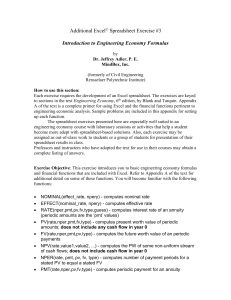

Additional Computer Exercise 3

... Each exercise requires the development of an Excel spreadsheet. The exercises are keyed to sections in the text Engineering Economy, 6th edition, by Blank and Tarquin. Appendix A of the text is a complete primer for using Excel and the financial functions pertinent to engineering economic analysis. ...

... Each exercise requires the development of an Excel spreadsheet. The exercises are keyed to sections in the text Engineering Economy, 6th edition, by Blank and Tarquin. Appendix A of the text is a complete primer for using Excel and the financial functions pertinent to engineering economic analysis. ...

The Economic Viability of Microfinancing in Pennsylvania

... a bank loan (Burrus, 2005). Of the 82 percent, 86 percent never applied for a bank loan, and 14 percent applied but were rejected. Burrus estimated that less than 1 percent of microentrepreneurs receive microfinancing, which illustrates both an enormous growth potential in this market, and the diffi ...

... a bank loan (Burrus, 2005). Of the 82 percent, 86 percent never applied for a bank loan, and 14 percent applied but were rejected. Burrus estimated that less than 1 percent of microentrepreneurs receive microfinancing, which illustrates both an enormous growth potential in this market, and the diffi ...

A Case for Active Management - Mawer Investment Management

... fact, passive investment fees are often not dramatically less than those of some active managers. And if the active manager provides superior returns after fees are taken into account...well, we think it’s a no-brainer. And at Mawer, we do believe that there are good managers out there. To us, being ...

... fact, passive investment fees are often not dramatically less than those of some active managers. And if the active manager provides superior returns after fees are taken into account...well, we think it’s a no-brainer. And at Mawer, we do believe that there are good managers out there. To us, being ...

Notice to Members

... However, if recording the bookkeeping entries results in a net payable to the fund, that amount needs to be locked up on “that day” into the broker-dealer’s 15c3-3 Reserve Bank Account. A separate 15c3-3 Reserve Bank Account need not be set up for this deposit. The required deposit can be made into ...

... However, if recording the bookkeeping entries results in a net payable to the fund, that amount needs to be locked up on “that day” into the broker-dealer’s 15c3-3 Reserve Bank Account. A separate 15c3-3 Reserve Bank Account need not be set up for this deposit. The required deposit can be made into ...

Issues in the Financing of Small and Medium Enterprises in China

... In most developing countries, small and medium enterprises (SMEs) get highest priority of the government policy supports, including the measures to improve the access to formal credit. In China, however, it has been only recent years that the government started to introduce measures to promote the g ...

... In most developing countries, small and medium enterprises (SMEs) get highest priority of the government policy supports, including the measures to improve the access to formal credit. In China, however, it has been only recent years that the government started to introduce measures to promote the g ...

title slide is in sentence case. green background. 2016 half

... • Underweight in London Dec 2010 Total ...

... • Underweight in London Dec 2010 Total ...

WHICH CAPITALISM? LESSONS FROM THE EAST ASIAN CRISIS

... potential competitors. Contrast this with the arm's-length, Anglo-Saxon system, where the financier is protected by explicit contracts. In such systems, contracts and associated prices determine the transactions that are undertaken. As a result, institutional relationships matter less and the market ...

... potential competitors. Contrast this with the arm's-length, Anglo-Saxon system, where the financier is protected by explicit contracts. In such systems, contracts and associated prices determine the transactions that are undertaken. As a result, institutional relationships matter less and the market ...

Chapter 14 Study Guide

... The most liquid assets also tend to be the least profitable. b. Yet disbursement demand must be accommodated: ...

... The most liquid assets also tend to be the least profitable. b. Yet disbursement demand must be accommodated: ...

Download attachment

... of the USD’s 5.3 trillion/day Forex market. The 16-day bipartisan impasse have dealt blows to the greenback throughout most of the month, driving the averageweighted USD below the 80 level. It rebounded towards the end of the month, recording a net loss of 3% M/M, closing at 80.2. The Fed decided to ...

... of the USD’s 5.3 trillion/day Forex market. The 16-day bipartisan impasse have dealt blows to the greenback throughout most of the month, driving the averageweighted USD below the 80 level. It rebounded towards the end of the month, recording a net loss of 3% M/M, closing at 80.2. The Fed decided to ...

Helpful Comments: Excel Financial functions perform common

... keyed to sections in the text Engineering Economy, 6th edition, by Blank and Tarquin. Appendix A of the text is a complete primer for using Excel and the financial functions pertinent to engineering economic analysis. Sample problems are included in this appendix for setting up each function. The sp ...

... keyed to sections in the text Engineering Economy, 6th edition, by Blank and Tarquin. Appendix A of the text is a complete primer for using Excel and the financial functions pertinent to engineering economic analysis. Sample problems are included in this appendix for setting up each function. The sp ...

The Impact of Financial Markets on Economic Stability and

... mortgage on which the rate is fixed for two years and is then reset to equal the value of a rate index, plus a margin. Because subprime margins are high, the rate on most 2/28s will rise sharply at the two-year mark, even if market rates do not change during the twoyear period. If the house has appr ...

... mortgage on which the rate is fixed for two years and is then reset to equal the value of a rate index, plus a margin. Because subprime margins are high, the rate on most 2/28s will rise sharply at the two-year mark, even if market rates do not change during the twoyear period. If the house has appr ...

