solve(A*m^NR*(m^N-1)/(m

... remains constant over the life of the loan. So if J denotes the monthly interest rate, we have R = JP + (amount applied to principal), and the new principal after the payment is applied is P + JP R = P(1 + J) R = Pm R , where m = 1 + J. So a table of the amount of the principal still outst ...

... remains constant over the life of the loan. So if J denotes the monthly interest rate, we have R = JP + (amount applied to principal), and the new principal after the payment is applied is P + JP R = P(1 + J) R = Pm R , where m = 1 + J. So a table of the amount of the principal still outst ...

The Mortgage Crisis and Credit Crunch: From Housing Losses to

... A pool of investment assets that attempts to profit from credit spreads between short-term debt and long-term structured finance products such as asset-backed securities (ABS). Funding for SIVs comes from the issuance of commercial paper that is continuously renewed or rolled over; the proceeds are ...

... A pool of investment assets that attempts to profit from credit spreads between short-term debt and long-term structured finance products such as asset-backed securities (ABS). Funding for SIVs comes from the issuance of commercial paper that is continuously renewed or rolled over; the proceeds are ...

Steady as she goes?

... much to allocate to any particular investment option. The asset allocation charts are provided for illustration purposes only and do not predict or guarantee the performance of any Wells Fargo Fund. When applying an asset allocation strategy to your own situation, variables such as your investment o ...

... much to allocate to any particular investment option. The asset allocation charts are provided for illustration purposes only and do not predict or guarantee the performance of any Wells Fargo Fund. When applying an asset allocation strategy to your own situation, variables such as your investment o ...

mmi07 Illing 4349405 en

... up and down in an economy with market imperfections: Default forces inefficient liquidations. In the stylized model considered here (a pure endowment economy), this is captured by a redirection of assets to agents which have a much lower valuation; in general, as a straightforward generalisation, fo ...

... up and down in an economy with market imperfections: Default forces inefficient liquidations. In the stylized model considered here (a pure endowment economy), this is captured by a redirection of assets to agents which have a much lower valuation; in general, as a straightforward generalisation, fo ...

Finding Opportunities — Tackling today`s uncertain

... or guarantee against a loss. 10 The fund is designed for investors with an above-average risk tolerance. The market value of securities may fall, fail to rise or fluctuate, sometimes rapidly and unpredictably. Market risk may affect a single issuer, sector of the economy, industry or the market as a ...

... or guarantee against a loss. 10 The fund is designed for investors with an above-average risk tolerance. The market value of securities may fall, fail to rise or fluctuate, sometimes rapidly and unpredictably. Market risk may affect a single issuer, sector of the economy, industry or the market as a ...

Contact - Xcel Energy - Web site maintenance

... Once an applicant is determined to be creditworthy, an unsecured credit limit will be established, which must equal the estimated highest 90-day credit exposure. If the unsecured credit limit granted is insufficient, or unsecured credit is not granted, the applicant must provide collateral or securi ...

... Once an applicant is determined to be creditworthy, an unsecured credit limit will be established, which must equal the estimated highest 90-day credit exposure. If the unsecured credit limit granted is insufficient, or unsecured credit is not granted, the applicant must provide collateral or securi ...

Cos, HNIs Set to Bypass MF Distributors, Invest Directly from January 1

... intermediate bond fund pool. “The entire institutional chunk will move into direct plan once it is launched. They cannot be blamed as institutions are bound by certain corporate governance norm which mandates them to invest surpluses at lower cost,” said Dhirendra Kumar, MD of fund research firm Val ...

... intermediate bond fund pool. “The entire institutional chunk will move into direct plan once it is launched. They cannot be blamed as institutions are bound by certain corporate governance norm which mandates them to invest surpluses at lower cost,” said Dhirendra Kumar, MD of fund research firm Val ...

notes 2nd midterm

... reserves that much be held by law. This requirement is set by the Fed as a percentage of deposits and is called the required reserve ratio. The remaining are excess reserves held to satisfy depositor withdrawals. Cash items in process of collection include funds being transferred from one bank to an ...

... reserves that much be held by law. This requirement is set by the Fed as a percentage of deposits and is called the required reserve ratio. The remaining are excess reserves held to satisfy depositor withdrawals. Cash items in process of collection include funds being transferred from one bank to an ...

Addressing the pro-cyclicality of capital requirements with a

... are denied access to credit. This credit rationing stunts growth at a time when job creation is most essential. Resources are misallocated. Well functioning, efficient markets rely on proper allocation of resources. Further, banks may raise capital as needed when the economy is growing. During this ...

... are denied access to credit. This credit rationing stunts growth at a time when job creation is most essential. Resources are misallocated. Well functioning, efficient markets rely on proper allocation of resources. Further, banks may raise capital as needed when the economy is growing. During this ...

IV - LSE

... Tax and regulatory reforms – There were three principal reforms in the 1980s which helped to spur the development of the subprime lending market. The Depository Institutions Deregulation and Monetary Control Act of 1980 pre-empted state level limitations on interest rates. As a result of this legis ...

... Tax and regulatory reforms – There were three principal reforms in the 1980s which helped to spur the development of the subprime lending market. The Depository Institutions Deregulation and Monetary Control Act of 1980 pre-empted state level limitations on interest rates. As a result of this legis ...

High earners can still struggle

... credit card was at its maximum. Steve and Nicole Brown could barely scrape by living paycheck to paycheck, but they never expected to find themselves in such perilous financial shape. As probation officers, the Balch Springs, Texas, couple earn $80,000 a year. Like many, they believed surviving with ...

... credit card was at its maximum. Steve and Nicole Brown could barely scrape by living paycheck to paycheck, but they never expected to find themselves in such perilous financial shape. As probation officers, the Balch Springs, Texas, couple earn $80,000 a year. Like many, they believed surviving with ...

