The Rise and Fall of Subprime Mortgages

... nonprime-rated applicants to qualify for mortgages, opening a new channel for funds to flow from savers to a new class of borrowers in this decade ...

... nonprime-rated applicants to qualify for mortgages, opening a new channel for funds to flow from savers to a new class of borrowers in this decade ...

File - get all chapter wise notes

... Longterm Finance : Financial Institution provide long term finance which is not provided by Commercial Bank. ...

... Longterm Finance : Financial Institution provide long term finance which is not provided by Commercial Bank. ...

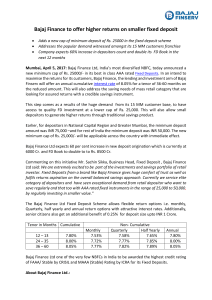

Bajaj Finance to offer higher returns on smaller fixed

... investor. Fixed Deposits from a brand like Bajaj Finance gives huge comfort of trust as well as fulfils returns aspiration on the overall balanced savings approach. Currently we service elite category of depositors and have seen exceptional demand from retail depositor who want to save regularly and ...

... investor. Fixed Deposits from a brand like Bajaj Finance gives huge comfort of trust as well as fulfils returns aspiration on the overall balanced savings approach. Currently we service elite category of depositors and have seen exceptional demand from retail depositor who want to save regularly and ...

HOW THE THAI REAL ESTATE BOOM UNDID FINANCIAL INSTITUTIONS

... – Duly established, transferable, registered property rights (special transaction costs, co-ownership issues) ...

... – Duly established, transferable, registered property rights (special transaction costs, co-ownership issues) ...

non-discretionary portfolio - Alternative Capital Partners

... This portfolio provides an investment strategy that emphasizes capital growth over the medium and long term. The portfolio takes advantage of investment opportunities in alternative asset classes as well as more volatile traditional asset classes. These assets classes provide opportunities for reali ...

... This portfolio provides an investment strategy that emphasizes capital growth over the medium and long term. The portfolio takes advantage of investment opportunities in alternative asset classes as well as more volatile traditional asset classes. These assets classes provide opportunities for reali ...

New Hampshire High Schooler is Capital Markets

... In his essay, Rhodes was asked to research the job responsibilities of a capital markets analyst and then, with a focus on long-term goals, select two investments, explain why these investments were chosen and describe how the national and global economic environment would affect them. Rhodes chose ...

... In his essay, Rhodes was asked to research the job responsibilities of a capital markets analyst and then, with a focus on long-term goals, select two investments, explain why these investments were chosen and describe how the national and global economic environment would affect them. Rhodes chose ...

High Yield Bond Prices – Are They Exhausted?

... Recall that this period followed a sharp correction in equity markets following the “dot-com boom & bust” of 2001. Steep stock market declines are often characterized by the retail investor doing exactly what they should not do, load up on bonds. For the investor who remembers this period, the chart ...

... Recall that this period followed a sharp correction in equity markets following the “dot-com boom & bust” of 2001. Steep stock market declines are often characterized by the retail investor doing exactly what they should not do, load up on bonds. For the investor who remembers this period, the chart ...

catalytic first-loss capital - Global Impact Investing Network

... It identifies the party, i.e., the Provider, that will bear first losses. The amount of loss covered is typically set and agreed upon upfront. It is catalytic. By improving the Recipient’s risk-return profile, CFLC catalyzes the participation of investors that otherwise would not have particip ...

... It identifies the party, i.e., the Provider, that will bear first losses. The amount of loss covered is typically set and agreed upon upfront. It is catalytic. By improving the Recipient’s risk-return profile, CFLC catalyzes the participation of investors that otherwise would not have particip ...

The revived investor

... Investors are optimistic about the stock market as well—nearly 70% expect strong returns for the next six months. Even Clinton supporters are more bullish than they were in the election’s aftermath, though they worry about Trump’s leadership on non-financial issues. Awash in new confidence, many wea ...

... Investors are optimistic about the stock market as well—nearly 70% expect strong returns for the next six months. Even Clinton supporters are more bullish than they were in the election’s aftermath, though they worry about Trump’s leadership on non-financial issues. Awash in new confidence, many wea ...

Long-Term Capital Market Assumptions

... returns are not always available in sectors such as infrastructure and private equity. To overcome these hurdles, we start with the same multifactor model as described on page 1 to form our assumptions for a public market proxy. We then adjust our assumptions to incorporate a few differences between ...

... returns are not always available in sectors such as infrastructure and private equity. To overcome these hurdles, we start with the same multifactor model as described on page 1 to form our assumptions for a public market proxy. We then adjust our assumptions to incorporate a few differences between ...

3.5 Financial Accounts

... compare it to last year, last quarter, or to a budget. Help make decisions…do we invest in a new product or close branch offices. Set performance goals for the future and compare to actual performance in order to remain on target. ...

... compare it to last year, last quarter, or to a budget. Help make decisions…do we invest in a new product or close branch offices. Set performance goals for the future and compare to actual performance in order to remain on target. ...

SBA Financing as a Credit Strategy

... As more business owners step up to fund their operations, create jobs and help expand the economy, financing options for working capital will need to be vetted. That process should include a solution that might have been overlooked in the past but cannot be dismissed in the present. Financing from t ...

... As more business owners step up to fund their operations, create jobs and help expand the economy, financing options for working capital will need to be vetted. That process should include a solution that might have been overlooked in the past but cannot be dismissed in the present. Financing from t ...