The role of information asymmetry and financial reporting quality in

... behavior, as well as by the general uncertainty regarding the firm’s creditworthiness and liquidity. My interpretation of the positive relation between the loan spread and the signed abnormal accruals is consistent with the “debt covenant” hypothesis which suggests that managers make accounting choi ...

... behavior, as well as by the general uncertainty regarding the firm’s creditworthiness and liquidity. My interpretation of the positive relation between the loan spread and the signed abnormal accruals is consistent with the “debt covenant” hypothesis which suggests that managers make accounting choi ...

q. please state your name, profession, and occupation.

... Mr. Hill criticizes me for not understanding that the expected rate of return applies to a book value per share whereas the required return applies to a market value per share. What I find interesting is that Mr. Hill can make this statement while at the same time recommending that the required retu ...

... Mr. Hill criticizes me for not understanding that the expected rate of return applies to a book value per share whereas the required return applies to a market value per share. What I find interesting is that Mr. Hill can make this statement while at the same time recommending that the required retu ...

for immediate release

... SAN ANTONIO—January 10, 2008—Ten mutual funds managed by U.S. Global Investors, Inc. (Nasdaq: GROW) are listed among the top-performing mutual funds over various time periods going back 10 years as of the end of 2007. ...

... SAN ANTONIO—January 10, 2008—Ten mutual funds managed by U.S. Global Investors, Inc. (Nasdaq: GROW) are listed among the top-performing mutual funds over various time periods going back 10 years as of the end of 2007. ...

statement on subprime mortgage lending

... prudent and worthy lending practices are generally in the long-term best interest of both the provider and the borrower, and NJDOBI fully endorses the guidance set forth by CSBS and AARMR in these documents. Providers should follow prudent underwriting practices in determining whether to consider a ...

... prudent and worthy lending practices are generally in the long-term best interest of both the provider and the borrower, and NJDOBI fully endorses the guidance set forth by CSBS and AARMR in these documents. Providers should follow prudent underwriting practices in determining whether to consider a ...

Risk-Spreading via Financial Intermediation: Life Insurance

... million): (at the derived rates with R = 1) the expected rate of return is zero and there is a .16 probability of one standard deviation to the right which translates into a $15 million loss! Few ...

... million): (at the derived rates with R = 1) the expected rate of return is zero and there is a .16 probability of one standard deviation to the right which translates into a $15 million loss! Few ...

Shopaholic Credit Case Study - socialsciences dadeschools net

... How do consumers effectively choose quality goods and services at an affordable cost? Why should consumers use practical reasoning when approaching spending habits? Learning Goals/Objectives Identify the opportunity cost in examples of personal decision making. Understand that spending is ex ...

... How do consumers effectively choose quality goods and services at an affordable cost? Why should consumers use practical reasoning when approaching spending habits? Learning Goals/Objectives Identify the opportunity cost in examples of personal decision making. Understand that spending is ex ...

The Power of Many” Helps Main Street Banks Offer Services Too

... States, many thousands of local and state governmental organizations use these reciprocal deposit services to access multi-million-dollar FDIC insurance through a single bank relationship. In this way, they can safeguard taxpayer money, keep funds local so Main Street banks can use these funds to ma ...

... States, many thousands of local and state governmental organizations use these reciprocal deposit services to access multi-million-dollar FDIC insurance through a single bank relationship. In this way, they can safeguard taxpayer money, keep funds local so Main Street banks can use these funds to ma ...

Working Paper No. 532 Old Wine in a New Bottle: Subprime

... divided into AAA tranche (70%), mezzanine tranche (20%), and subordinated tranche (10%). An investor, depending on his risk appetite, can choose which tranche to invest in. The AAA tranche pays lowest interest rate, but provides highest priority in terms of debt repayment. To further complicate matt ...

... divided into AAA tranche (70%), mezzanine tranche (20%), and subordinated tranche (10%). An investor, depending on his risk appetite, can choose which tranche to invest in. The AAA tranche pays lowest interest rate, but provides highest priority in terms of debt repayment. To further complicate matt ...

Slide 1

... effect on a country’s total foreign liabilities. • It affects the composition significantly. As FDI and portfolio debt are strongly discouraged, foreign loans take their places. • Corruption increases a country’s vulnerability to a balance-of-payments crisis by altering its composition of capital in ...

... effect on a country’s total foreign liabilities. • It affects the composition significantly. As FDI and portfolio debt are strongly discouraged, foreign loans take their places. • Corruption increases a country’s vulnerability to a balance-of-payments crisis by altering its composition of capital in ...

Going Back to the Basics – Rethinking Market Efficiency

... 3 Dynamic markets and relativistic effects We mentioned that conventional economics makes its inferences on efficient markets on the basis of a model in which economic agents are entities that act according to the rational expectation strategy. Any differences in planning horizons, frequency of trad ...

... 3 Dynamic markets and relativistic effects We mentioned that conventional economics makes its inferences on efficient markets on the basis of a model in which economic agents are entities that act according to the rational expectation strategy. Any differences in planning horizons, frequency of trad ...

Aalborg Universitet Mortgage Finance and Security of Collateral Haldrup, Karin

... loans and bonds, which ensure an alignment of risks and responsibilities. The simple and transparent funding mechanism reduces risks and overhead costs, and ensures a simple cash flow. Standardized loan conditions protect borrowers against predatory lending, while creating transparency in the market ...

... loans and bonds, which ensure an alignment of risks and responsibilities. The simple and transparent funding mechanism reduces risks and overhead costs, and ensures a simple cash flow. Standardized loan conditions protect borrowers against predatory lending, while creating transparency in the market ...