Existing proposals for taming procyclicality

... • Some variables, both macroeconomic and bank-specific, had statistically significant effect on the size of the loan loss provisions. • As expected, the coefficient on GDP growth was generally negative (though often not significant), indicating that provisioning is higher during economic downswings ...

... • Some variables, both macroeconomic and bank-specific, had statistically significant effect on the size of the loan loss provisions. • As expected, the coefficient on GDP growth was generally negative (though often not significant), indicating that provisioning is higher during economic downswings ...

View/Open

... Second, loans are rationed, even in equilibrium (Stiglitz and Weiss, 1981). For this paper, rationing is defined as when the price and contractual terms do not fully adjust to equalize supply and demand. The main cause of rationing in loan markets is, of course, default; prudent lenders will not mee ...

... Second, loans are rationed, even in equilibrium (Stiglitz and Weiss, 1981). For this paper, rationing is defined as when the price and contractual terms do not fully adjust to equalize supply and demand. The main cause of rationing in loan markets is, of course, default; prudent lenders will not mee ...

Can International Capital Standards Strengthen Banks

... demanded by citizens, the development of the following asset classes is recommended (which exists only in some countries to a very limited extent): – Securitized bonds based on the pooling of receivables such as farm crops, livestock breeding, future flows of university tuitions, etc. – Infrastructu ...

... demanded by citizens, the development of the following asset classes is recommended (which exists only in some countries to a very limited extent): – Securitized bonds based on the pooling of receivables such as farm crops, livestock breeding, future flows of university tuitions, etc. – Infrastructu ...

Rationing Agricultural Credit in Developing

... private banks, credit unions), and another set of dummy variables that captured the effect of loan end-use. 1 As expected, transaction costs as a percentage of the loan amount were a decreasing function of the loan amount. Transaction costs per loan are an increasing function ofloan amount; however, ...

... private banks, credit unions), and another set of dummy variables that captured the effect of loan end-use. 1 As expected, transaction costs as a percentage of the loan amount were a decreasing function of the loan amount. Transaction costs per loan are an increasing function ofloan amount; however, ...

ABA Response to FDIC NPR on Risk

... We note the statistics in the proposal that support a high weighting for the tier 1 leverage ratio. These may primarily reflect the near-term effect of weak capital in unsound banks. Unquestionably, a bank whose capital is depleted when management is not prepared to deal with problems may fail in th ...

... We note the statistics in the proposal that support a high weighting for the tier 1 leverage ratio. These may primarily reflect the near-term effect of weak capital in unsound banks. Unquestionably, a bank whose capital is depleted when management is not prepared to deal with problems may fail in th ...

May 2, 2014 Dear Client: Last year was a year of planned, positive

... fundamentals often take a back seat to momentum and speculation and that actively-managed strategies typically have some portion of their portfolios in cash (whereas index funds do not). This was certainly the case in 2013, as all segments of the U.S. equity market eclipsed +30% gains. Conversely, N ...

... fundamentals often take a back seat to momentum and speculation and that actively-managed strategies typically have some portion of their portfolios in cash (whereas index funds do not). This was certainly the case in 2013, as all segments of the U.S. equity market eclipsed +30% gains. Conversely, N ...

4. definitions/terminologies

... earned but not yet due for payment). Such valuation is herein referred to as the book value of a loan. The loan valuation is not adjusted for expected losses. The value of a loan portfolio should be adjusted downward only when (1) loans are actually written off as un-collectible or (2) when the outs ...

... earned but not yet due for payment). Such valuation is herein referred to as the book value of a loan. The loan valuation is not adjusted for expected losses. The value of a loan portfolio should be adjusted downward only when (1) loans are actually written off as un-collectible or (2) when the outs ...

Capital Markets Institutions, Instruments, and Risk

... Asset-Backed CP 639 Defaults in the CP Market and the Recent Financial Crisis 640 Yields on CP 641 Non-U.S. CP Markets 642 Large-Denomination Negotiable Certificates of Deposit 642 CD Issuers 643 CD Yields 643 Banker's Acceptances 644 Illustration of the Creation of a BA 645 Accepting Banks 646 Elig ...

... Asset-Backed CP 639 Defaults in the CP Market and the Recent Financial Crisis 640 Yields on CP 641 Non-U.S. CP Markets 642 Large-Denomination Negotiable Certificates of Deposit 642 CD Issuers 643 CD Yields 643 Banker's Acceptances 644 Illustration of the Creation of a BA 645 Accepting Banks 646 Elig ...

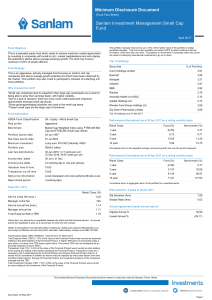

Sanlam Investment Management Small Cap Fund

... by a particularly weak fourth quarter (-0.3% quarter-on-quarter (q/q)), down from 1.5% y/y in 2015. Key sectors such as mining and agriculture saw year-on-year declines while manufacturing endured a very tough second half of the year. The local growth outlook continues to remain subdued. Consumer re ...

... by a particularly weak fourth quarter (-0.3% quarter-on-quarter (q/q)), down from 1.5% y/y in 2015. Key sectors such as mining and agriculture saw year-on-year declines while manufacturing endured a very tough second half of the year. The local growth outlook continues to remain subdued. Consumer re ...

Chapter 1: Finance and the Firm

... – Real Rate of Interest – Expected Inflation – Default Risk – Maturity Risk – Illiquidity Risk ...

... – Real Rate of Interest – Expected Inflation – Default Risk – Maturity Risk – Illiquidity Risk ...