolute Return Strategies Fund

... by the fund exceeds the amount it has invested) and in these market conditions the effect of leverage will be to magnify losses. The fund makes extensive use of derivatives. The fund invests in high yielding bonds which carry a greater risk of default than those with lower yields. All investment inv ...

... by the fund exceeds the amount it has invested) and in these market conditions the effect of leverage will be to magnify losses. The fund makes extensive use of derivatives. The fund invests in high yielding bonds which carry a greater risk of default than those with lower yields. All investment inv ...

Chapter 5 Credit risk - Department of Applied Mathematics and

... determine that a loan which has not been repaid for some time period is indeed nonperforming, implying that the loss should be recognized by the bank. For example, if the client is past due 10 days, this may already indicate that he or she has some troubles with repaying the loan, but it may be only ...

... determine that a loan which has not been repaid for some time period is indeed nonperforming, implying that the loss should be recognized by the bank. For example, if the client is past due 10 days, this may already indicate that he or she has some troubles with repaying the loan, but it may be only ...

Slide set 2 File

... – sanctioned disclosure duties – anonymity of the market prevents investors from “contractual” information seeking ...

... – sanctioned disclosure duties – anonymity of the market prevents investors from “contractual” information seeking ...

MPFD Lesson 9A: The Three C`s of Credit

... age, character references, past loans, and so on, explain that although lenders would value such information, it is not possible to get complete information for everyone, so they have to work with the information they have.) Handout 9A.3: Approve or Deny Credit?—Part C Answer Key It is unlikely that ...

... age, character references, past loans, and so on, explain that although lenders would value such information, it is not possible to get complete information for everyone, so they have to work with the information they have.) Handout 9A.3: Approve or Deny Credit?—Part C Answer Key It is unlikely that ...

Guidelines for using this template

... We send more than 4 billion multi-channel communications on behalf of our clients annually. ...

... We send more than 4 billion multi-channel communications on behalf of our clients annually. ...

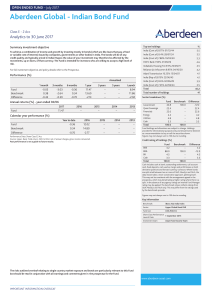

Aberdeen Global - Indian Bond Fund

... Variable (a “SICAV”). The information contained in this marketing document is intended to be of general interest only and should not be considered as an offer, or solicitation, to deal in the shares of any securities or financial instruments. Aberdeen Global has been authorized for public sale in ce ...

... Variable (a “SICAV”). The information contained in this marketing document is intended to be of general interest only and should not be considered as an offer, or solicitation, to deal in the shares of any securities or financial instruments. Aberdeen Global has been authorized for public sale in ce ...

Document

... 780 small towns in 38 regions across 8 time zones The close proximity to our customers and their ...

... 780 small towns in 38 regions across 8 time zones The close proximity to our customers and their ...

the exchange rate

... rate differential with one-month U.S. rates. The non-carry currencies are those with interest rates that are similar to or lower than U.S. rates. The carry-trade return is how much the basket of carry currencies appreciated relative to non-carry currencies over a month on a given day. The model resu ...

... rate differential with one-month U.S. rates. The non-carry currencies are those with interest rates that are similar to or lower than U.S. rates. The carry-trade return is how much the basket of carry currencies appreciated relative to non-carry currencies over a month on a given day. The model resu ...

Document

... • This section will help you recognize and avoid different types of investment fraud. You'll also learn what questions to ask before investing, where to get information about companies, who to call for help, and what to do if you run into ...

... • This section will help you recognize and avoid different types of investment fraud. You'll also learn what questions to ask before investing, where to get information about companies, who to call for help, and what to do if you run into ...

Institutional non-bank lending and the role of Debt Funds

... loan volumes fosters the risk of exaggerating to the downside. Morover, there are significant differences between countries. It is not always clear whether weak lending levels are driven by the supply or by the demand side. In general, the availability of loans to SMEs seems to slightly improve; at ...

... loan volumes fosters the risk of exaggerating to the downside. Morover, there are significant differences between countries. It is not always clear whether weak lending levels are driven by the supply or by the demand side. In general, the availability of loans to SMEs seems to slightly improve; at ...