Big Freeze part 1: How it began - Departamento de Economia PUC

... began selling assets and cutting loans to hedge funds. But that hit asset prices, hurting those balance sheets once again. What made this “feedback loop” doubly intense was that the introduction of mark-tomarket accounting earlier this decade forced banks to readjust their books after every panicky ...

... began selling assets and cutting loans to hedge funds. But that hit asset prices, hurting those balance sheets once again. What made this “feedback loop” doubly intense was that the introduction of mark-tomarket accounting earlier this decade forced banks to readjust their books after every panicky ...

fund risks - Royal London pensions for employers and trustees

... as cash. They work in much the same way as a bank or building society account. Investments are put on deposit with a financial institution where they earn interest. Deposits are generally considered safer than other asset classes; however, over the longer term they are likely to provide lower return ...

... as cash. They work in much the same way as a bank or building society account. Investments are put on deposit with a financial institution where they earn interest. Deposits are generally considered safer than other asset classes; however, over the longer term they are likely to provide lower return ...

Active Vs. Passive - Jentner Wealth Management

... market predictions and name the hottest stocks. But is this the best way? The debate remains: Does implementing an active or a passive approach yield more lucrative long-term returns? Today, societal pressure calls us to act now, do not just stand by, make things happen. These catch phrases penetrat ...

... market predictions and name the hottest stocks. But is this the best way? The debate remains: Does implementing an active or a passive approach yield more lucrative long-term returns? Today, societal pressure calls us to act now, do not just stand by, make things happen. These catch phrases penetrat ...

Lending Booms, Reserves and the Sustainability of Short

... Note that these theories of delegated monitoring, while they can explain the preference for bank over bond finance, cannot by themselves explain the preference for syndicated bank lending. To this one must add another consideration, like the assumption that individual emerging market loans are too l ...

... Note that these theories of delegated monitoring, while they can explain the preference for bank over bond finance, cannot by themselves explain the preference for syndicated bank lending. To this one must add another consideration, like the assumption that individual emerging market loans are too l ...

Munis and the Markets

... The Barclays High Yield Index is an unmanaged market-weighted index including only SEC registered and 144(a) securities with fixed (non-variable) coupons. The Barclays High Yield Municipal Bond Index is a rules-based, market-value-weighted index that measures the non-investment grade and non-rated U ...

... The Barclays High Yield Index is an unmanaged market-weighted index including only SEC registered and 144(a) securities with fixed (non-variable) coupons. The Barclays High Yield Municipal Bond Index is a rules-based, market-value-weighted index that measures the non-investment grade and non-rated U ...

Wells Fargo Low Volatility U.S. Equity Fund now available

... Q. Who are the fund’s portfolio managers? The fund is managed by the following portfolio managers: Harindra de Silva, Ph.D., CFA, has 30 years of investment experience, with 12 years focused on lowvolatility investing, and performs research for equity and global asset allocation strategies. Befor ...

... Q. Who are the fund’s portfolio managers? The fund is managed by the following portfolio managers: Harindra de Silva, Ph.D., CFA, has 30 years of investment experience, with 12 years focused on lowvolatility investing, and performs research for equity and global asset allocation strategies. Befor ...

i Banking brighter .

... in 1990 and their aggregate asset value was only $1 1 billion, compared to $59 billion at the end of 1990. Continued improvement in the financial condition of New England banks depends in part on three real-estate-relatedfactors beyond the control of individual institutions. First, while real estat ...

... in 1990 and their aggregate asset value was only $1 1 billion, compared to $59 billion at the end of 1990. Continued improvement in the financial condition of New England banks depends in part on three real-estate-relatedfactors beyond the control of individual institutions. First, while real estat ...

Book Note - Osgoode Digital Commons

... as a five per cent down payment, based only on the applicants’ self-declared income. These reckless loans were then packaged and sold as securities, receiving investment-grade ratings. Institutional investors bought them, either because they “did not understand what they were buying … or [they] didn ...

... as a five per cent down payment, based only on the applicants’ self-declared income. These reckless loans were then packaged and sold as securities, receiving investment-grade ratings. Institutional investors bought them, either because they “did not understand what they were buying … or [they] didn ...

“...one of the more evocative of the soft commodities and a hugely

... In itself, this is not harmful to the West. In fact, falling import prices provide a demand stimulus to most Western economies. There are two main ways that this boost could be offset. First, exporters to emerging economies will find the demand environment in those countries much more difficult. Sec ...

... In itself, this is not harmful to the West. In fact, falling import prices provide a demand stimulus to most Western economies. There are two main ways that this boost could be offset. First, exporters to emerging economies will find the demand environment in those countries much more difficult. Sec ...

IOSR Journal of Business and Management (IOSR-JBM)

... becomes available to the general public. Therefore, the individuals who had access to such information are able to take full advantage of it. Apart from the importance of availability, emphasis should also be placed on themethod available information is communicated. At this point, the role of impar ...

... becomes available to the general public. Therefore, the individuals who had access to such information are able to take full advantage of it. Apart from the importance of availability, emphasis should also be placed on themethod available information is communicated. At this point, the role of impar ...

The Pro-cyclical Effects of Bank Capital on Bank Lending: A Case of Kazakhstan:

... excessively optimistic view on asset prices and risk, led them to increase their foreign currency leverage substantially and to enjoy high profit margins by extending loans to high risk sectors during the economic boom period. The spread between lending and funding rates was substantially high for m ...

... excessively optimistic view on asset prices and risk, led them to increase their foreign currency leverage substantially and to enjoy high profit margins by extending loans to high risk sectors during the economic boom period. The spread between lending and funding rates was substantially high for m ...