Monday, March 23, 2009 - Lynbrook Computer Science

... its children ? must be smaller than S, larger than G and L. Leaves 6 possibilities: M, N, O, P, Q, R Two of those are already in heap: Q and N, so they can’t be the ? The answer thus is: ...

... its children ? must be smaller than S, larger than G and L. Leaves 6 possibilities: M, N, O, P, Q, R Two of those are already in heap: Q and N, so they can’t be the ? The answer thus is: ...

RMTF - The Greeks - Society of Actuaries

... equal and opposite in sign to the option being hedged. Again, this is essentially the same process as matching duration and convexity to obtain an immunized fixed-income portfolio. ...

... equal and opposite in sign to the option being hedged. Again, this is essentially the same process as matching duration and convexity to obtain an immunized fixed-income portfolio. ...

Thinkorswim from TD Ameritrade Webinar Series

... Investors should consider contacting a tax advisor regarding the tax treatment applicable to options transactions. Probability analysis results are: based on historical data, theoretical in nature, not guaranteed and do not reflect any degree of certainty of an event occurring. Past performance of a ...

... Investors should consider contacting a tax advisor regarding the tax treatment applicable to options transactions. Probability analysis results are: based on historical data, theoretical in nature, not guaranteed and do not reflect any degree of certainty of an event occurring. Past performance of a ...

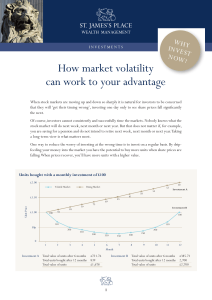

How market volatility can work to your advantage

... make regular investments. Given current market volatility, now might be a good time to start. ...

... make regular investments. Given current market volatility, now might be a good time to start. ...

(Module A) – Part II

... • Bermudan option- An option which is exercisable only during a pre-defined portion of its life ...

... • Bermudan option- An option which is exercisable only during a pre-defined portion of its life ...

Distinguishing between `Normal` and `Extreme` Price Volatility in

... need for interventionist public policy. An emergent alternative view is that market dynamics are inherently unstable so that volatility persists endogenously. Interventionist public policy is needed to deal with chronic food panics. Since neither view of ‘normal’ price volatility is a theoretical im ...

... need for interventionist public policy. An emergent alternative view is that market dynamics are inherently unstable so that volatility persists endogenously. Interventionist public policy is needed to deal with chronic food panics. Since neither view of ‘normal’ price volatility is a theoretical im ...

Bond Pricing Project 1

... Your priceOf() method will compute the theoretical price of the bond. According to Hull, “the theoretical price of a bond can be calculated as the present value of the cash flows received by the owner of the bond using the appropriate zero-coupon interest rates as discount rates”. The price of the b ...

... Your priceOf() method will compute the theoretical price of the bond. According to Hull, “the theoretical price of a bond can be calculated as the present value of the cash flows received by the owner of the bond using the appropriate zero-coupon interest rates as discount rates”. The price of the b ...

Monetary Policy and Financial Markets

... economy becomes very risky. Financial economists, using partial equilibrium models, have shown that this result is a natural consequence of asymmetric information. Many have argued heuristically that this financial market model has important implications for monetary policy, but no one has integrate ...

... economy becomes very risky. Financial economists, using partial equilibrium models, have shown that this result is a natural consequence of asymmetric information. Many have argued heuristically that this financial market model has important implications for monetary policy, but no one has integrate ...

yield option pricing in the generalized cox-ingersoll

... The purpose of this paper is to derive the prices of yield options in the ECIR( δ ( t ) ) model by assuming that the market is complete and arbitrage-free. Nowadays, both European and American options on yields are incorporated in different interest-rate derivatives like e.g. interest-rate caps, flo ...

... The purpose of this paper is to derive the prices of yield options in the ECIR( δ ( t ) ) model by assuming that the market is complete and arbitrage-free. Nowadays, both European and American options on yields are incorporated in different interest-rate derivatives like e.g. interest-rate caps, flo ...

is a binary tree where every node has a value and the tree is

... the tree is arranged so that, for any node all the values in its left subtree are less than the node’s value, and all the values in its right subtree are greater than the node’s value. To build a BST from a sequence of distinct integers the following procedure is used. The first integer becomes the ...

... the tree is arranged so that, for any node all the values in its left subtree are less than the node’s value, and all the values in its right subtree are greater than the node’s value. To build a BST from a sequence of distinct integers the following procedure is used. The first integer becomes the ...

Title goes here This is a sample subtitle

... • Allows for “stochastic” (nondeterministic) analysis using multiple variables and randomly generated “real world” trials ...

... • Allows for “stochastic” (nondeterministic) analysis using multiple variables and randomly generated “real world” trials ...

Topic: reference currency basket of the renminbi

... buoyant global economy is providing considerable support to the stability of the global financial system, as central banks increasingly do not wish to be “behind the curve” in containing inflation or anchoring inflation expectation, and as interest rates continue to rise, albeit at a slower pace, th ...

... buoyant global economy is providing considerable support to the stability of the global financial system, as central banks increasingly do not wish to be “behind the curve” in containing inflation or anchoring inflation expectation, and as interest rates continue to rise, albeit at a slower pace, th ...

Bonds Payable * A corporate debt

... If market rate > stated rate, issue at a discount If market rate < stated rate, issue at a premium ...

... If market rate > stated rate, issue at a discount If market rate < stated rate, issue at a premium ...

Edgeworth Binomial Trees - University of California, Berkeley

... European derivatives are then easily valued by using this risk-neutral density to weight their possible payoffs. European options with earlier maturities, American and exotic options can be valued in a consistent manner by using the method of implied binomial trees. These trees are particularly well ...

... European derivatives are then easily valued by using this risk-neutral density to weight their possible payoffs. European options with earlier maturities, American and exotic options can be valued in a consistent manner by using the method of implied binomial trees. These trees are particularly well ...

Lattice model (finance)

For other meanings, see lattice model (disambiguation)In finance, a lattice model [1] is a technique applied to the valuation of derivatives, where, because of path dependence in the payoff, 1) a discretized model is required and 2) Monte Carlo methods fail to account for optimal decisions to terminate the derivative by early exercise. For equity options, a typical example would be pricing an American option, where a decision as to option exercise is required at ""all"" times (any time) before and including maturity. A continuous model, on the other hand, such as Black Scholes, would only allow for the valuation of European options, where exercise is on the option's maturity date. For interest rate derivatives lattices are additionally useful in that they address many of the issues encountered with continuous models, such as pull to par.