Assets

... • Once debt is in place, reducing leverage is a gift to creditors (or the government), makes debt safer. • Because banks’ creditors, e.g., depositors, do not do much to counter, leverage is easy to increase but bankers/shareholders resist reducing it. ...

... • Once debt is in place, reducing leverage is a gift to creditors (or the government), makes debt safer. • Because banks’ creditors, e.g., depositors, do not do much to counter, leverage is easy to increase but bankers/shareholders resist reducing it. ...

Bank lending during the financial crisis of 2008

... used for corporate restructuring as well as those used for general corporate purposes and working capital. While syndicated lending fell, commercial and industrial (C&I) loans reported on the aggregate balance sheet of the U.S. banking sector actually rose by about $100 billion from September to mid ...

... used for corporate restructuring as well as those used for general corporate purposes and working capital. While syndicated lending fell, commercial and industrial (C&I) loans reported on the aggregate balance sheet of the U.S. banking sector actually rose by about $100 billion from September to mid ...

Tough times continue for Singapore oil rig builders

... Sembcorp Marine is focusing on liquidity and balance sheet management. In order to maintain a healthy liquidity profile, Keppel is reducing its workforce and mothballing some facilities in its rig-building operations. Keppel expects lower working capital requirements moving forward but feels that it ...

... Sembcorp Marine is focusing on liquidity and balance sheet management. In order to maintain a healthy liquidity profile, Keppel is reducing its workforce and mothballing some facilities in its rig-building operations. Keppel expects lower working capital requirements moving forward but feels that it ...

Japan`s Financial Problems

... shareholding and issuance of new shares to existing shareholders at par value, reduced the stock market to a purely speculative game. Corporate managers were not influenced by movements in share prices, since a falling price did not expose firms to takeover bids; shareholders could not express disco ...

... shareholding and issuance of new shares to existing shareholders at par value, reduced the stock market to a purely speculative game. Corporate managers were not influenced by movements in share prices, since a falling price did not expose firms to takeover bids; shareholders could not express disco ...

Moldova Poverty Trends 2001/2002

... There is need to foster the development of the secondary market for securities e.g. through reduction of high withholding taxes on government securities trading Establish suitable clearing and settlement mechanisms. At the moment, there are no custody systems in Malawi as such securities are physica ...

... There is need to foster the development of the secondary market for securities e.g. through reduction of high withholding taxes on government securities trading Establish suitable clearing and settlement mechanisms. At the moment, there are no custody systems in Malawi as such securities are physica ...

Financial Crises: Mechanisms, Prevention, and Management

... So far I have not explained why a drop in asset prices leads to higher margins and haircuts, as well as a more cautious attitude towards lending. There are at least three reasons: (i) backward-looking risk measures, (ii) time-varying volatility, and (iii) adverse selection. Margins, haircuts and ba ...

... So far I have not explained why a drop in asset prices leads to higher margins and haircuts, as well as a more cautious attitude towards lending. There are at least three reasons: (i) backward-looking risk measures, (ii) time-varying volatility, and (iii) adverse selection. Margins, haircuts and ba ...

Liquidity Measurement and Management

... defined as “having money when you need it to meet loan commitments and funding replacements.” Further enhancing this definition: “liquidity for a financial institution is its ability to raise cash quickly (within 30 days), without principal loss and at a reasonable cost.” Traditional approaches are ...

... defined as “having money when you need it to meet loan commitments and funding replacements.” Further enhancing this definition: “liquidity for a financial institution is its ability to raise cash quickly (within 30 days), without principal loss and at a reasonable cost.” Traditional approaches are ...

Seminar on JESSICA and State Aid Provisions – Brussels, 4

... Co-investors in UDPs • In order to limit State aid intervention and at the same time benefit as much as possible from market players’ intelligence, the UDF may not finance a UDP without market oriented co-financing sharing investment risks. • Co-financing must be significant, e. g. not smaller than ...

... Co-investors in UDPs • In order to limit State aid intervention and at the same time benefit as much as possible from market players’ intelligence, the UDF may not finance a UDP without market oriented co-financing sharing investment risks. • Co-financing must be significant, e. g. not smaller than ...