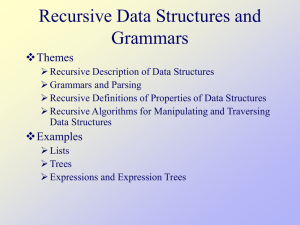

Professor Banko`s Presentation

... offsetting (no risk to system). Remaining short is covered by short position (net no risk). ...

... offsetting (no risk to system). Remaining short is covered by short position (net no risk). ...

Document

... Can be built on a list or array. All operations are constant-time E.g.: The “undo” stack in an editor The operands and operators in a scientific ...

... Can be built on a list or array. All operations are constant-time E.g.: The “undo” stack in an editor The operands and operators in a scientific ...

Questions from Chapter 3 - Purdue Agricultural Economics

... has projected sales to increase 50% and expects the new cost ratio to decrease by 2% due to increased efficiency. Assuming that Williamson wants to maintain an inventory turnover of 5.0, calculate their projected level of inventory. (round to the nearest $) a. $1,230 b. $1,920 c. $2,180 d. $2,340 9. ...

... has projected sales to increase 50% and expects the new cost ratio to decrease by 2% due to increased efficiency. Assuming that Williamson wants to maintain an inventory turnover of 5.0, calculate their projected level of inventory. (round to the nearest $) a. $1,230 b. $1,920 c. $2,180 d. $2,340 9. ...

Corporate Valuation, Tool Kit

... Gives owner of option the right to buy a share of the company’s stock at a specified price (called the strike price or exercise price) even if the actual stock price is higher. Usually can’t exercise the option for several years (called the vesting period). ...

... Gives owner of option the right to buy a share of the company’s stock at a specified price (called the strike price or exercise price) even if the actual stock price is higher. Usually can’t exercise the option for several years (called the vesting period). ...

Trade Log - Portfolio Strategies Investment Managers

... involves the risk of losing money and should be considered as part of an overall program, not a complete investment program. An investment in ETFs involves additional risks: non diversified, the risks of price volatility, competitive industry pressure, international political and economic developmen ...

... involves the risk of losing money and should be considered as part of an overall program, not a complete investment program. An investment in ETFs involves additional risks: non diversified, the risks of price volatility, competitive industry pressure, international political and economic developmen ...

inflation, real interest rates and the shiller p/e

... markets. He showed that historically the level of the P/E was related to the level of inflation and the level of real interest rates. He also showed that for investment horizons longer than a ...

... markets. He showed that historically the level of the P/E was related to the level of inflation and the level of real interest rates. He also showed that for investment horizons longer than a ...

session_6_ne_yh_money_ecology_bs

... funding partners • Loan to value – up to 80% at any stage of the project, including purchase of land • No set stage payments – drawdown profile is agreed with borrower • No differentiation on rates from our other lending • BUT • Limits to levels development finance linked to our capital • Concentrat ...

... funding partners • Loan to value – up to 80% at any stage of the project, including purchase of land • No set stage payments – drawdown profile is agreed with borrower • No differentiation on rates from our other lending • BUT • Limits to levels development finance linked to our capital • Concentrat ...

Chapter 3: The IS

... • Price is rigid only in the short run. • In the long run, price is flexible and output is at the full employment level (QF). • From (5), the interest rate is constant, r=rF as well. • Consider the equilibrium in the money market: M0/P = kQF-hrF. An increase in the money stock leads to price increas ...

... • Price is rigid only in the short run. • In the long run, price is flexible and output is at the full employment level (QF). • From (5), the interest rate is constant, r=rF as well. • Consider the equilibrium in the money market: M0/P = kQF-hrF. An increase in the money stock leads to price increas ...

Problems: Round your final answers to two decimal places. 1. Ten

... 11. What is the value of a 15-year, zero-coupon bond with a maturity value of $1,000 and a semiannual-pay yield of 7.00%? 12. 5-year Treasury bonds yield 5.5%. The inflation premium (IP) is 1.9%, and the maturity risk premium (MRP) on 5-year bonds is 0.4%. What is the real risk-free rate, r*? 13. Iv ...

... 11. What is the value of a 15-year, zero-coupon bond with a maturity value of $1,000 and a semiannual-pay yield of 7.00%? 12. 5-year Treasury bonds yield 5.5%. The inflation premium (IP) is 1.9%, and the maturity risk premium (MRP) on 5-year bonds is 0.4%. What is the real risk-free rate, r*? 13. Iv ...

Derivatives - MyCourses

... (i) An interest rate swap is a contractual agreement entered into between two counterparties under which each agrees to make periodic payment to the other for an agreed period of time based upon a notional amount of principal. The principal amount is notional because there is no need to exchange act ...

