Document

... Over the last years a number of new techniques have been developed that allow for the extraction of considerably more information from option prices than just the expected value or the expected standard deviation (i.e. implied volatility). By using these techniques it is possible to construct implie ...

... Over the last years a number of new techniques have been developed that allow for the extraction of considerably more information from option prices than just the expected value or the expected standard deviation (i.e. implied volatility). By using these techniques it is possible to construct implie ...

Phd Economics, Siena - Finance – Final exam (16 April 2014

... Phd Economics, Siena - Finance – Final exam (16 April 2014) ...

... Phd Economics, Siena - Finance – Final exam (16 April 2014) ...

B+ Tree

... Start at root, find leaf L where entry belongs. Remove the entry. › If L is at least half-full, done! › If L has only d-1 entries, Try to re-distribute, borrowing from sibling (adjacent node with same parent as L). If re-distribution fails, merge L and sibling. ...

... Start at root, find leaf L where entry belongs. Remove the entry. › If L is at least half-full, done! › If L has only d-1 entries, Try to re-distribute, borrowing from sibling (adjacent node with same parent as L). If re-distribution fails, merge L and sibling. ...

1 Balanced Binary Search Trees

... the nodes in the right subtree of a node is at least the value of the node and the values at nodes in the left subtree of the node is at most the value of the node. It supports three operations:(Insert, Delete and Find). A balanced binary search tree performs all three operations in O(log n) time wh ...

... the nodes in the right subtree of a node is at least the value of the node and the values at nodes in the left subtree of the node is at most the value of the node. It supports three operations:(Insert, Delete and Find). A balanced binary search tree performs all three operations in O(log n) time wh ...

FROM NAVIER-STOKES TO BLACK-SCHOLES

... of financial products (such as stocks, options, commodities and interest rate products). These products are traded in the marketplace and it is important to price them using accurate and efficient algorithms. Furthermore, financial institutions need to compute and monitor the risks associated with t ...

... of financial products (such as stocks, options, commodities and interest rate products). These products are traded in the marketplace and it is important to price them using accurate and efficient algorithms. Furthermore, financial institutions need to compute and monitor the risks associated with t ...

Price Comparison Results and Super-replication: An

... continuous local martingale into Brownian motion. The approach taken here is to apply a comparison theorem of Hajek [9] to achieve the result. This provides a short alternative proof, relying on an existing theorem. We do not require the true model to be a diffusion, although we do need this for the ...

... continuous local martingale into Brownian motion. The approach taken here is to apply a comparison theorem of Hajek [9] to achieve the result. This provides a short alternative proof, relying on an existing theorem. We do not require the true model to be a diffusion, although we do need this for the ...

Institute of Actuaries of India INDICATIVE SOLUTION

... Portfolio insurance means that the portfolio does not fall below the floor because if it falls somebody will pay. Portfolio managers sometimes issue scheme guaranteeing a floor value for the portfolio and then to hedge the guarantee risk they need to buy a put option. Since derivative markets may no ...

... Portfolio insurance means that the portfolio does not fall below the floor because if it falls somebody will pay. Portfolio managers sometimes issue scheme guaranteeing a floor value for the portfolio and then to hedge the guarantee risk they need to buy a put option. Since derivative markets may no ...

KDD06rdt - Columbia University

... pruning: MDL pruning, reduced error-pruning, costbased pruning. ...

... pruning: MDL pruning, reduced error-pruning, costbased pruning. ...

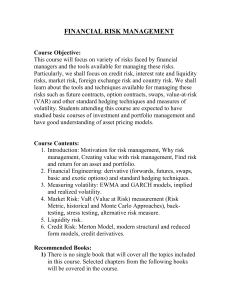

FINANCIAL RISK MANAGEMENT

... 1. Introduction: Motivation for risk management, Why risk management, Creating value with risk management, Find risk and return for an asset and portfolio. 2. Financial Engineering: derivative (forwards, futures, swaps, basic and exotic options) and standard hedging techniques. 3. Measuring volatili ...

... 1. Introduction: Motivation for risk management, Why risk management, Creating value with risk management, Find risk and return for an asset and portfolio. 2. Financial Engineering: derivative (forwards, futures, swaps, basic and exotic options) and standard hedging techniques. 3. Measuring volatili ...

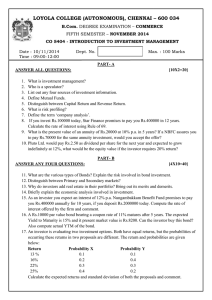

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

... 12. Distinguish between Primary and Secondary markets? 13. Why do investors add real estate in their portfolio? Bring out its merits and demerits. 14. Briefly explain the economic analysis involved in investment. 15. As an investor you expect an interest of 12% p.a. Nungambakkam Benefit Fund promise ...

... 12. Distinguish between Primary and Secondary markets? 13. Why do investors add real estate in their portfolio? Bring out its merits and demerits. 14. Briefly explain the economic analysis involved in investment. 15. As an investor you expect an interest of 12% p.a. Nungambakkam Benefit Fund promise ...

Module 3 Quiz - Venture Highway

... a. Who is your customer? b. What is the customer’s ideal solution to their problem? c. What does the customer value? d. How do you deliver value at an appropriate cost? 2. Your customers may be: a. Your beneficiaries – the people with the problem you are trying to solve. b. A market of people buying ...

... a. Who is your customer? b. What is the customer’s ideal solution to their problem? c. What does the customer value? d. How do you deliver value at an appropriate cost? 2. Your customers may be: a. Your beneficiaries – the people with the problem you are trying to solve. b. A market of people buying ...

Problem 7—Skewed Trees Trees are particularly annoying to test

... substandard and cannot be guaranteed to avoid the greenery. Hal is not actually afraid of trees—he was evidently born without fear and could never be called “yellow”—but they are annoying. Hal's spent enough time observing trees to notice that some are more even than others. Some have branches evenl ...

... substandard and cannot be guaranteed to avoid the greenery. Hal is not actually afraid of trees—he was evidently born without fear and could never be called “yellow”—but they are annoying. Hal's spent enough time observing trees to notice that some are more even than others. Some have branches evenl ...

Institute of Actuaries of India May 2013 Examinations INDICATIVE SOLUTIONS

... negatively correlated, so when a long future contract makes a gain, the interest would be lower and investment gain would be lower where as if the long future makes a loss the interest rate would go up and the funding would be at a higher rate. Therefore in either situation, the investment gains are ...

... negatively correlated, so when a long future contract makes a gain, the interest would be lower and investment gain would be lower where as if the long future makes a loss the interest rate would go up and the funding would be at a higher rate. Therefore in either situation, the investment gains are ...

Lattice model (finance)

For other meanings, see lattice model (disambiguation)In finance, a lattice model [1] is a technique applied to the valuation of derivatives, where, because of path dependence in the payoff, 1) a discretized model is required and 2) Monte Carlo methods fail to account for optimal decisions to terminate the derivative by early exercise. For equity options, a typical example would be pricing an American option, where a decision as to option exercise is required at ""all"" times (any time) before and including maturity. A continuous model, on the other hand, such as Black Scholes, would only allow for the valuation of European options, where exercise is on the option's maturity date. For interest rate derivatives lattices are additionally useful in that they address many of the issues encountered with continuous models, such as pull to par.