... (i) An interest rate swap is a contractual agreement entered into between two counterparties under which each agrees to make periodic payment to the other for an agreed period of time based upon a notional amount of principal. The principal amount is notional because there is no need to exchange act ...

VARIABLE STRIKE OPTIONS and GUARANTEES in LIFE

... and hedging strategies, overcoming the traditional risk profile. The innovation process leads to new kinds of exotic options and it modifies the typical elements such as the underlying, the strike price, the maturity. In this note, we are especially interested with the development of the strike pric ...

... and hedging strategies, overcoming the traditional risk profile. The innovation process leads to new kinds of exotic options and it modifies the typical elements such as the underlying, the strike price, the maturity. In this note, we are especially interested with the development of the strike pric ...

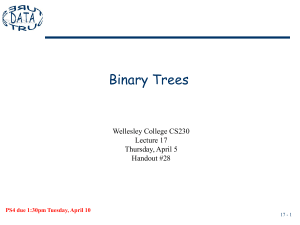

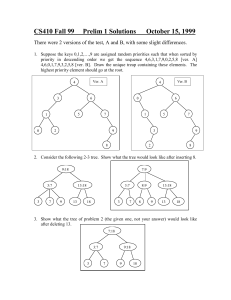

binary search tree - Wellesley College

... the values to be ordered. A binary search tree (BST) is a binary tree in which the following properties hold at every node: (1) All elements in the left subtree are ≤ the value; (2) All elements in the right subtree are ≥ the value. Here is a sample BST → BSTs will be very important in the next lect ...

... the values to be ordered. A binary search tree (BST) is a binary tree in which the following properties hold at every node: (1) All elements in the left subtree are ≤ the value; (2) All elements in the right subtree are ≥ the value. Here is a sample BST → BSTs will be very important in the next lect ...

of a tree

... Children of a node ordered (List of children). Children of a node unordered (Set/Bag of children). Item in each node is less than items in child nodes. Item at each node is smaller that all items in its left subtree and greater than all items in its right subtree. ...

... Children of a node ordered (List of children). Children of a node unordered (Set/Bag of children). Item in each node is less than items in child nodes. Item at each node is smaller that all items in its left subtree and greater than all items in its right subtree. ...

When t=T

... the option lifetime [0, T] into N intervals: 0 t0 t1 ... t N T . Suppose the price change of the underlying asset S in each interval ...

... the option lifetime [0, T] into N intervals: 0 t0 t1 ... t N T . Suppose the price change of the underlying asset S in each interval ...

The Black-Scholes-Merton Approach to Pricing Options

... We remark that such a portfolio and hedge is useful for example when a bank sells a call option. The proceeds from selling the option must be invested so that the bank can fulfill its obligations at maturity. From no arbitrage principles we showed that there is a self-financing dynamic replicating p ...

... We remark that such a portfolio and hedge is useful for example when a bank sells a call option. The proceeds from selling the option must be invested so that the bank can fulfill its obligations at maturity. From no arbitrage principles we showed that there is a self-financing dynamic replicating p ...

Options-Implied Probability Density Functions for Real Interest Rates

... option, and the volatility of daily changes in seven-year TIPS yields implied by an EGARCH(1,1) model with conditionally t−distributed errors. The parameters of the EGARCH model are estimated by maximum likelihood over the whole period for which TIPS yields are available (since January 1999). The id ...

... option, and the volatility of daily changes in seven-year TIPS yields implied by an EGARCH(1,1) model with conditionally t−distributed errors. The parameters of the EGARCH model are estimated by maximum likelihood over the whole period for which TIPS yields are available (since January 1999). The id ...

Arbitrage Opportunities in Misspecified Stochastic volatility Models

... ii) The functions ã(y, t), b̃(y, t), ρ̃(y, t) are twice differentiable with respect to y; these coefficients as well as their first and second derivatives with respect to y are bounded and Hölder continuous in y, t. iii) The function σ̃ is twice differentiable; this function as well as its first an ...

... ii) The functions ã(y, t), b̃(y, t), ρ̃(y, t) are twice differentiable with respect to y; these coefficients as well as their first and second derivatives with respect to y are bounded and Hölder continuous in y, t. iii) The function σ̃ is twice differentiable; this function as well as its first an ...

Lattice model (finance)

For other meanings, see lattice model (disambiguation)In finance, a lattice model [1] is a technique applied to the valuation of derivatives, where, because of path dependence in the payoff, 1) a discretized model is required and 2) Monte Carlo methods fail to account for optimal decisions to terminate the derivative by early exercise. For equity options, a typical example would be pricing an American option, where a decision as to option exercise is required at ""all"" times (any time) before and including maturity. A continuous model, on the other hand, such as Black Scholes, would only allow for the valuation of European options, where exercise is on the option's maturity date. For interest rate derivatives lattices are additionally useful in that they address many of the issues encountered with continuous models, such as pull to par.